Industrial stalwart Alcoa (click ticker for report: ) reported solid fourth quarter results and relatively optimistic 2013 guidance. Revenue exceeded expectations, falling 2% year-over-year to $5.9 billion. Earnings, after excluding several one-off items, were $0.06, roughly in-line with consensus estimates and favorable compared to the same period a year ago.

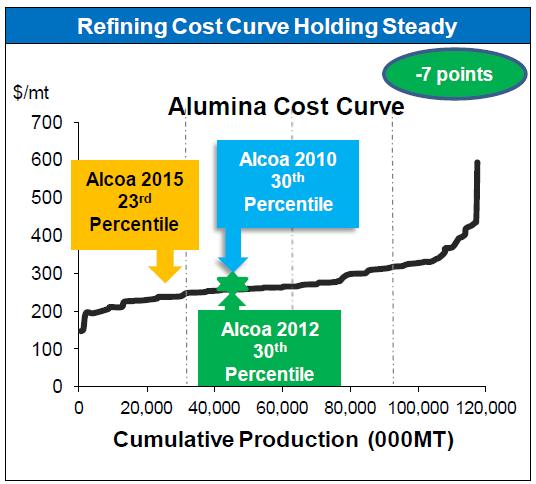

Upstream products continue to feel the pressure of weaker commodity pricing, which has obviously negatively impacted earnings. However, the company has been able to lower its position on the cost curve, leaving it with considerable leverage to the upside in the event of price appreciation.

Though upstream revenue remains mostly weak (even with favorable supply/demand dynamics), Alcoa continues to drive strong earnings from its midstream and downstream products, particularly in Global Rolled Products, which posted record fourth quarter after-tax operating income of $69 million (up 165% year-over-year). Demand in Engineered Products and Solutions is also strong, as the company has been able to achieve record EBITDA margins of 17.7%. This business is responsible for driving strong free cash flow, which totaled $535 million during the fourth quarter, easily exceeding every other period that year.

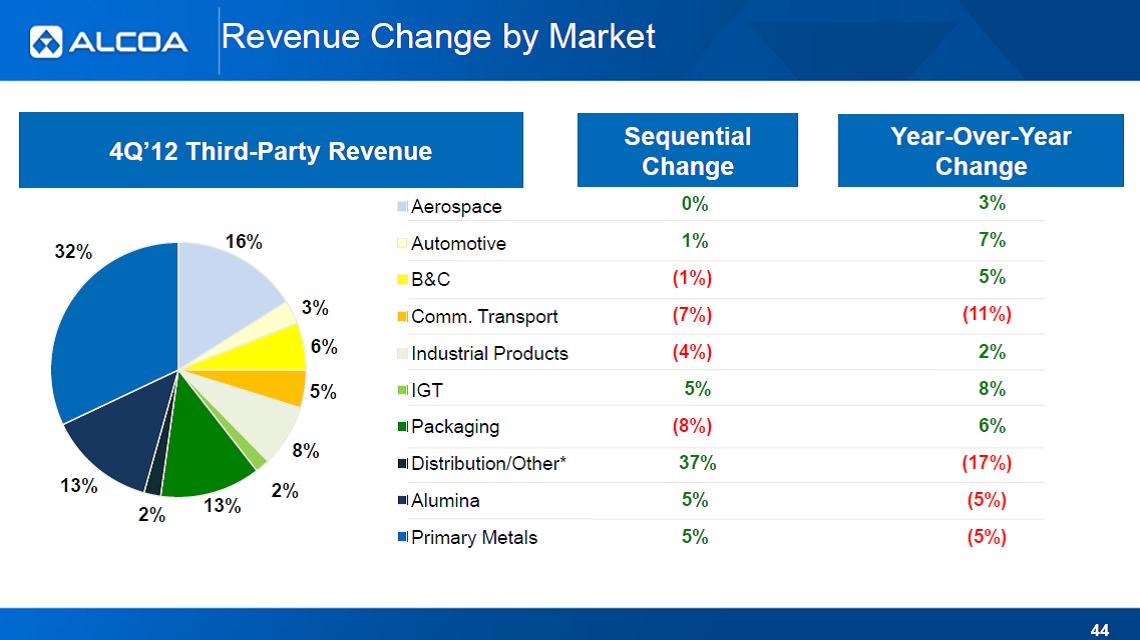

Not surprisingly, CEO Klaus Kleinfeld singled out aerospace and automotive as two key drivers of success in 2012, and the firm expects this trend to continue going forward. On top of forecasted aluminum growth of 7% (exceeding the earlier 6.5% forecast), the firm expects global automotive growth of 1%-4%, and global aerospace growth of 9%-10%.

The aerospace number is incredibly bullish for several of our Best Ideas Newsletter holdings, including supply-chain firms EDAC Technologies (click ticker for report: ), Precision Castparts (click ticker for report: ), and Astronics (click ticker for report: ), but also the larger players such Boeing (click ticker for report: ) and United Technologies (click ticker for report: ). Both industries are dealing with large amounts of pent-up demand, and we expect both to be key drivers of global economic growth in 2013.

Image Source: Alcoa Q4 2012 Analyst Presentation

But could Boeing’s hiccups with the 787 Dreamliner the past few days cause a disruption in this forecast? We don’t think so, primarily because we’ve seen nothing but support from Boeing’s customer base. Small glitches are not fun, nor are they acceptable, but we have confidence the firm will continue to learn from its mistakes.

United Technologies, a large producer of jet engines, recently reaffirmed its 2013 earnings and revenue outlook of $5.85-$6.15 in earnings per share on $64 billion-$65 billion in revenue. It also scored a deal with Embraer (ERJ) to be the exclusive provider of power for its next generation of jets. We continue to believe shares of both Boeing and United Technologies are fairly valued.

Ultimately, Alcoa’s fourth quarter was solid, in our view, and we think the industrial firm should show some improvement heading into 2013. Kleinfeld made some relatively bullish comments on China, particularly that the firm expects alumina demand to grow 11% in 2013, though Alcoa doesn’t do much exporting to the burgeoning economic powerhouse. Still, the firm provides the country with some downstream operations, and as Kleinfeld noted:

“On the downstream side, when you look at our downstream businesses that are in China we’ve just, for instance, opened a wheels facility in China to benefit from the substantial growth of the heavy trucks business there we didn’t benefit from that in the past. This is a market that’s bigger – the Chinese trucks and trailer market is bigger than the rest of the world market. I think its about 1.5 times the rest of the world’s market.”

Regardless, we think shares of the aluminum producer and product maker are fairly valued. We’re not interested in adding Alcoa to the portfolio of our Best Ideas Newsletter, but we like what recent performance from a number of bellwethers suggests about other portfolio holdings leveraged to aerospace.