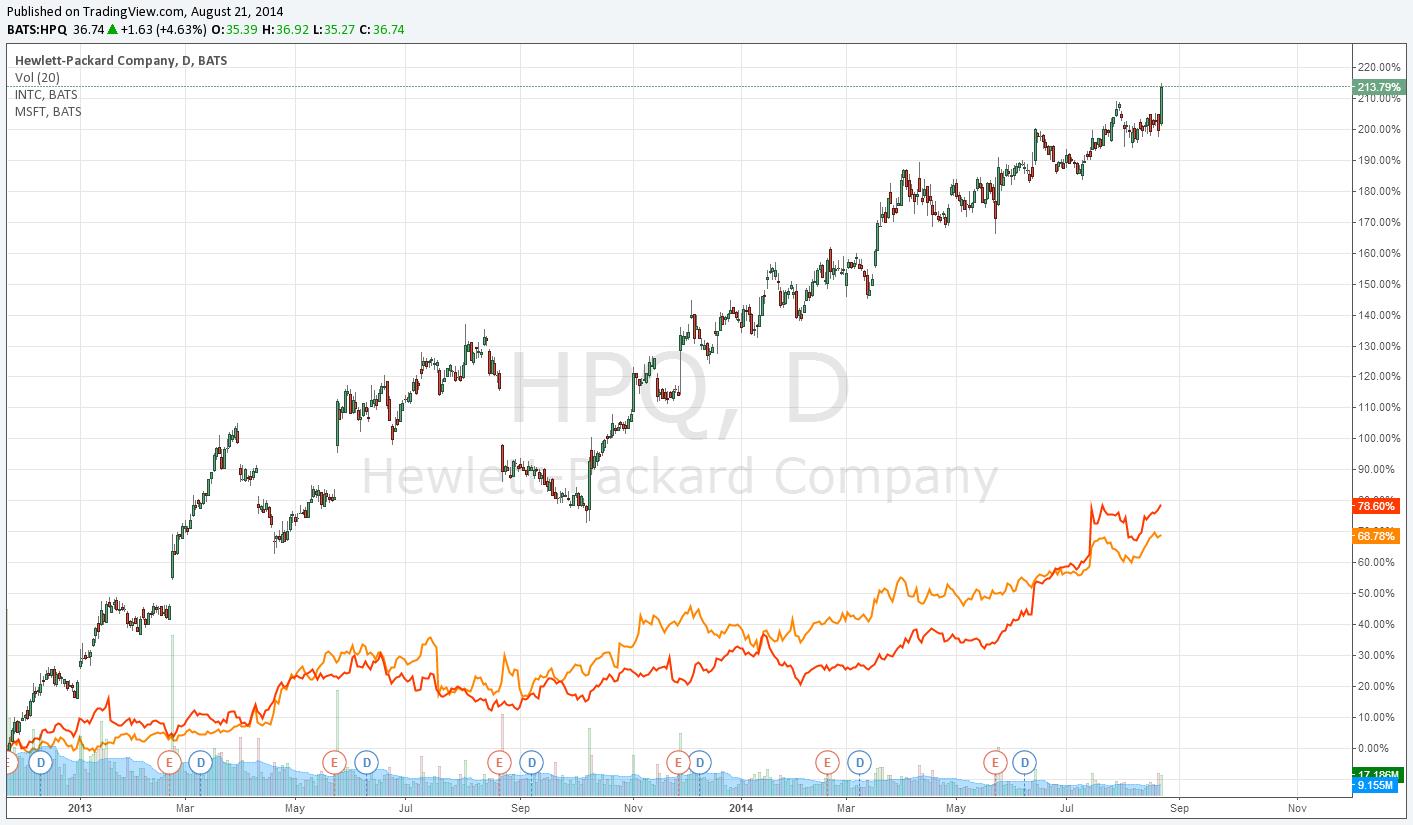

In investing, there are always trade-offs, and one of the challenges we face as a publisher is being crystal clear about this. For example, within the personal computer (PC) supply chain, we held the view that PC demand stabilization would be a key driver behind price-to-fair value convergence among a number of participants. But while we were pounding the table on Intel (INTC) and Microsoft (MSFT) for much of the past few years, we were less-enthused about the prospects of a turnaround at Hewlett-Packard (HPQ).

