On Tuesday, IBM (click ticker for report: ) reported strong fourth-quarter results that showed flat revenue growth but solid non-GAAP operating earnings-per share expansion (up 14%) and GAAP earnings-per-share expansion (up 11%). Software sales advanced 4%, while services revenue fell 1%, both measures adjusted for currency. The firm’s systems and technology revenue fell 1%, but z mainframe revenue jumped an impressive 56%. Non-GAAP gross margin reached 52.3% of sales, up 2.1 percentage points from the year-ago quarter. Free cash flow increased $0.6 billion to $9.5 billion (an impressive 32.4% of sales in the period). Importantly, services backlog advanced roughly $1 billion, to $140 billion, after adjusting for currency. For all of 2012, IBM achieved record profit, earnings per share, and free cash flow.

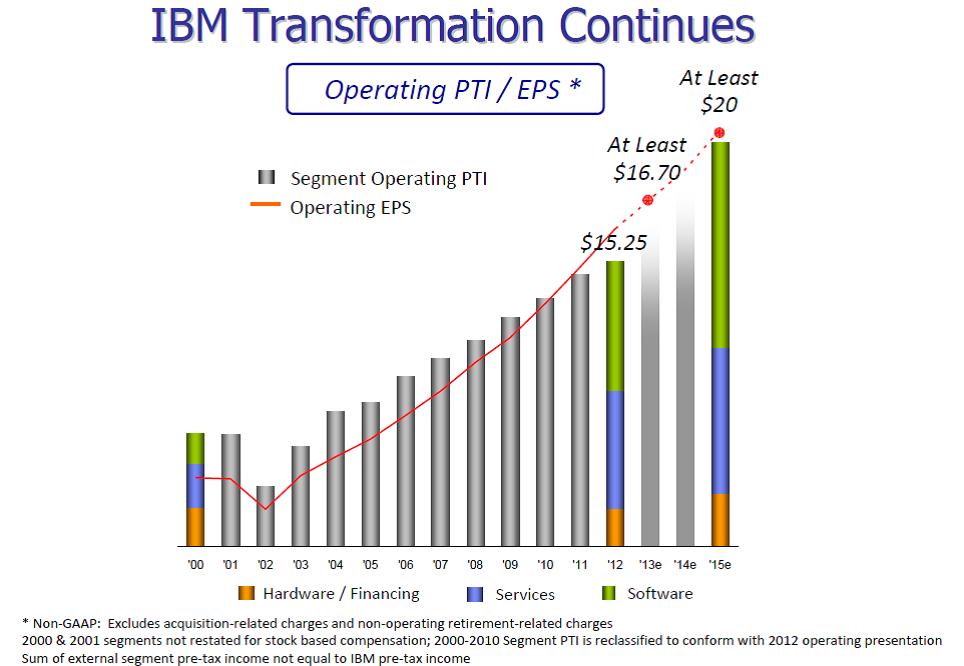

Looking ahead, IBM expects GAAP earnings per share of at least $15.53 per share and operating (non-GAAP) earnings per share of at least $16.70 per share. The company continues to invest in the enterprise market (big data, mobile solutions, social business and security) and believes it remains on track to achieve its long-term target for $20 in operating earnings per share by 2015, as shown in the image below (Image Source: IBM 4Q Earnings Presentation). If the company doesn’t hit that mark, it won’t be far from it, in our view. We’re sticking with our fair value estimate.