Boeing’s (click ticker for report: ) shares tumbled a few percentage points Friday after reports of a fire in the upper part of the rear fuselage of one of Ethiopian Airlines’ 787 Dreamliners that was parked on the tarmac at London Heathrow Airport. Preliminary results of the investigation reveal that the fire (heat damage) was not caused by the plane’s lithium-ion battery (location of batteries shown here), which had been the trigger of previous fire-related incidents on the aircraft. Interestingly, the plane had been parked for as many as eight hours and was unoccupied, leaving the cause of the blaze unidentified (unwitnessed) and somewhat peculiar. We expect the aft fuselage on this 787 to be a total loss, given our assessment of the damage. Boeing South Carolina, a unit of Boeing, makes the aft fuselage on the 787 (sections 47 and 48)—Spirit Aerosystems (click ticker for report: ), on the other hand, builds the forward fuselage and other parts of the plane.

Image Source: New York Times, Valuentum

We don’t believe the fire and any resulting ramifications of this particular event will be tragic to the tremendous long-term demand opportunity of the Boeing 787. Even Ethiopian Airlines stated on Saturday that it would continue to fly its other 787s, citing the issue as being “not related to flight safety” – after all, the plane had been parked for hours. Other airlines including United Airlines (click ticker for report: ) also said that they will continue to fly the Dreamliner. Though it is still too early for us to determine the exact cause of the most recent fire (heat damage), we believe it could be related to installation issues or the plane’s electrical wiring system (the aircraft was connected to an external ground source). The 787 relies on electricity more than any other Boeing airplane. We expect a full explanation by the investigating authorities soon.

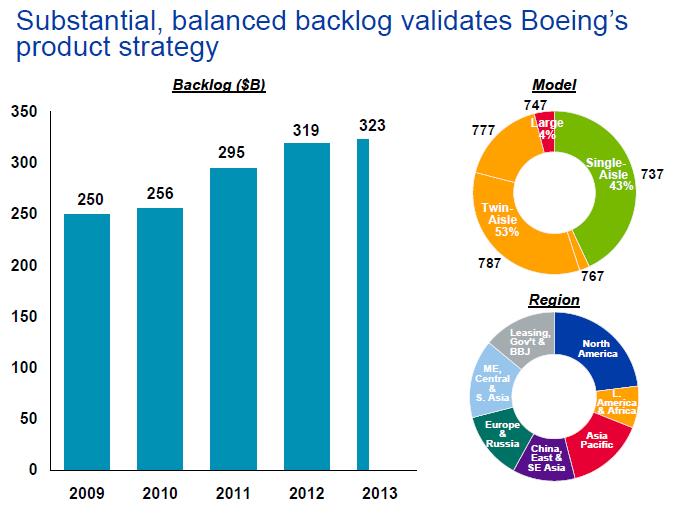

The reporting of the event caused shares of the aerospace giant and many in the supply chain to come under selling pressure, but we think the market simply overreacted (as it often does) on the lack of details. Though this is certainly not welcome news for Boeing, the event hasn’t stopped airlines from flying the plane or caused any cancelations within the firm’s burgeoning backlog, which stood at over $320 billion on the commercial side at the end of the first quarter of 2013.

Boeing’s Large and Growing Commercial Aerospace Backlog

Image Source: Boeing’s Current Market Outlook, June 2013

Valuentum’s Take

This won’t be the last problem we hear about Boeing’s 787, but we also don’t expect airlines to rush to cancel their orders of the revolutionary aircraft. We’re reiterating our positive outlook on the aerospace industry and point to Precision Castparts (click ticker for report: ) as our favorite idea within the supply chain.

Aerospace Suppliers: AIR, ATRO, COL, HEI, HXL, PCP, SPR, TDY, TXT