The much maligned Green Mountain (click ticker for report: ) reported better than anticipated fourth quarter results Tuesday afternoon. Revenue surged 33% year-over-year to $946.7 million, which was better than expected, though boosted by an additional selling week. Earnings, helped by a 3.1 million-share stock-buyback, grew 36% year-over-year to a better-than-expected $0.64 per share, on a non-GAAP basis.

One of the firm’s largest concerns, inventories, grew 14% year-over-year, which was much slower than the sales rate. Considering the SEC inquiry into the company’s accounting practices, we’ve been particularly focused on the firm’s financial statements. Accounts payable increased only 5% year-over-year, though we did see meaningful spikes in accrued expenses (up 44% year-over-year) and current income tax payable (up 204% year-over-year). Though dragging out paying expenses may signal better cash-management practices, the increase in liabilities versus a comparatively light increase in accounts receivable (up 17% year-over-year versus 46% sales growth) suggests cash generation may become an issue once liabilities are paid down and sales growth inevitably slows.

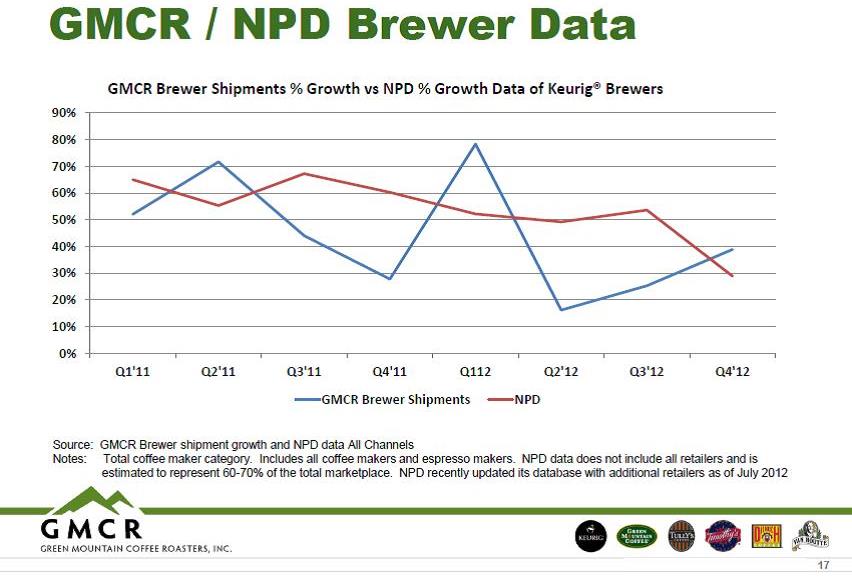

Without question, the Keurig brewer continues to be a success, though the Vue doesn’t appear to be following suit. Green Mountain sold 1.8 million Keurig brewers, versus $9.6 million worth of Vue and Vue packs, implying that the “innovative” Vue trails Keurig sales by well over $100 million. Although it may not be much of an issue in the near term, the increase in generic K-cup competition could erode sales, and the company won’t have a new patented system to generate excess margins again anytime soon. In fact, gross margins in the quarter fell 230 basis points year-over-year to 33.4%, even as K-cup pack sales surged 47%, to $700 million. Oddly enough, the company presented a slide that implies channel stuffing. Green Mountain is increasing supply to the market while we see demand decelerating, which happened earlier in the year and wasn’t positive for the stock’s market value:

Image Source: Green Mountain

Looking ahead, the firm gave bullish fiscal-year 2013 guidance, forecasting full-year non-GAAP earnings per share at $2.64-$2.74, which excludes the impact of amortization and litigation expenses, as well as stock buybacks. Considering the new earnings range implies 10% expansion at the low end, we think the company is setting itself up to exceed expectations next year, especially given its 15-20% forecasted revenue growth rate. Either that is the case, or the company is forecasting a substantial decline in gross margins or operating margins (which is feasible given new competitive pressures). Free cash flow generation remains fairly weak ($77 million in during fiscal year 2012), though guidance of $100 million to $150 million during the coming fiscal year indicates quite an improvement.

With new CEO Brian Kelley taking the helm, we expect the firm to clean up its notoriously poor internal controls, and we think questions about the firm’s accounting practices could eventually be put to rest. Still, the road ahead looks choppy given Starbucks (click ticker for report: ) foray into consumer products (Teavana acquisition; Verismo) and the lack of a next-generation brewer to replace the Keurig. Given the wide range of potential outcomes, which range from a buyout from Starbucks to suffering the negative consequences of an accounting scandal, we believe shares are fairly valued at the time. We’re steering clear of this speculative firm.