Shares of Exelon (click ticker for report: ) have been tumbling lately due to the possibility of a dividend cut. The utility company needs rates to increase in order to keep up its current payout. That may not occur, and CEO Chris Crane noted that the firm may have to cut its dividend in order to keep its strong credit rating standing, which is fundamental to running Exelon’s business.

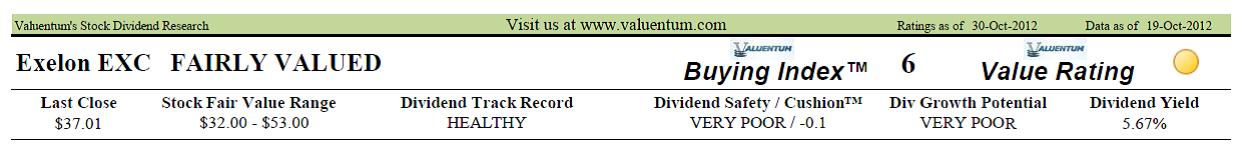

In the aftermath of the announcement, both Jefferies and Argus cut the ratings on the stock, but we think both firms were a bit late to the party. Inside our Valuentum Dividend Report for Exelon, we can see what we thought about Exelon on October 30. The fact that Exelon’s dividend was risky was not surprising to Valuentum members. The headline of our dividend report on Exelon is shown below:

Though Exelon’s dividend track record has been good, we just didn’t see much safety in the firm’s dividend. Unlike most firms, Exelon is a publicly-regulated monopoly, with rates determined by outside forces that may not care about the company’s dividend, as long as it makes “enough” money. Unfortunately for investors, companies like Exelon tend to trade on a dividend-yield basis rather than more common valuation metrics like historical P/E ratios, discounted cash-flow values, or comparable multiple analysis. Therefore, not only could investors lose income, but it also increases the chance for loss of capital. Rear-view mirror investing or looking at what a company has done with its dividend during the past 20 years does very little for you as an investor. Only the future matters.

The same event happened to Dover Downs (DDE) recently, which we identified as likely to cut its dividend in the February 2012 edition of our Dividend Growth Newsletter (see page 14). In late October, the firm slashed its payout. Dover’s share price has fallen over 21% over the last 6 months as investors became increasingly concerned about its payout and underlying earnings. And, of course, Valuentum members are well aware of how the Valuentum Dividend Cushion predicted SuperValu’s cut.

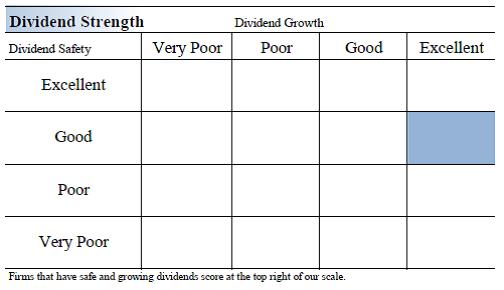

Let’s compare this to one of our favorite dividend growth names, Emerson Electric (click ticker for report: ). Emerson announced satisfactory earnings earlier this week and even raised its dividend by 2.5% compared to the previous period. The company is highly sensitive to macroeconomic conditions, and it has been able to provide investors with greater income, despite this broader weakness. Emerson’s matrix is provided below (it scores a 1.9 on our Dividend Cushion):

Just today, another company whose dividend we thought was in jeopardy, grocery store firm Roundy’s (click ticker for report: ) announced that it will reduce its dividend. Roundy’s registered a terrible Dividend Cushion score of -3.2, meaning that it had little chance to sustain its dividend at the previous pace. Though we think the move is good for the company’s survival, shares have been clobbered since speculation that the unrealistic payout would have to end. A 10% yield was certainly not worth a 50% loss of capital!

What does this show us? Well, for one, high yields aren’t necessarily good yields. If the sagas of SuperValu (click ticker for report: ), Dover Downs, and now Roundy’s have taught us anything, it’s that the “accidentally” high yield is a signal that something’s probably wrong. Though a 15%-20% dividend yield sounds amazing, it’s rarely, if ever, worth the risk.

As dividend growth investors, we prefer a combination of yield, dividend growth, and capital preservation. We’re much more interested in stocks with strong business models, fantastic cash flows, and 3%+ dividend yields such as Microsoft (click ticker for report: ). Microsoft has already raised its dividend this year, and we think shares have considerable valuation upside from current levels. A total return layover on top of dividend growth investing can help investors avoid losing income and capital.

Please click the following link to search our Dividend Reports: