Though profit margins on iron ore operations are hefty, swings in commodity prices translate into large swings in equity prices as mid-cycle valuations are tweaked. Management teams within the mining space are well-aware of the boom-and-bust cycles of their business, and recent tactical moves indicate that constituents continue to be very cautious.

We commented on Rio Tinto’s (RIO) and Vale’s (VALE) decision to cut spending, and recent news suggests that BHP (BHP) will also look to keep annual spending below $15 billion, a large cut from the $21.7 billion the firm spent in the previous fiscal year. The billions of dollars in reduced mining equipment spending doesn’t bode well for firms specializing in earth-moving equipment such as Caterpillar (CAT) and Joy Global (JOY), the latter reporting a sharp 19% decline in bookings during its fourth-quarter results, released Wednesday. ‘Surface Mining Equipment’ orders at Joy Global fell a whopping 31.6% during the quarter ending October 25, 2013. The mining equipment makers will face some tough sledding in the years ahead, and cost-cutting and restructuring initiatives should be expected.

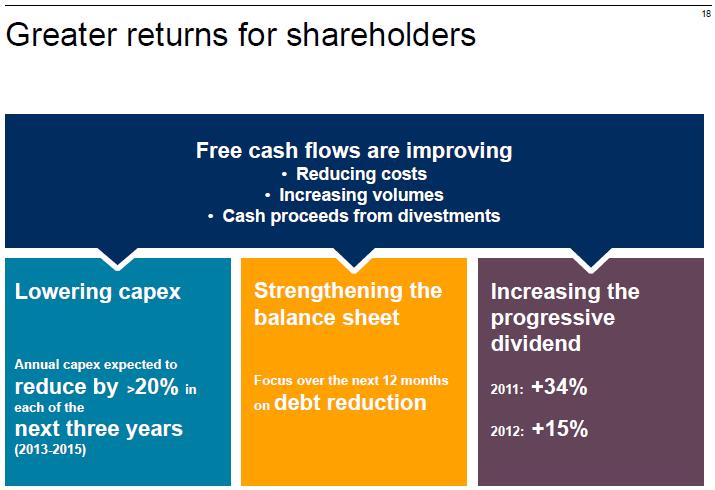

In this highly uncertain mining environment, we continue to like the prudent moves taken by Best Ideas portfolio holding Rio Tinto. The company noted that it has already exceeded its target of operating cost cuts of $2 billion by the end of this year and is on track for $3 billion by next year. We’re big fans of the operating cost cuts, which coincide with capital spending declines and an ongoing focus on shoring up the balance sheet. CFO Chris Lynch said 2014 will be one focused on de-leveraging (paying off debt) to preserve its comfortable investment-grade credit rating. All-in, the moves by Rio Tinto speak volumes of its focus on shareholder returns (shown below).

Image Source: Rio Tinto

Valuentum’s Take

We continue to reiterate our view that we like what management teams are doing to de-risk their mining business models in the face of an increasingly uncertain commodity price environment. Rio Tinto continues to be our favorite mining idea on the basis of valuation.

Metals & Mining – Diversified: BHP, CLF, FCX, RIO, SCCO, SLW, VALE