At Valuentum, we feel that the best stocks will be those that are undervalued on both a DCF basis and on a relative-value basis and are just starting to demonstrate positive technical and momentum indicators. We think this allows our subscribers to identify the most attractive stocks at the most opportune time to buy.

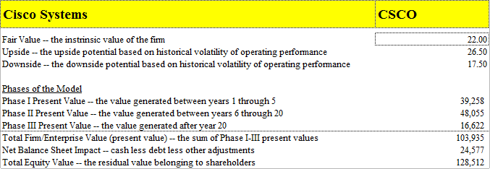

Let’s use Cisco (CSCO) to illustrate our process. For starters, we feel the firm represents a very compelling opportunity from a DCF valuation standpoint. We provide our valuation summary below and make our DCF valuation model template available here, so that readers can use it to value any firm in their portfolio.

Source: Valuentum Securities, Inc.

What the above valuation reveals is that we think Cisco is worth between $17.50 and $26.50 per share (with a point estimate of $22 per share), meaning that we think it is undervalued under $17.50 but overvalued above $26.50. Okay, let’s assume we agree that Cisco is undervalued at these levels. But what if you pulled the trigger immediately like other research firms did when the stock dipped below their respective trigger prices, at $17.50 per share or perhaps even at a higher price? Well, you’d still be considerably under-water based on Cisco’s current share price.

However, patient investors that adhere to Valuentum’s process would have waited until the technicals started to improve in order to confirm an entry point in a very attractively valued stock. After all, you would have already liked Cisco, have done your homework, checked our Valuentum ValueRating and corresponding research report, and would be merely looking for the right time to buy. We reveal a page from our Cisco report at the end of this article that reveals the technical work we do to accompany our rigorous discounted cash-flow process.

In fact, as of today, our timeliness matrix (a cross section of the firm’s valuation and technicals) would trigger an attractive entry point above $15.60 per share in Cisco’s shares based on a technical assessment (but below $17.50 per share based on a valuation assessment). If you would have bought at $17.50 based on valuation, you’d still be underwater. However, by using valuation and technicals (and our research), you would have pulled the trigger at $15.61 and would be sitting on a nice gain right now.

The beauty of our process is that it identifies undervalued stocks, but keeps you out of value traps. For example, what if Cisco keeps falling from these levels? Well, we would have bought the shares at a much lower level, and our technical assessment would provide clues if a further move lower is in the cards. But you may say, what if Cisco rises to our fair value estimate? Well, you would have bought it at a much lower price than that of other research firms. The point is that by combining a rigorous valuation approach with a technical assessment, you have a leg up on picking the best entry point in Cisco’s shares.

This represents the core of what we do at Valuentum and maintain that an entry point for Cisco’s shares is between the $15.60 and $17.50 range.