When money is cheap (i.e. when interest rates are low) and equity price euphoria is running wild, deals will happen.

Last Wednesday, activist hedge fund Elliot Management launched an opportunistic bid to acquire all of the outstanding shares of Riverbed (RVBD) for $19 per share in cash. We think the offer is too low on the basis of our fair value estimate, and we don’t think Riverbed will accept terms as they currently stand (the board is still evaluating); it remains uncertain whether a higher offer from Elliot is an eventuality. We think a fair price for Riverbed is $22 per share (our fair value), and we’re reiterating this opinion. Before the bid, we believed Riverbed was undervalued on both a discounted cash-flow and a relative value basis and highlighted the company as one of the cheapest stocks on the market (click here for list). Elliot has been one of the more active hedge funds thus far in 2014, subsequently pushing for change at Juniper (JNPR). Unlike Riverbed’s, Juniper’s shares are a bit pricey, trading above the high end of our fair value range (see its 16-page report).

Also hitting the news desk recently was British engineer AMEC provisionally agreeing to buy engineering and construction (E&C) firm Foster Wheeler (FWLT). We’re not fans of the E&C space at all and view this acquisition as a blessing for Foster Wheeler’s shareholders on a fundamental level:

Firms in the E&C industry design and construct facilities for customers across a variety of end markets. Participants generally have slim margins and use percentage-of-completion accounting, which can cause wild swings in profitability, especially on fixed-priced contracts when cost overruns occur. Firms that operate primarily under cost-reimbursable contracts tend to have lower risk profiles. Still, order trends can be volatile, and cash flow depends on projects in cyclical industries. Competition remains fierce, and industry consolidation won’t change existing rivalries much. We generally don’t like the group.

Foster Wheeler shareholders will receive 0.8998 shares of AMEC common stock and $16 per share in cash for each share of Foster Wheeler stock they own. The total buyout price of $32 per share falls within our estimate of Foster Wheeler’s fair value range, so the pricing appears appropriate. Though the equity component of AMEC will offer Foster Wheeler shareholders the opportunity to benefit from the “strategic and commercial benefits of the combined company,” we’re not at all interested in exposure to the E&C industry. Razor-thin margins, lumpy order trends, and risky contract cost overruns are but a few reasons.

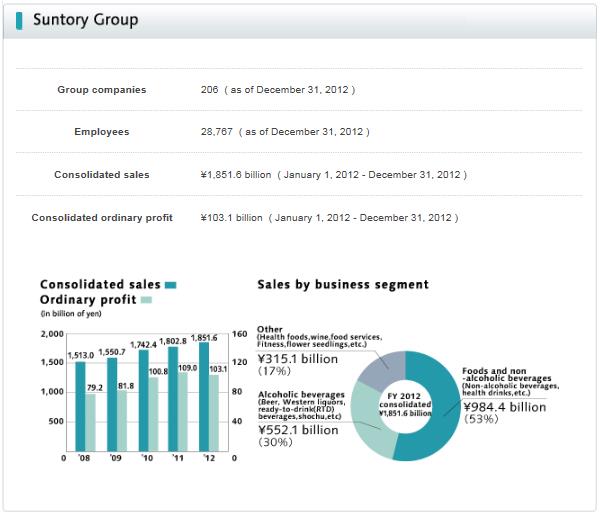

Beam (BEAM) also became the prey of a strategic acquirer. On Monday, the firm announced that Japanese firm Suntory (corporate breakdown in image below) will acquire all of the outstanding shares of Beam for $83.50 per share in cash. The price paid exceeds the high end of our estimate of the company’s fair value range and represents a 25% premium to Beam’s Friday closing price. Suntory is paying more than 20 times BEAM’s EBITDA for the 12-month period ended September 30, 2013, an extremely lofty price tag. We think Beam’s shareholders should take the money and run.

Image Source: Suntory

Valuentum’s Take

With money still relatively cheap (but getting more expensive; interest rates are rising), 2014 may be the year where M&A activity really takes off. Though we think Riverbed shareholders should wait for a better offer, owners of Foster Wheeler’s and Beam’s equity should be very happy with the offers on the table. Two other likely takeout scenarios >>