On Thursday, defense contractors Lockheed Martin (click ticker for report: ) and Raytheon (click ticker for report: ) reported mixed fourth-quarter results. Though both ended the year with strong backlogs, we think cautious commentary regarding sequestration risk may put a cap on future revenue upside (relative to expectations).

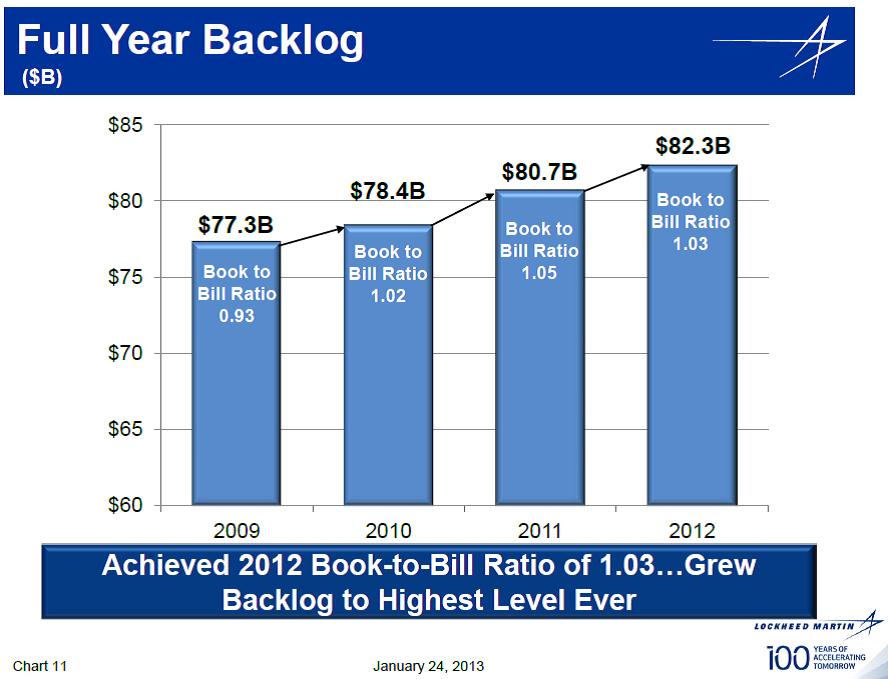

Lockheed Martin’s bottom-line missed the mark during the fourth quarter, but revenue came in slightly better than expected. The defense contractor issued 2013 guidance of $44.5-$46 billion in sales and $8.80-$9.10 in earnings per share, both ranges higher than consensus estimates. The firm ended 2012 with a record backlog of $82.3 billion (implying a book-to-bill ratio of 1.03 for the year), representing roughly 1.75 times expected 2013 revenue (Image Source: LMT 4Q Earnings Presentation).

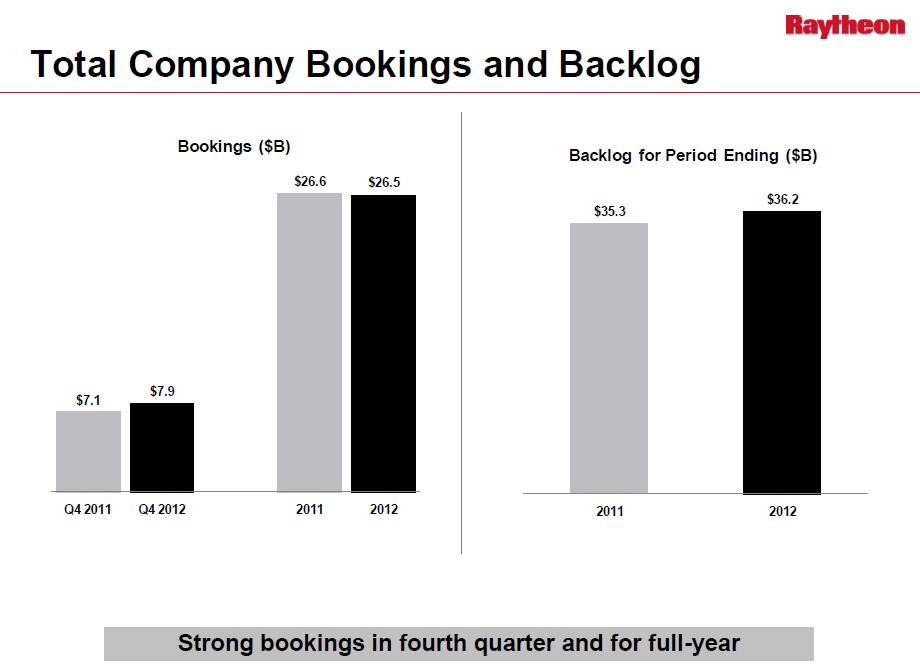

Raytheon put up better-than expected performance on both the top and bottom lines during its fourth quarter, but the company’s outlook disappointed. The firm expects earnings per share from continuing operations of $5.16-$5.31 and revenue of $23.6-$24.1 billion in 2013, both ranges below consensus estimates (and down from last year’s levels). Raytheon’s bookings were strong during the fourth quarter, and the company ended the year with a backlog of $36.2 billion (implying a book-to-bill ratio of 1.09 for the year), representing 1.5 times next year’s sales (Image Source: RTN 4Q Earnings Presentation).

Though we were encouraged by the backlog trends, we think the top-line risk (relative to expectations) for many defense contractors, including General Dynamics (click ticker for report: ) and Northrop Grumman (click ticker for report: ), is to the downside. The uncertainty of sequestration has not gone away with the fiscal cliff deal. And while such disclosure may not be new, Lockheed explicitly outlined the following in its press release, which we think is quite telling:

The Corporation’s outlook for 2013 is premised on the assumption that sequestration does not occur, that the U.S. Government continues to support and fund the Corporation’s programs, which is consistent with the continuing resolution funding measure through March 2013, and that Congress approves defense budget legislation for government fiscal year 2013 at a level consistent with the President’s proposed defense budget for the second half of the U.S. Government’s fiscal year 2013.

Congress may in fact approve the defense budget at a level consistent with the President’s proposal for the second half of 2013, but we don’t think that’s the key takeaway from this disclosure. Instead, it is abundantly clear that shifting defense budget priorities will pose ongoing uncertainty through the course of the President’s remaining four years in office. Absent an unforeseen large-scale conflict involving the US, we doubt there is any upside to the top-line forecasts at the defense contractors during the next couple years.

Lockheed and Raytheon are among the better dividend growth ideas on the market today, but we are only considering them for addition to our Dividend Growth portfolio at this time. We’ve yet to pull the trigger.