Shares of Pandora (click ticker for report: ) have been on a wild ride lately as a result of the combination of strong listening metrics and the announcement of a new competitor in the form of Apple’s iTunes Radio (click ticker for report: ).

We continue to steer clear of shares. Here’s why.

Share Offering

Though shareholders rarely ever want to see companies issue equity as Pandora did when it sold 18.2 million shares of its overvalued stock at $25 per share September 24, when a firm sells overpriced shares, the process actually creates value for existing shareholders. Think of it this way. If you can get more money for something than it is actually worth, you’re creating value. From a valuation (mechanical) standpoint, the increase in cash per share on the firm’s balance sheet is greater than the dilution per share caused by the increased number of shares. Pandora’s new issuance equates to $455 million, but with 5.2 million sold on behalf of a shareholder, the firm pocketed net proceeds closer to $320 million.

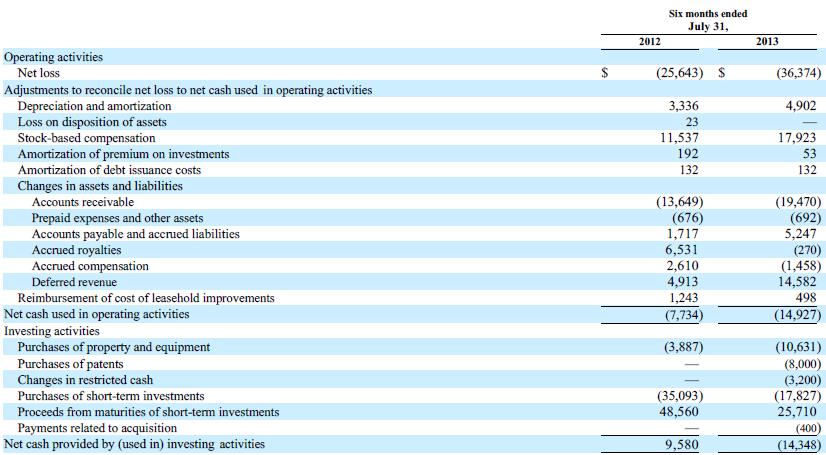

Though we’d love to think Pandora simply raised cash to capitalize on its overvalued stock, that’s not the case. The firm continues to burn cash, with more than $25 million going out the door through the first six months of 2013 (negative $14.9 million in cash from operations plus negative $10.6 million in purchases of property and equipment, as shown below). We also think the company raised cash because it has a giant competitor in iTunes Radio, and Pandora must now prepare for long battle – with survival not guaranteed.

Source: 10-Q, released 8/27/2013

September Listening was Strong But Misleading

Pandora released September listening metrics October 2 that clearly pleased the market. Listening hours increased 18% year-over-year to 1.36 billion, though sequentially, listening hours rose just 1%. Considering August listening hours increased 16% year-over-year, the shallow interpretation could be that Pandora is successfully fending off iTunes Radio. We don’t believe that is the case.

Unlike August, September listening hours were uncapped, so heavy-usage free listeners likely increased listening. Active monthly users increased 25% year-over-year to 72.7 million users, which was also a sequential increase of 1%. In our view, this suggests that some users are defecting elsewhere at least some of the time.

Importantly, the September listening data doesn’t include much competition from iTunes Radio. Though iTunes Radio was released September 18, the service was only available to iOS 7 users. iOS 7 adoption sits at an impressive 60% level, but it took time for the installed base to ramp, and users of older model iPhones aren’t able to use iTunes Radio.

October will give us a better assessment of what Pandora is up against.

iTunes Radio: Not an Ideal Competitor

Apple’s iTunes Radio is a very compelling product with huge market potential. Pandora is limited to the United States and has 1 million songs, whereas iTunes Radio has an installed user base of at least 500 million people and can utilize 27 million songs. This enormous installed base allowed the product to achieve 11 million active users in just 5 days. While it is limited to the United States at this point, Apple can easily make it a global service.

Reviews of the product are also fantastic, with CNET declaring the service superior to Pandora. As we mentioned earlier, iTunes Radio has a song catalog 27x larger than Pandora’s, making it more appealing to users looking to discover music. The service also has access to iTunes purchase history, potentially providing users with a better song selection. To top it off, users can easily purchase songs via iTunes while using the service—a feature unique to iTunes Radio.

With a large installed user base and gigantic song catalog, iTunes Radio also has Apple behind it. Obviously, this allows iTunes Radio to be the stronger funded product, considering that Apple generates free cash flow in a given quarter that’s enough to acquire Pandora. Apple also sits on a mound of cash that gives the firm unmatched financial flexibility.

Valuentum’s Take

Though we admit September listening metrics were solid, we do not believe September accurately reflects the new dynamic with Apple involved. More importantly, Pandora is truly in a battle of David versus Goliath—this isn’t Spotify or Rhapsody—this is Apple.

We hold shares of Apple in both of our actively managed portfolios and view iTunes Radio as an incremental positive. As for Pandora, we think shares look overpriced, and we would consider it as a put option candidate in the event that the firm’s Valuentum Buying Index score deteriorates (currently a 6).

RJ Towner owns shares of the following companies: AAPL