Be sure to catch Valuentum’s Brian Nelson discussing Tiffany’s reports on CNBC Asia at 9:30 PM CST today. The video clip will be posted to the website as soon as it is made available.

Luxury jewelry maker Tiffany (TIF) reported fantastic second-quarter results Wednesday and raised its bottom-line guidance for the second time this year and in as many quarters.

Tiffany has been benefiting from a modernization of its classical jewelry line-up thanks to the ongoing success of its newest ATLAS collection (shown right) and TIFFANY T jewelry collection (shown below). The ATLAS collection is named for the mythic Greek god and showcases Roman numerals in designs symbolic of strength and freedom on pieces ranging from pendants and earrings to bangles and rings. The TIFFANY T collection is the first from new Design Director Francesca Amfitheatrof, who joined the company September 2013. Francesca Amfitheatrof currently oversees the design of all Tiffany product categories, and she has reimagined the letter T in cuffs and other lines of jewelry in this particular line.

Tiffany has been benefiting from a modernization of its classical jewelry line-up thanks to the ongoing success of its newest ATLAS collection (shown right) and TIFFANY T jewelry collection (shown below). The ATLAS collection is named for the mythic Greek god and showcases Roman numerals in designs symbolic of strength and freedom on pieces ranging from pendants and earrings to bangles and rings. The TIFFANY T collection is the first from new Design Director Francesca Amfitheatrof, who joined the company September 2013. Francesca Amfitheatrof currently oversees the design of all Tiffany product categories, and she has reimagined the letter T in cuffs and other lines of jewelry in this particular line.

A new design director is not the only change at Tiffany. Long-time Tiffany CEO Michael Kowalski announced his plans in July to retire in 2015. Frederic Cumenal, currently the company’s president, has been named his successor, and we expect him to keep the business momentum going. We also have no qualms with the firm’s decision to bring on board Cigna (CI) veteran Ralph Nicoletti to take over the reigns as CFO, replacing Jim Fernandez who also announced his retirement earlier this year. Patrick Dorsey, Tiffany’s general counsel, also retired this year. Ongoing changes should further reignite the brand, and we think a fresh focus will continue to breathe new life into the company.

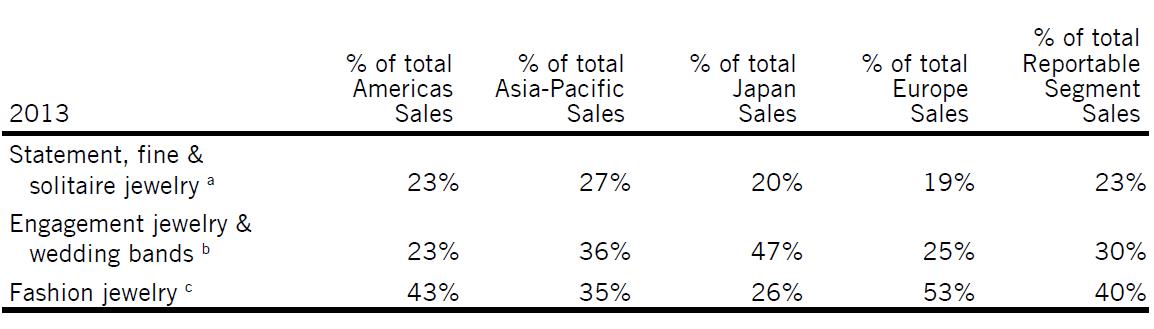

The new TIFFANY T collection’s debut appears to be resonating well with consumers, and comparable store sales in the Americas expanded an impressive 8% during both the second quarter and for the first-half of the year on a constant-currency basis. Sales in the Americas account for ~50% of worldwide sales at Tiffany, while sales in the US account for ~90% of net sales in the Americas. We were very pleased with the strength in this area. Tiffany’s comparable store sales in the Asia-Pacific region also performed well, advancing 7% during the quarter and 9% during the first half of the year on a constant-currency basis. Management noted strong growth in China and Australia. Sales in Asia-Pacific represent ~25% of worldwide net sales, while sales in China account for more than half of Asia-Pacific’s net sales.

