The summer months have been relatively uneventful, with the exception of concerns relating to the Federal Reserve’s coming tapering of its bond-buying program and quibbles between hedge fund giants over a company that makes protein shakes—we’re talking about Herbalife (HLF) in the latter example. Even the sequester proved to be a largely underwhelming event so far through 2013.

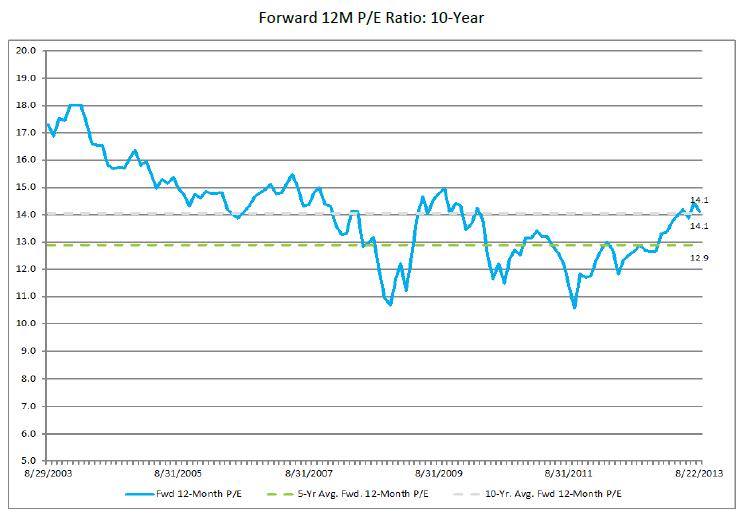

As a result, the market has focused on fundamentals, awarding strong performance and punishing poor performance (almost irrespective of valuation parameters). However, the market remains fully valued at current levels, with the forward price-to-earnings ratio on S&P 500 companies in-line with its 10-year average at 14.1 times, and the distribution of our Valuentum Buying Index ratings tilting decidedly negative. The forward price-to-earnings ratio of S&P 500 companies is currently above its 5-year average of 12.9 times, which in our view, doesn’t bode well for continued multiple expansion (considering the pace of future global growth prospects from today).

Image Source: Factset, August 2013

We put much more weight in the forward price-to-earnings ratio, which is a component of our relative value assessment within the Valuentum Buying Index framework, relative to the trailing price-to-earnings ratio, which is also roughly in-line with historical trends at just over 15 times. As we continue to hammer home to our readers, the future is all that matters in investing, and while historical performance can provide some insight into a firm’s track record, it is only valuable if it informs how the company will perform in the future.

Though valuations have become less-than-attractive across our broader coverage universe, some major headline risks also appear to be surfacing, meaning volatility is poised to increase relative to the mundane 2013 we’ve had thus far. Still, we continue to be well-positioned for increased volatility (and market declines) in the portfolio of our Best Ideas Newsletter with our December expiration put position on the S&P 500 SPDR (SPY), which we added a few months ago.

Let’s take a look at some headline events that continue to be on investors’ radars.

Syria

The situation has intensified in Syria, with rhetoric about chemical weapons suggesting an increased probability that the United States and the Western world begin an attack on the Middle Eastern country. US Secretary of State John Kerry told a global audience that President Obama takes chemical weapon usage seriously, and that Syria should be punished for its actions.

Though a full-scale war could have a major impact on several sectors, the more likely outcome of any small-scale action, if it happens, would provide a short-term boost (a speculative premium) to the price of global benchmark North Sea Brent crude oil. We think an advantaged crude refinery—which focuses more on US supplies from the Bakken in North Dakato and Eagle Ford in Texas—like Philips 66 (click ticker for report: ) could capture more of the oil value chain, though competitors like Valero (click ticker for report: ) and Marathon (click ticker for report: ) may also benefit to a degree. Pipeline owners like Kinder Morgan (click ticker for report: ) and Energy Transfer Partners (click ticker for report: ) could also experience stronger utilization of shale pipelines as refiners look to refine as much advantaged crude as possible. A few of the railroad operators including Union Pacific (click ticker for report: UNP), Berkshire’s Burlington Northern, and Canadian Pacific (CP), which have helped alleviate some of the pipeline bottlenecks from the shale oil fields in recent years, could also see a short-term jump in crude-by-rail demand.

