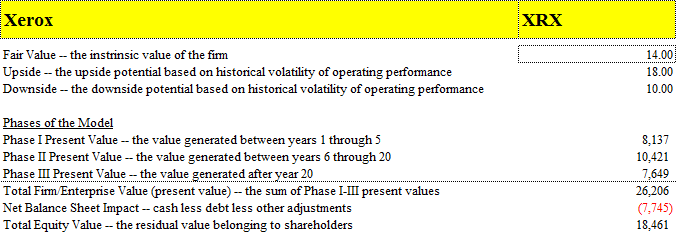

As part of our process, we employ a discounted cash-flow model to arrive at a fair value estimate for every company within our equity coverage universe. In Xerox’s (XRX) case, we think the shares look undervalued at today’s prices. Our fair value estimate for Xerox is $14 per share, significantly higher than where it is currently trading. In the spirit of transparency, our DCF model valuation template can be found here. We make this template available to investors, and it can be re-used to value any other operating firm.

Valuation Summary

We assume annual average top-line growth will average in the mid-single-digits over the next five years. We also assume that Xerox will grow earnings at a nice double-digit clip during our discrete five-year horizon. We expect the firm’s excess returns on invested capital to fade to our estimate of its cost of capital (about 8.4%) by Year 20 in our model.

Our estimated fair value range between $10 per share and $14 per share considers the risks inherent to Xerox’s business, as well as the future potential variability in the company’s free cash flow stream. We’d consider adding Xerox to our Best Ideas portfolio, if it became relatively more attractive than our existing long ideas.