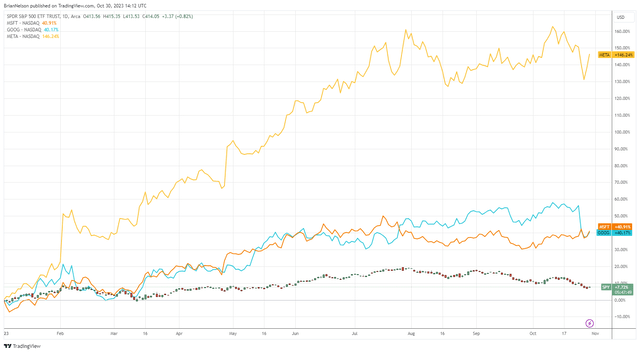

Image: Shares of Microsoft, Alphabet, and Meta Platforms have trounced the market return so far in 2023.

By Brian Nelson, CFA

We continue to reiterate that the key components of a company’s valuation are the following: net cash on the balance sheet and future expected free cash flows. These two cash-based sources of intrinsic value generally account for almost all of the value of a firm. There are some exceptions, where contingent liabilities and a more complicated capital structure come into play, but when it comes to simplifying what drives share prices, that’s about it. It’s probably no wonder then that we love net-cash-rich, free-cash-flow, secular growth powerhouses, and it’s also probably no wonder why these companies have grown into some of the strongest-performing stocks on the market, dominating last decade.

We think a holistic view to a company’s fundamentals provides an upper hand when it comes to outperforming the market, but we also feel that the discounted cash-flow model is an indispensable tool to help investors collect all of their thoughts and quantitatively put them together within valuation to arrive at what a company is worth. After all, the stock market is an expectations game, where expectations of free cash flow form the baseline for value, and changes in them heavily influence the direction of share prices. We like stocks that have strong net cash positions on the books and have a high probability of achieving better-than-expected free-cash-flow generation in coming years. In this article, we’ll talk about the cash-based sources of intrinsic value at three large cap growth names.

Our first idea is Microsoft (MSFT). Microsoft ended its calendar third quarter (its fiscal first quarter of 2024) with ~$144 billion in total cash and short-term investments and short-term debt of ~$25.8 billion and long-term debt of $41.9 billion, translating into a very robust net cash position. The company’s operating cash flow absolutely exploded during the first nine months of this year, coming in at ~$30.6 billion versus ~$23.2 billion in the same period last year. Capital spending was ~$9.9 billion for the first nine months of 2023, and while this is up from ~$6.3 billion in last year’s quarter, Microsoft’s free cash flow generation has nonetheless been phenomenal so far in 2023. Microsoft’s revenue growth was a stellar ~12% in constant currency during the third quarter, too, making Microsoft a net-cash-rich, free-cash-flow generating, secular growth powerhouse.

Our second idea is Alphabet (GOOG) (GOOGL). Alphabet ended its most recently-reported third quarter of 2023 with total cash, cash equivalents and marketable securities of ~$119.9 billion versus long-term debt of just ~$13.8 billion, good enough for a huge net cash position. Alphabet probably has the best balance sheet out there given how much financial flexibility it has to defend its economic moat in search and other areas. The company’s free cash flow during the first nine months of 2023 came in at a whopping ~$61.6 billion, up from $44 billion during the same period a year ago. For the three months ended September 30, 2023, revenue growth at Alphabet was ~11%, putting it in a similar class as Microsoft with a label as a net-cash-rich, free-cash-flow generating, secular growth powerhouse.

Our third idea is Meta Platforms (META). The social media giant ended the third quarter of 2023 with total cash, cash equivalents and marketable securities of $61.1 billion versus long-term debt of ~$18.4 billion, also good for a very nice net cash position. Meta’s adjusted free cash flow came in at $31.5 billion through the first nine months of 2023, up materially from the depressed levels of ~$13.2 billion it achieved during the same period a year ago. The free cash flow growth at Meta was very welcome news, and something that was a big concern of ours toward the back half of 2022 when things really fell apart at the company. Revenue growth came in at a whopping 23% for Meta, which was very welcome given the competitive environment with respect to Tiktok, and putting things all together, Meta is yet another net-cash-rich, free-cash-flow, secular-growth powerhouse.

Microsoft, Alphabet and Meta are net-cash-rich, free-cash-flow generating, secular-growth powerhouses, but they are not without risks. The first risk is general market malaise. For starters, investors are afraid that these tech giants won’t stay near the top of the S&P 500 in the coming years, but we just don’t see it that way. Their balance sheets provide so much flexibility to get ahead of trends or to catch up so fast that we think we’re in a new era, where big cap tech and large cap growth maintain their dominance for at least this decade, maybe longer. After all, artificial intelligence is perhaps the best example, with the potential to be a huge disrupter. However, when we look at who’s doing the disrupting, it’s Microsoft with OpenAI and Alphabet with Bard. They are literally disrupting themselves, and this means that they aren’t resting on their laurels, paving the way for economic sustainability for years to come.

Some other risks include deal-making at Microsoft that could jeopardize its net cash position, cloud revenue growth and the pace of expense expansion at Alphabet, and while Meta may experience some softness in advertising revenue during the current quarter, all three entities’ quarterly performances during the calendar third quarter showcased why they have been market darlings during 2023–and the market darlings for much of the past 15 years. We’re not jumping on the bandwagon as we’ve been on top of these names for a long time now, and we continue to believe that the best areas of the market will continue to be big cap tech and large cap growth for the foreseeable future, even in the face of a 10-year Treasury yield that stands at ~5%. Macro headlines may sway the trader, but for long-term investors, Microsoft, Alphabet, and Meta Platforms are three for consideration.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.