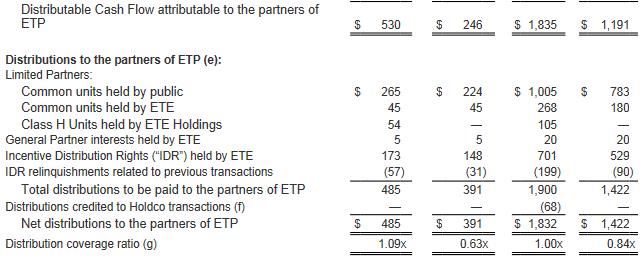

Energy Transfer Partners (ETP) reported solid fourth-quarter results Wednesday. Adjusted EBITDA for the master limited partnership increased $38 million from the same period a year ago, to $986 million. Distributable cash flow attributable to the partners of ETP for the quarter totaled $530 million, up $284 million from the same period a year ago. Though the increases in adjusted EBITDA and distributable cash flow were due in part to acquisitions, we’re very pleased at the significant improvement in the entity’s distribution coverage ratio, which advanced to 1.09x from 0.63x in the same period a year ago. For dividend growth investors, we’re laser-focused on the distribution coverage, as it reveals both the security of the distribution as well as the excess potential for distribution growth.

Image Source: Energy Transfer Partners

Valuentum’s Take

Though there is much to like about Energy Transfer Partners’ renewed distribution coverage, it’s worth reiterating that the hefty distributions that master limited partnerships issue make the group extremely dependent on the healthy-functioning of the capital markets for incremental equity and debt. However, we don’t foresee an event such as that which happened to Boardwalk Pipeline (BWP) (see here) occurring with ETP on the basis of the company’s improved distribution coverage. Energy Transfer Partners remains a holding in the portfolio of the Dividend Growth Newsletter.

<< View Energy Transfer Partners 2013 Analyst Day Presentation