Since the inception of the Best Ideas portfolio, May 2011, Microsoft’s shares (yellow) have surged 80%+, Intel’s shares (orange) have jumped more than 45%, while Hewlett-Packard’s shares (bottom line) have been roughly flat (bottom line). Under the microscope, it appears that we made the correct decision, as Hewlett-Packard has been the relative underperformer over this time horizon.

However, depending on the measurement period, Hewlett-Packard can actually be considered an outperformer (see chart below). For example, from Hewlett-Packard’s bottom in November 2012, the company has more than tripled (top line), while Intel is up ~80% (orange line) and Microsoft is up ~70% (yellow line). In this light, it appears that we missed the boat and were wrong on Hewlett-Packard. To a large degree, whether we were right or wrong on Hewlett-Packard depends on your perspective and measurement horizon.

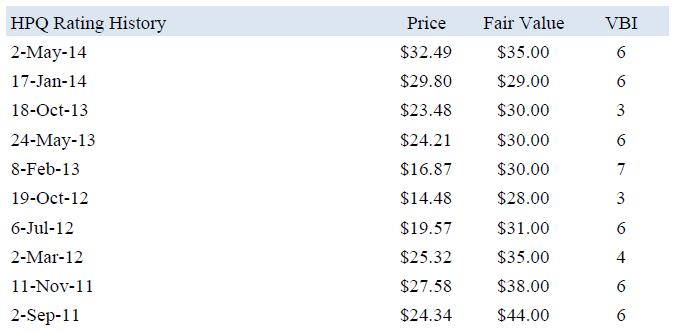

That said, from September 2011 through the end of 2013, our fair value estimate of Hewlett-Packard has hovered significantly above the firm’s share price (see table below). In fact, at the stock-price bottom shown in chart above (which occurred in fourth quarter of 2012), the price-to-fair value discount was the greatest (companies with low price-to-fair values are considered underpriced).

As Hewlett-Packard moved off its bottom in early 2013, the firm registered the highest Valuentum Buying Index rating of a 7 over the measurement period (see table below). Unfortunately, it did not register a 9 or 10 on the index as a result of its forward price-earnings-to-growth (PEG) ratio, which wasn’t meaningful given muddy year-over-year comparisons (and expected earnings pressure). Excluding the PEG ratio from the relative valuation consideration (the second pillar in the Valuentum Buying Index), Hewlett-Packard would have registered a 9 or higher (the equivalent of a we’d consider buying rating).

It begs the question then: did we really get Hewlett-Packard wrong?

Image Source: Hewlett-Packard’s 16-page report

To us, however, we’ll acknowledge the view that we didn’t perform as well as we could have with respect to Hewlett-Packard, and we think it’s important that we bring up stocks that we didn’t do so well with. For one, we think having a conversation helps members get a better understanding of the Valuentum process, its many underlying components, and how and where to make qualitative adjustments to the systematic output, if applicable.

Hewlett-Packard reported fiscal third-quarter performance today that showcased modest top-line growth and better-than-expected free cash flow generation. The top-line growth is welcome news as the firm navigates a very challenging revenue environment. Cash flow from operations leapt an impressive 36% from the prior-year period, and the firm continues to deliver with respect to share buybacks and dividends. Though we don’t expect a material change to the company’s fair value estimate of $35 per share as a result of the report, we acknowledge that there is an upward bias to it on the basis of the better-than-expected cash-flow generation.

In any case, however, the company no longer offers the valuation opportunity it once did. We should have done a better job pounding the table on Hewlett-Packard in early 2013. And while we know that you know that nobody can call a bottom with absolute certainty, we had plenty of time to relay this idea to you, especially given the tremendous valuation opportunity with shares.

We hope that the calls on Intel and Microsoft have made up for this, and we want to reiterate the importance of not only paying attention to the Valuentum Buying Index output but also its underlying components in evaluating new ideas.

The 16-page report and dividend report on Hewlett-Packard will be updated shortly.