Let’s take a look at a few deals that hit the wires recently – some proposed, some speculated.

Analog Devices (ADI) Scoops Up Hittite Microwave (HITT)

Norwood, MA (06/09/2014) – Analog Devices, a global leader in high-performance semiconductors for signal processing applications, and Hittite Microwave Corporation, an innovative designer and manufacturer of high performance integrated circuits, modules, subsystems and instrumentation for RF, microwave and millimeter wave applications, announced that the two companies have entered into a definitive agreement whereby ADI will acquire Hittite for $78 per share in cash. The closing price of Hittite’s common stock on June 6, 2014 was $60.56 per share.

This agreement reflects a total enterprise value for Hittite of approximately $2 billion. ADI expects to fund the acquisition through a combination of cash on hand and short-term debt financing. The Boards of Directors of each company have approved the transaction, which is expected to close near the end of ADI’s third fiscal quarter of 2014, subject to regulatory approvals and other customary closing conditions.

Medtronic (MDT) Rumored to Be Interested In Smith & Nephew (SNN)

Per Bloomberg (6/05/2014): “Medtronic Inc., the largest maker of heart rhythm devices, is evaluating a takeover of London-based Smith & Nephew Plc that could see the U.S. company move its tax domicile overseas, people familiar with the matter said…

…Smith & Nephew, with a market value of about 9.5 billion pounds ($15.9 billion) based on yesterday’s closing stock price, is aware of Medtronic’s interest as are investment banks, said two of the people, asking not to be named discussing a private matter. Medtronic’s preparations for a bid are at an early stage and no offer is imminent, the people said.”

Merck (MRK) Buys Idenix (IDIX)

WHITEHOUSE STATION, N.J. & CAMBRIDGE, Mass (6/09/2014) – Merck, known as MSD outside the United States and Canada, and Idenix Pharmaceuticals, today announced that the companies have entered into a definitive agreement under which Merck will acquire Idenix for $24.50 per share in cash. The transaction, which values the purchase of Idenix at approximately $3.85 billion, has been approved by the boards of directors of both companies.

“Idenix has established a promising portfolio of hepatitis C candidates based on its expertise in nucleoside/nucleotide chemistry and prodrug technologies,” said Dr. Roger Perlmutter, president, Merck Research Laboratories. “Idenix’s investigational hepatitis C candidates complement our promising therapies in development and will help advance our work to develop a highly effective, once-daily, all oral, ribavirin-free, pan-genotypic regimen that has a duration of treatment as short as possible for millions of patients in need around the world.”

Idenix is a biopharmaceutical company engaged in the discovery and development of medicines for the treatment of human viral diseases, whose primary focus is on the development of next-generation oral antiviral therapeutics to treat hepatitis C virus (HCV) infection. The company currently has three HCV drug candidates in clinical development: two nucleotide prodrugs (IDX21437 and IDX21459) and a NS5A inhibitor (samatasvir). These novel candidates are being evaluated for their potential inclusion in the development of all oral, pan-genotypic fixed-dose combination regimens.

Sprint (S) and T-Mobile (TMUS) Reported to Tie the Knot

Per Bloomberg (6/05/2014): “Sprint Corp. is nearing an agreement on the price, capital structure and termination fee for an acquisition of T-Mobile US Inc. that could value the wireless carrier at almost $40 a share, people with knowledge of the matter said…

…Sprint will offer about 50 percent stock and 50 percent cash for T-Mobile, leaving Bonn-based parent Deutsche Telekom AG with about a 15 percent stake in the combined company, according to the people, who asked not to be identified because the process is private. The agreement could be announced as soon as July, the people said. At just under $40 a share, T-Mobile’s equity would be valued at about $31 billion.”

Tyson (TSN) Picks Up Hillshire Brands (HSH)

SPRINGDALE, Ark., June 9, 2014 – Tyson Foods, Inc. announced it has submitted a unilaterally binding offer to acquire all outstanding shares of The Hillshire Brands Company for a price of $63 per share in cash. The offer is subject to Hillshire Brands being released from its existing agreement to acquire Pinnacle Foods Inc. in accordance with the terms thereof. It follows a bidding process conducted by Hillshire Brands that concluded Sunday, June 8, 2014. The all-cash transaction is valued at approximately $8.55 billion, including Hillshire Brands’ outstanding net debt, and represents a multiple of 16.7x trailing 12 months adjusted EBITDA or 10.5x including $300 million in synergies.

“The Hillshire Brands acquisition would represent a defining moment for Tyson Foods,” said Donnie Smith, Tyson’s president and chief executive officer. “Our strategy has been to grow our prepared foods business, and it has been our aspiration to be a leader in retail prepared foods just as we are in chicken. Now we will have those iconic #1 and #2 brands in numerous categories.”

“Tyson Foods has a history of growing through strategic acquisition,” said John Tyson, chairman of the board, “It is the view of the board of directors that this is truly a transformational opportunity and one that best fits with our strategic plan while enhancing our margins and creating long-term shareholder value.” The Tyson family and the board are prepared to issue shares to maintain the company’s investment grade credit rating.

Valuentum’s Take

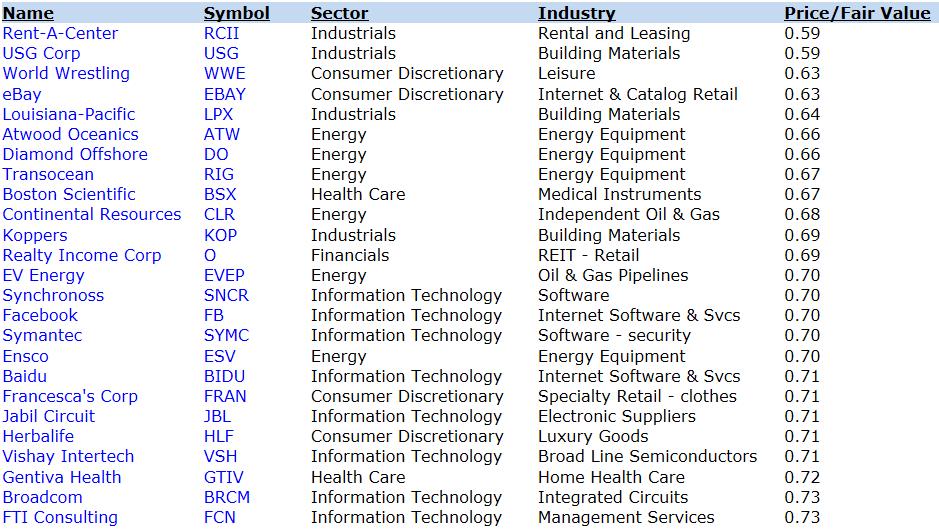

Merger and acquisition activity remains robust across a number of sectors. We don’t expect the pace of M&A to slow anytime soon, as long as corporate balance sheets remain healthy and borrowing rates remain near all-time lows. For an opportunistic corporate buyer, a table of the 25 cheapest stocks on the market today is provided below. We’re not speculating on which firms below may be takeover candidates, but we do think their undervaluation increases the likelihood of their involvement in M&A activity.

Image Source: Valuentum Securities