Europe and Japan were two areas that weighed on performance, however. The firm’s same-store sales in Europe dropped 8% during the second quarter and 5% during the first half of the year on a constant currency basis. Weak performance in the UK and most of continental Europe was to blame. Though same-store sales growth for the first half of the year in Japan came in at a solid 9% on a constant-currency basis, same-store sales fell 13% during the second quarter as consumers pulled forward purchases to avoid the long-anticipated increased consumption tax, implemented April 1 in Japan. According to management, the monthly rates of sales declines in Japan have been slowing following the second quarter, however. Sales in Japan and Europe collectively account for ~25% of sales.

Overall, net sales increased 7% and same-store sales increased 3% in the quarter. Net earnings advanced 16% thanks in part to a higher gross margin driven by pricing increases. We like that price increases across all product categories and regions are sticking—a move that signals continued strength of the Tiffany brand, its core competitive advantage. The strength of the Tiffany brand goes beyond trademark rights but rests in the consumer perception of the brand: high-quality gemstone jewelry (particular diamond jewelry), strong customer service, elegant store environment, and distinctive packaging (the Tiffany blue box). Though Tiffany’s strategy in some ways allows it to accept a reduced gross margin to maintain its position at the high-end of the market, the company’s margins continue to expand.

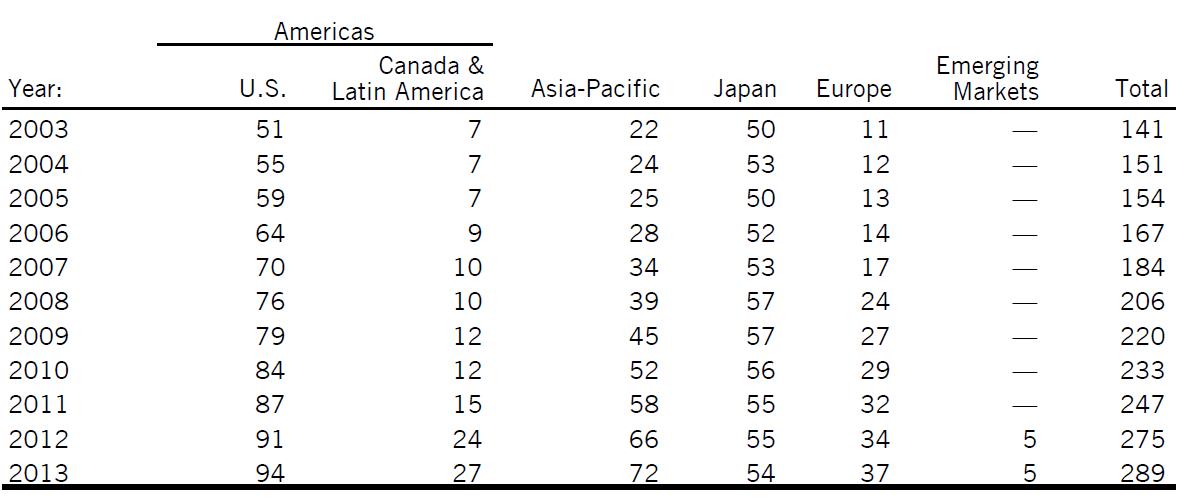

Looking ahead, Tiffany raised its bottom-line outlook for the second time in as many quarters. The company had initiated 2014 earnings-per-share guidance in the range of $4.05-$4.15 per diluted share, raised it during the first quarter earnings release to the range of $4.15-$4.25, and increased it yet again today, to the range of $4.20-$4.30 per share. Free cash flow for the full-year is expected to be greater than $400 million, in-line with our updated forecasts. Tiffany will look to open 10 company-owned stores and close 3 existing stores during 2014 (it has already opened 5). At the end of July 2014, the company operated 293 stores. Regional store growth through the end of 2013 is shown below:

Image Source: Tiffany

Valuentum’s Take

Tiffany continues to buy back stock and recently increased its dividend 12%, to $0.38 per share on a quarterly basis (shares yield 1.6% at the time of this writing). At over $100 per share, the company’s price, however, is not a bargain. Though we think the high-end consumer is more resilient during tough economic times (giving Tiffany more predictable performance), we don’t think this added safety-net justifies a multiple of 23+ times on 2014 earnings, as is currently the multiple at which Tiffany’s shares are trading hands.