<< See our Long-term Outlook on Crude Oil and Natural Gas

Perhaps a more obvious outcome from any military action is a heightened focus on the trajectory of defense spending, which we would view as a positive for much of the defense group. Though spending is expected to decline in coming years due in part to competing budget priorities, increased geopolitical uncertainty may help level off the declines that are expected during the mid- and latter parts of this decade. Within the defense arena, we continue to prefer defense contractors that also have commercial aerospace exposure (on a fundamental basis), namely Boeing (click ticker for report: BA) and United Technologies (click ticker for report: UTX). Though we’re not making any portfolio moves at this time, we’re keeping a close eye on the Syria situation.

Aerospace & Defense – Prime: BA, FLIR, GD, LLL, LMT, NOC, RTN

The New Fed Chairman

Sources now say the Federal Reserve chairmanship is a running between three candidates: Larry Summers, Janet Yellen, and Donald Kohn. Each comes from a strong academic and governmental background, but Summers is viewed as a far different choice than Yellen and Kohn.

Summers is more of an outside candidate to the Fed, though he is more of an inside candidate to the Obama administration—Summers had previously worked as Director of the National Economic Council. He has moved freely between working at Harvard, the government (from 1999-2001, he was the US Secretary of the Treasury), and hedge fund D.E. Shaw. There’s little doubt about Summers’ economic aptitude, but the common worry is that he’s too difficult to work with, though we have not worked with him personally.

Yellen is a likely candidate after serving as Vice Chairwoman for departing Chairman Ben Bernanke. Yellen is known as a consensus builder and receives credit for accurately predicting the housing bubble, though she underestimated the magnitude.

As with Summers, Yellen’s economic expertise is not in question, but the big concern seems to be that she wouldn’t fit in well with other important actors. Some believe that she had some distance from the crisis-busting actions taken by the Fed in 2009 (and by extension, less relevant experience) as she led the San Francisco Fed while most of the actions occurred in Washington, D.C. and New York.

Yellen seems to be dovish like Bernanke, suggesting her focus would remain on unemployment rather than inflation. Therefore, we may not see a shift in monetary policy.

Cohn doesn’t have the profile of Yellen or Summers, but he also served as Vice Chairman of the Fed to Bernanke. Cohn worked his way up from the bottom at the Fed before retiring in 2010. Though he served as a top lieutenant to Bernanke, reports suggest he might be slightly less aggressive than Bernanke, Yellen, or Summers in fiscal policy actions.

The next pick for Fed chairmanship will be incredibly important, as the Chairman or Chairwoman will have to decide when to unwind mortgage-backed security purchases and allow interest rates to rise. We’re certainly keeping a close eye on the developments at the Fed, but we don’t expect to make any abrupt changes to our actively-managed portfolios on any announcement.

The Debt Ceiling…Part 2

We remember previous concerns about the ‘Debt Ceiling’. Washington politicians bickered over whether or not the routine of increasing the debt ceiling should continue. Politicians even held the process hostage, leading S&P to downgrade the US’ credit rating to ‘AA+’ from ‘AAA’, but the government eventually came to a resolution. Equity markets did initially sell off on these concerns, but they ended up rebounding nicely for a fantastic run over the past two years. The episode turned out to be pretty much a ‘non-event’, as we had predicted.

Earlier this week, Treasury Secretary Jack Lew warned that the debt ceiling would need to be raised by mid-October to avoid a repeat of the fiasco. The event may go more smoothly this time because the US isn’t close to another major election cycle, so Republicans and Democrats have less incentive to embarrass each other.

We think the situation will end like it did the prior time with the two sides eventually reaching a deal. However, as we outlined above, the valuation considerations are vastly different than they were just two years ago, so we wouldn’t expect a rally anywhere near the magnitude of that which occurred during the past two years.

Valuentum’s Take

Headline worries are always present in the market, and the three concerns above could heighten volatility in coming months. However, headline risks often have little, if any, influence on the true intrinsic worth of firms (which is based on future free cash flows), and we don’t expect to make any immediate changes to our fair value estimates across our coverage universe in light of these developments. We continue to feel very comfortable with our positions in both of our actively-managed portfolios.