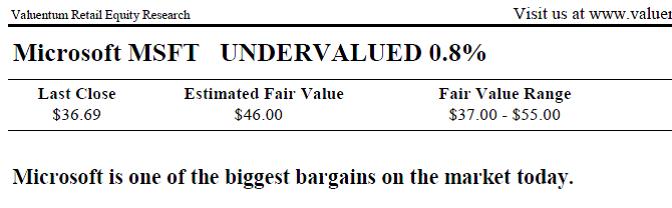

We tell our members exactly what we mean. For those that watch the Dividend Growth portfolio closely and analyze our 16-page reports, you’re well aware that we’ve been pounding the table on Microsoft’s (MSFT) undervaluation for some time.

Image Source: Valuentum

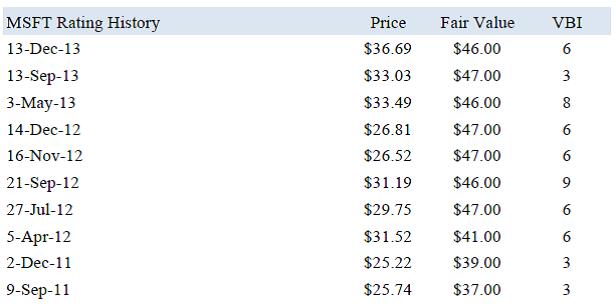

The software giant is just another great example of the process in action. In every 16-page report, the last page reveals the rating history on each company. Since the middle of 2012 (see below), we’ve been saying that Microsoft’s shares are going to buck the historical malaise and rise to $40+ on the basis of our fair value estimate. The software giant also registered a coveted 9 on the Valuentum Buying Index in September 2012. And its hefty dividend yield of 3% is covered nicely by its Valuentum Dividend Cushion rating of 3.3 – an excellent measure, especially for the size of its dividend payout/yield. Microsoft has always been a no-brainer to us, and we hope you have capitalized. If not, don’t worry. There will always be the next idea.

Source: Valuentum

Though many are excited about recent news of Microsoft planning to unveil Office for the iPad, which is helping the stock, the company fits the mold of the Valuentum process very nicely: undervalued, nice pricing momentum, solid dividend. With the move in recent weeks, Microsoft is now trading at post dot-com bubble highs, and we couldn’t be more pleased with the firm’s performance in the Dividend Growth portfolio. We still think Microsoft is a great idea even after its price performance, with more capital appreciation upside to come and significant dividend growth potential to boot. The company is also a candidate for the Best Ideas portfolio, though our technology weighting is already relatively large there.