This morning, the maligned big box electronics retailer Best Buy (click ticker for report: ) provided updates on its holiday sales results, which were relatively strong, in our view. Breaking the downward spiral, same-store sales in the US were flat compared to last year, but continued to decline internationally, down 6.4% year-over-year. However, overall sales declined to $12.8 billion for the 9-week holiday season compared to $12.9 billion for the same period last year, suggesting overall business was fairly solid.

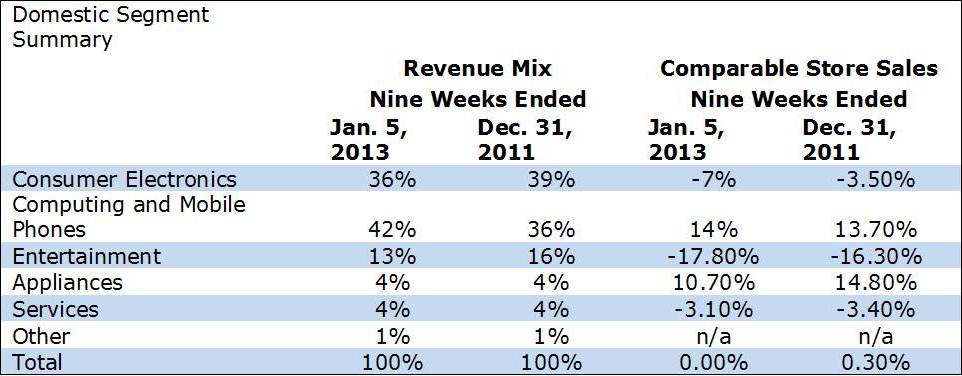

Consistent with trends throughout 2012, consumer electronics were weak, while ‘Computing and Mobile Phones’ revenues surged.

Source: Best Buy Holiday Sales Report, Valuentum

Consumer electronics, largely comprised of TVs, has been weak and probably will continue to be until we see some actual innovation in the space. On the positive side, TV sizes continue to get bigger and bigger, so we could see some higher-ARPU (average revenue per unit) product moving through the course of 2013. On the downside, TVs are largely a commodity product, so consumers will likely search for the best TV at the best price regardless of whether it’s a Samsung at Best Buy, an Emerson TV from Wal-Mart (click ticker for report: ), or a Vizio from Amazon (click ticker for report: ).

Another problem we see is in the growth in ‘Computing and Mobile Phones.’ The 2-year stacked growth rate for the category is 27.7% (14% + 13.7%)—easily the best performing segment at the company. Unfortunately for Best Buy, the margins on these items tend to be subpar, and Apple (click ticker for report: ), one of the most important players in phones, tablets, and computers, is likely among the lowest margin, in our view. Not only are hardware margins lower, but we doubt consumers will opt for high-margin service plans from Best Buy when Apple Care is available at a (generally) more reasonable price.

Entertainment is another spot of weakness that we do not see improving in the near term. After losing CD sales thanks to the iTunes revolution, the company now has to deal with digital game distribution for video games, a longer system refresh cycle, and even reduced DVD and Blu-Ray sales due to Netflix (click ticker for report: ). DVD and Blu-Ray sales were once the largest space filler in the average Best Buy store, but the firm now will need to find something to fill the space. We think the sales void will continue.

Appliances continue to be a small portion of overall sales, but the trend is certainly positive due to the recovery in housing, in our view. We think a strong growth rate remains sustainable, and Best Buy, while not as relevant as it was five years ago, could be in a better position to benefit than Sears (click ticker for report: ), which hasn’t really been relevant for some time.

For the full-year, management reduced Best Buy’s free cash flow target to $500 million from its previous forecast of $850 million to $1 billion. The firm cites a reduced accounts payable balance as the main driver, which suggests creditors are demanding cash at a more aggressive rate. While this is probably true, we think it is in the best interest of most vendors to see Best Buy survive. Thus, we think the real cause behind Best Buy’s ongoing troubles could be lower gross margins. In a low-margin business, controlling SG&A expenses becomes even more vital for survival, and with its huge store locations and staff overhead (fixed costs), a decline in gross margins could wreak havoc on profitability.

Even if profits are worse than expected, as we assume they will be, we’re encouraged to see business stabilizing on a sales basis, as this could lead to higher interest from founder Richard Schulze and his private equity consortium. Still, we think seeing the actual GAAP results for the quarter will be more important than this holiday sales update.

Shares certainly do not look expensive on a discounted cash-flow basis, but we aren’t interested in adding this speculative name to the portfolio of our Best Ideas Newsletter at this time. In our view, the risk/reward is somewhat attractive, but the situation doesn’t fit the Valuentum style of investing.