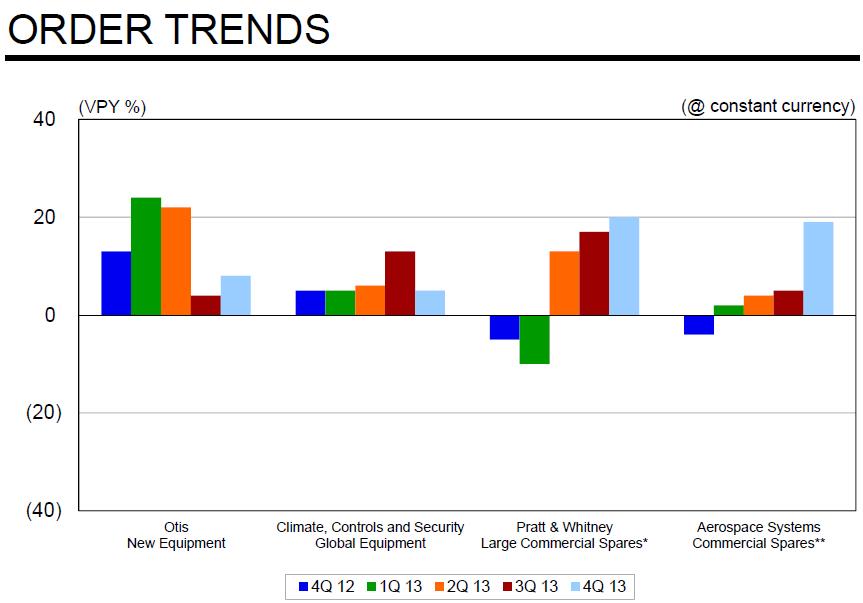

On Wednesday, industrial conglomerate United Technologies (UTX) reported solid fourth-quarter results. During 2013, earnings per share and net income attributable to common shareholders advanced 16% and 17%, respectively, over the prior year period. Though most of it was acquired expansion, sales jumped 9%, while the company’s adjusted segment operating margin increased 90 basis points, to 15.7%. Cash flow from operations came in at $7.5 billion for the year and capital expenditures were $1.7 billion, resulting in free cash flow of $5.8 billion (or 9.3% of sales). We were particularly pleased with CEO Chenevert’s comments about witnessing an acceleration of organic growth throughout the year. Fourth-quarter organic sales growth was 4% (better than the 1% pace recorded for the entire year), and order growth during the fourth-quarter was solid:

New equipment orders at Otis increased 8 percent over the year ago quarter. UTC Climate, Controls & Security equipment orders increased 5 percent organically. Large commercial engine spares orders were up 20 percent at Pratt & Whitney and commercial spares orders increased 19 percent at UTC Aerospace Systems.

Strong order growth, accelerating organic expansion, and a relentless focus on cost controls speak to potential upside to its 2014 targets for earnings per share of $6.55-$6.85 on sales of approximately $64 billion. We like United Technologies quite a bit on a fundamental level, especially given its material aerospace exposure. For one, the strength of ‘Pratt & Whitney Large Commercial Spares’ and ‘Aerospace Systems Commercial Spares’ orders in the quarter was the highest in some time:

Image Source: United Technologies

We were also enamored by Best Ideas portfolio holding Precision Castparts’ (PCP) fiscal third quarter results, released Thursday. Precision Castparts’ company profile sums up to a large degree its ubiquitous exposure and strong customer relationships:

Precision Castparts is the world leader in structural investment castings, forged components, and airfoil castings for aircraft engines and industrial gas turbines. Airbus, Boeing, GE, Rolls-Royce, and many other leading manufacturers depend on us for critical airframe, engine, power generation, medical, and general industrial components. With few exceptions, every aircraft in the sky flies with parts made by PCC.

