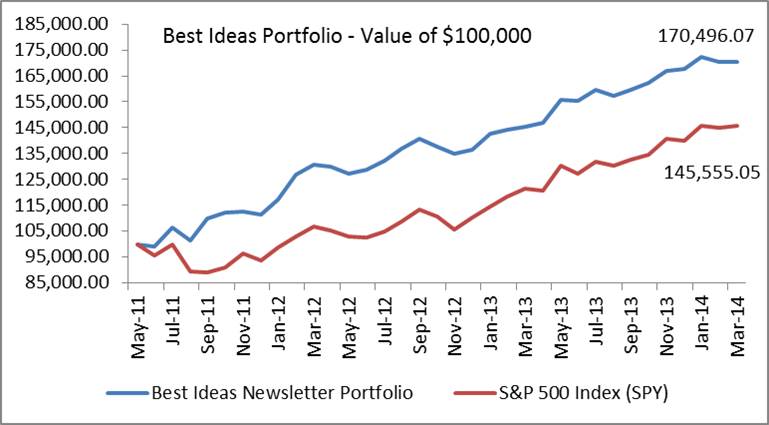

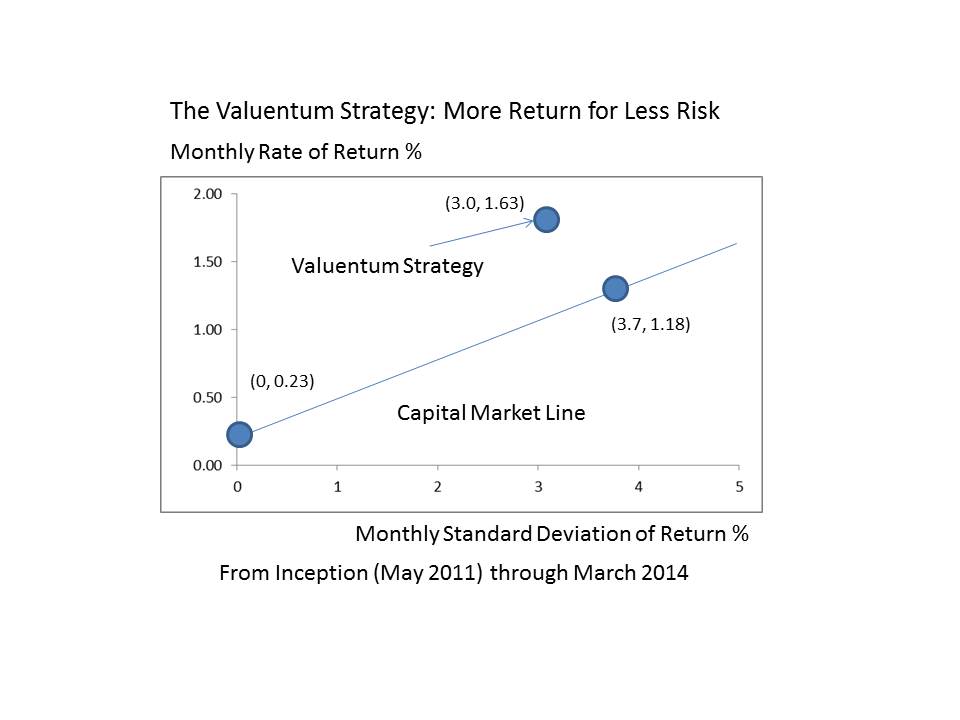

We wanted to provide a brief update of the Best Ideas portfolio. We don’t want to make too much of the update, as we know that the future is the only thing that matters for our new members. But since the team updated the graphics, we thought we’d share. The first picture is the outperformance of the Best Ideas portfolio relative to the S&P 500 (SPY) since inception. The second is a measurement of the reward of the portfolio per unit-of-risk taken. Any portfolio that plots above the capital market line (CML) has a superior Sharpe ratio and risk-adjusted performance versus the market benchmark. This tells us that the Valuentum process is adding considerable value, as the Best Ideas portfolio is taking on less risk but generating a higher reward. What investor wouldn’t want this, right?

Image Source: Valuentum

Image Source: Valuentum

Though the numbers look good, we’re not resting on our laurels. We recently highlighted the importance of knowing sector leadership as it relates to uncovering where potential new ideas could be brewing across the market. Interestingly, two of the industries that the Best Ideas portfolio is noticeably underweight have been performing well thus far in 2014, the utilities and the basic materials sectors. Though we don’t want members to read too much into the portfolio adjustment we plan to make on Tuesday (March 18), we need to fix this portfolio shortcoming. We have no utilities exposure in the Best Ideas portfolio. In a market that continues to be “stretched” to new highs almost on a weekly basis, gaining exposure to the defensive utilities sector is just starting to make sense, particularly in light of the group’s relative performance so far this year.

| Sector ETF | Dec 31, 2013 – close | Mar 14, 2014 – close | YTD % |

| Utilities (XLU) | 37.97 | 40.89 | 7.7% |

| Health Care (XLV) | 55.44 | 58.44 | 5.4% |

| Materials (XLB) | 46.22 | 46.90 | 1.5% |

| S&P 500 (SPY) | 184.69 | 184.66 | 0.0% |

| Financials (XLF) | 21.86 | 21.80 | -0.3% |

| Technology (XLK) | 35.74 | 35.63 | -0.3% |

| Consumer Staples (XLP) | 42.98 | 42.58 | -0.9% |

| Consumer Discretionary (XLY) | 66.83 | 65.85 | -1.5% |

| Industrials (XLI) | 52.26 | 51.35 | -1.7% |

| Energy (XLE) | 88.51 | 86.38 | -2.4% |

Source: Valuentum

We know a large number of members have individual favorites across the utilities sector such as MGE Energy (MGEE), AmeriGas Partners (APU) and Dividend Growth portfolio holding PPL (PPL), but our team has decided to take a broader stab at the group in the Best Ideas portfolio. Even though the Dividend Cushion successfully warned investors about the potential risk of a dividend cut at Exelon (EXC) and First Energy (FE), utilities have a slim margin for operating error as measured by the Dividend Cushion, despite being steady-eddy entities oftentimes with regulated returns. Diversified utility exposure ensures that we won’t suffer from an unusual and often difficult-to-predict dividend cut in the space. We plan to add the Utilities Select Sector SPDR (XLU) on Tuesday, starting with a 2% position in the Best Ideas portfolio.

Please expect an email transaction alert Tuesday (March 18) with further details!

Download the fact sheet of the Utilities Select Sector SPDR (XLU) here.

Download top holdings in the XLU here: DUK, NEE, D, SO, EXC, AEP, SRE, PPL, PCG, PEG.