Following the weak North American farm yields in 2012, demand for Monsanto’s (click ticker for report: ) enhanced seed products drove fantastic fiscal year 2013 first quarter results. Revenue increased 21% compared to the same period a year ago to $2.9 billion, well above consensus estimates. Earnings grew 169% year-over-year to $0.62 per share, well in excess of consensus expectations.

The results came as a bit of a surprise, even after seed competitor DuPont (click ticker for report: ) announced that it expected agricultural sales to accelerate in 2013, as the firm did a fantastic job increasing profitability. Sales of corn seed and traits surged 27% year-over-year to $1.1 billion, driving the 14% revenue increase in Monsanto’s seed and genomics segment. Demand and trait upgrades were strong in both Mexico and South America, as farmers hope to increase yields. The US also experienced backlog growth, suggesting another year of strong performance in the firm’s core market.

Image Source: Monsanto Q1 2013 Pipeline Presentation

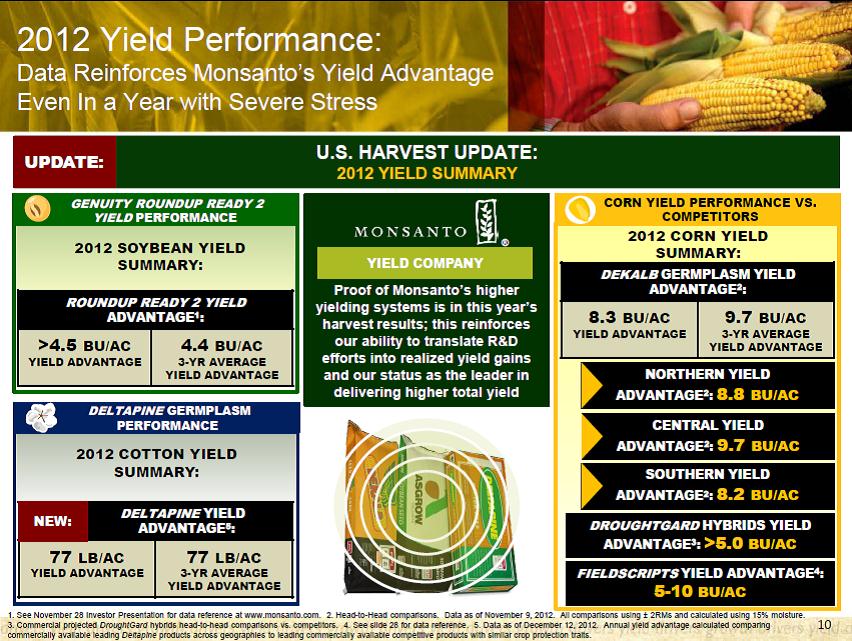

When it comes down to it, Monsanto’s agricultural products showed a real advantage, particularly in corn yields, despite terrible growing weather in the US. We expect this to be a major driver of revenue growth going forward, especially as its technology improves.

We thought we’d see a little more strength from soybeans, which were down 5% compared to the same period last year. Overall, seed sales outside of corn were flat-to-down, but when compared to corn, other seeds make up a relatively small portion of the firm’s revenue mix.

Agricultural productivity revenue jumped 31% during the first quarter, with a large portion of the sales increase flowing straight to the bottom line. EBIT increased more than two-fold to $270 million. Again, financially stable farmers are showing a strong willingness to invest in products that can be accretive to yields

On a company-wide level, gross margins were fantastic, increasing 300 basis points year-over-year to 48%, reflecting the low marginal cost nature of the business. SG&A declined 300 basis points as a percentage of sales to 18%, while R&D declined 200 basis points to 12%. R&D was roughly flat on an absolute basis. Operating cash flow jumped to $1.5 billion during the first quarter, up substantially from $1.1 billion in the same period a year ago. We continue to love the cash-rich nature of Monsanto’s business, and its current cash position now totals $4.6 billion.

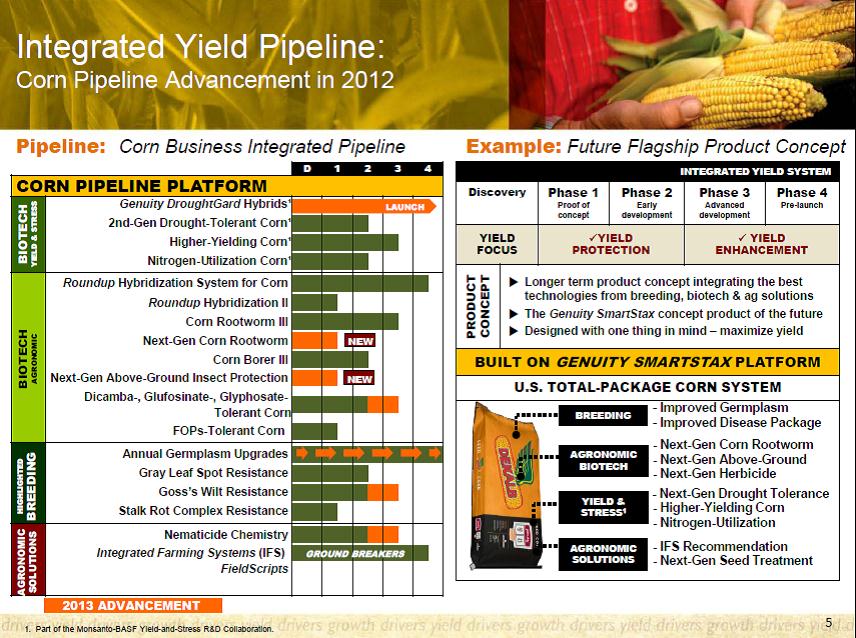

Going forward, the company raised its full-year earnings guidance to $4.30-$4.40 per share, well above its fiscal 2012 earnings of $3.77 and previous guidance of $4.18-$4.32, but roughly in-line with consensus estimates. It also expects to generate $1.8-$2 billion in free cash flow, which we think can be returned to shareholders in a variety of ways. Investment in the company’s future pipeline of corn products remains particularly strong, and we’re excited about some new features, including a second generation draught resistant seed still in development.

Image Source: Monsanto Q1 2013 Pipeline Presentation

We continue to like the fundamental momentum in Monsanto’s business, but we’d wait for a more attractive valuation before getting excited about adding shares to the portfolio of our Best Ideas Newsletter. The agricultural biotechnology sector could be one of the largest beneficiaries of global macroeconomic growth, in our view.