Precision Castparts’ fiscal third quarter was solid: record earnings per share from continuing operations of $2.95 (diluted); record consolidated segment operating margins, record cash generation, and it completed its acquisition of Permaswage. Though organic growth wasn’t blockbuster during the period, sales advanced 16%, which leveraged into a 27% increase in consolidated segment operating income. The incremental profit margin on each new dollar of revenue continues to be fantastic, and Precision’s ability to execute with respect to productivity and cost-takeouts is among the best in our coverage universe. The firm’s segment operating margin advanced an impressive 250 basis points, to 28% in the quarter. Precision Castpart’s overall commentary was stellar:

Commercial aerospace OEM production, which accounts for more than 40 percent of the (Investment Cast Products) segment’s sales, continues to be robust and is expected to increase as the slope of aircraft build rates ramps.

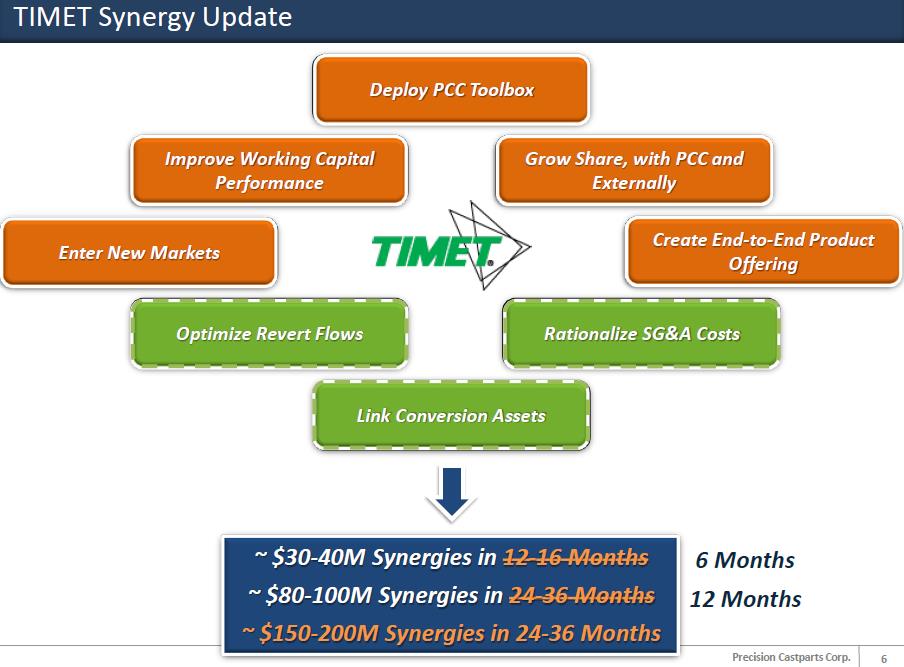

TIMET continues to flourish and is not only growing in concert with the aerospace market, but has also gained additional market share with key customers.

Critical aerospace fastener and aerostructure shipments are now closely tracking the current base commercial build rates. In addition, fastener 787 shipments, now at an average of six shipsets per month, are continuing to close the gap with aircraft production schedules. (Airframe Products) segment growth in aerospace sales will be tied to further ramps in aircraft production.

Still, CEO Mark Donegan noted that it faced some performance headwinds as a result of the shift in customer delivery schedules very late in the quarter. We’re not reading too much into what management described as “unprecedented dynamics,” particularly since its customers “have already begun to re-accelerate schedules in the new calendar year, and (its) operations are meeting this demand with an even better cost profile.”

Valuentum’s Take

We like United Technologies and Precision Castparts, and while organic growth at both firms wasn’t as strong as it could have been, we’re expecting accelerated expansion in 2014. United Technologies’ order growth and the re-acceleration of customer schedules at Precision speak to this dynamic. We think both firms remain laser-focused on costs, and we would not be surprised to see material operating-margin expansion throughout the year, especially for Precision, which continues to extract cost synergies from TIMET (see image below). United Technologies is a less volatile business thanks to its more diversified operations (Otis, climate controls), but Precision dominates its markets within commercial aerospace, which we expect to remain strong for some time to come—given robust order backlogs at Boeing (BA) and Airbus. We don’t expect to make any changes to the actively-managed portfolios. Our best ideas are always included in the Best Ideas portfolio and Dividend Growth portfolio.

Image Source: Precision Castparts

Aerospace Suppliers: AIR, ATRO, COL, EDAC, HEI, HXL, PCP, SPR, TDY, TXT