Our fair value estimate of Tiffany is in the mid-$80s, and while we think the firm is executing fantastically as of late, we’re not rushing to add the company to the Best Ideas portfolio. Our fair value estimate is based on a forecast of the firm’s free cash flows, unlike that of a price target, which attempts to predict the price at which the company may trade at in the future. In any case, we’ll be paying close attention to how Tiffany performs during the all-important holiday fourth quarter, which accounts for about one third of annual net sales and a higher percentage of its annual net earnings. There will be a better price at which to initiate a position in Tiffany than today’s prices, in our view.

Firms at the ultra-high end of luxury such as Richemont (CFRUY) and Louis Vuitton (LVMUY) continue to show sales gains (here and here), and we’d describe the outlook for the ultra-luxury and luxury markets as healthy, a segment in which we’d also include Tiffany. High-end consumers seem to be unfazed by pricing increases, as witnessed most recently in Tiffany’s second-quarter results, and we think this bodes well for continued resiliency in the space. New highs in the stock market are also fueling strength in this segment thanks to what we’d describe to be as a wealth effect.

Though we don’t have an ultra-luxury or luxury firm in either the Best Ideas portfolio or the Dividend Growth portfolio, aspirational brand and premium handbag maker Coach (COH) is one worth keeping an eye on. The firm is trading at about 10 times adjusted trailing earnings (excluding transformation items), and shares have fallen ~30% year-to-date. If Coach can reinvigorate the brand with respect to its North American women’s bag and accessory business and continue to grow its men’s business, shares could become one of the better performers in coming years. As evidenced by aspirational brand Micheal Kors’ (KORS) recently-reported calendar second-quarter results, which showed same-store sales gains of 24%+, the aspirational brand segment is very healthy.

Coach has a war chest of cash (pdf) to the tune of $850+ million to right the ship and has no long-term debt (it has short-term debt of ~$140 million). The firm has a transformation plan in place and has recently hired an Executive Creative Director to improve the creative direction of the brand. Free cash flow remains significantly positive, and the firm yields nearly 4%. Our fair value of Coach is ~$50 per share (implying more than 30% upside from today’s levels). Consistent with methodology requirements, however, we’d wait for a better Valuentum Buying Index rating before scooping up the company. In any case, Coach remains one of the top ideas on our watch list.

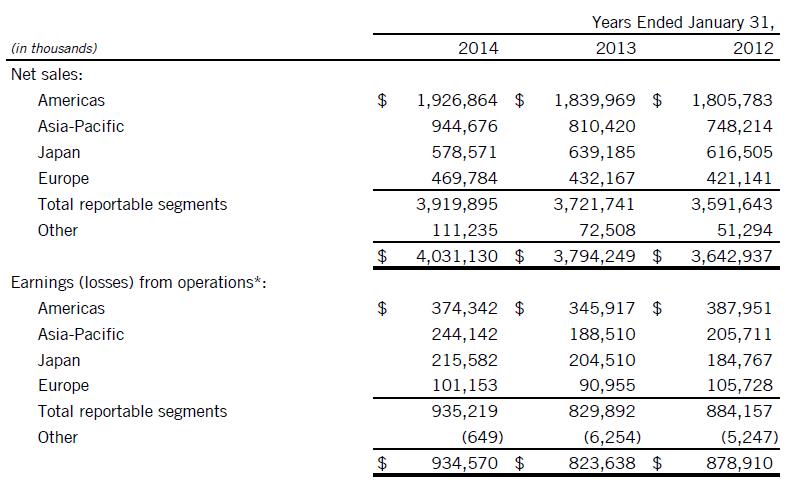

Appendix: Tiffany Financials

Image Source: Tiffany

Image Source: Tiffany