Shares of da Vinci surgical systems maker Intuitive Surgical (click ticker for report: ) fell in after-hours trading Monday afternoon after the company released weak preliminary results. Fiscal year 2013 second quarter revenue is expected to be 7% higher than the same period a year ago at $575 million—well below the consensus estimate calling for $630 million. Net income is expected to be marginally higher at $160 million compared to $155 million during the same period last year. This net income figure implies earnings per share in the $3.85-$3.87 range, well below consensus estimates calling for $4.29 per share.

Management was quick to blame other parties, saying on the press release:

“The slowdown in benign gynecologic procedures reflected a number of factors including, but not limited to, reduced hospital admissions and a trend by payers toward encouraging conservative management and treatment in outpatient settings.“

The bolded section echoes what we heard from the American Congress of OB/GYN’s president back in March, questioning the need for the “arguably” more expensive robotic procedures. We also brought the issue to light following news of FDA investigations into the da Vinci system. We note, however, the peer-reviewed literature regarding the clinical evidence for the efficacy of the da Vinci surgery is deep across many applications. Assuming management is forthright in its statements, we can imply that health insurers are using recent negative commentary regarding robotic surgery to avoid paying for it.

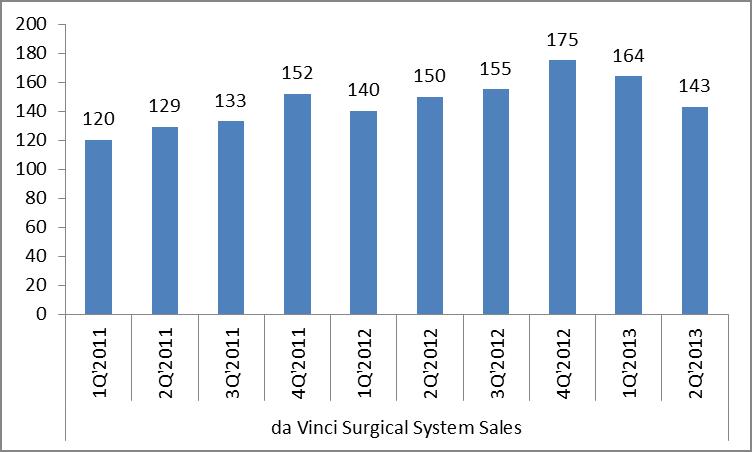

Regardless, we did not see a material slowdown in the number of procedures performed on da Vinci systems (which we would need to see if the ‘short-seller’ case held any water). In fact, da Vinci procedure growth increased 18% year-over-year. The issue has been on the new system side, where Intuitive sold 143 da Vinci systems compared to 150 in the second quarter of 2012, dragging system revenue down 6% year-over-year. Though system sales in Europe, Japan and ROW (rest of world) advanced nicely, system sales in the US were significantly lower during the period, with 90 systems sold in the second quarter of 2013 compared to 124 during the same period a year ago—a decline of 28%.

Though the quarterly performance was a disappointment in the US, system sales of the da Vinci are still robust. Through the first half of the year, da Vinci system sales have advanced 6% (307 versus 290). As such, we’re not ready to extrapolate the current downward trajectory. We’ll know more when the firm reports full quarterly results July 18.

Source: Intuitive Surgical, Valuentum

Valuentum’s Take

The preliminary second-quarter results from Intuitive Surgical reveal that the company has hit a speed bump in the pace of expansion in the US market. It seems like system sales in the US may face ongoing pressure if hospitals become increasingly concerned about the value proposition of da Vinci systems. But even if doctors don’t grow more concerned, insurers may balk at paying for robotic surgeries if a clear advantage isn’t presented. Still, underlying financial performance at Intuitive Surgical isn’t terrible; at this point, we’re looking at just a speed bump.

That said, we will be keeping this Best Ideas Newsletter portfolio holding on a short leash going forward (our position is one of the smallest in the portfolio at about 2%). We typically weight the stocks in the portfolio on the basis of the conviction we have in each respective idea.