Has Honeywell’s business value truly increased by 170% in less than seven years, or are shares overheated? We think investors should continue to exercise prudence in today’s stretched market. GE may be a better relative bet than Honeywell.

By Brian Nelson, CFA

What a wonderful ride it has been these past seven years from the March 2009 panic bottom. The S&P 500 (SPY) has experienced one of its strongest showings in history during this time, and even large caps have posted returns that have turned heads. The share price of Honeywell (HON), for one, has leapt more than 170% since the end of 2009, simply a huge run for a company of its size. The question, however, on everyone’s mind: Will Honeywell continue to set new heights, or will the ballast of the economic cycle begin to weigh on shares? Longtime CEO Dave Cote will step down March 2017. Will a more ominous picture begin to form as new management gets settled in?

One thing remains: Honeywell continues to be an M&A story, as organic growth trends have been under pressure as a result of a global economy that has failed to stack up to expectations. During the past 15 years, for example, Honeywell has completed ~90 acquisitions and divested ~70 businesses. In 2015 alone, the company spent ~$5.8 billion in cash for the acquisitions of Elster, ComDev, Satcom, Sigma, and Aviaso. In August 2016, Honeywell completed the buyout of Intelligrated (automation solutions business), and unconfirmed reports suggest it is interested in acquiring JDA Software for $3 billion. Honeywell also spun-off AdvanSix (ASIX), its resins and chemicals operation, where shareholders received one share of AdvanSix for every 25 shares of common Honeywell stock they owned. It recently sold its government service provider to KBR (KBR).

Profit taking in Honeywell’s shares became more prominent October 2016, as the company trimmed its full-year earnings per share guidance for 2016 and noted that core organic sales are now expected to be down 1-2% for the year. We find the bottom-line revision a little troubling because Honeywell had announced a $5 billion stock buyback program in April 2016 as a strategy to deploy cash. The buyback program in itself was peculiar and may have been the catalyst for CEO Cote’s impending departure. One doesn’t have to look much further than Cote’s 2015 annual letter to shareholders to see that there may have been some disagreement in the board room regarding opportunistic share buybacks:

As you may know, there has been significant Analyst support over the years for “meaningful” share buyback. To the consternation of several analysts and likely many short-term holders, we took a different path than many of our peers. We chose instead to keep our powder dry for the day when opportunity and pricing came together, limiting our buyback activity to periods where opportunistic market conditions existed and largely to keep share count flat over the long term. While that same $5.8 billion deployed to share buyback would have yielded higher EPS, I don’t believe it would have made us a better long-term investment. And as it turns out, on top of the $5.8 billion deployed for acquisitions, the market conditions (particularly in the late third and early fourth quarters) presented an opportunity for us to repurchase almost $2 billion of our outstanding shares in 2015, almost twice the amount we have historically done.

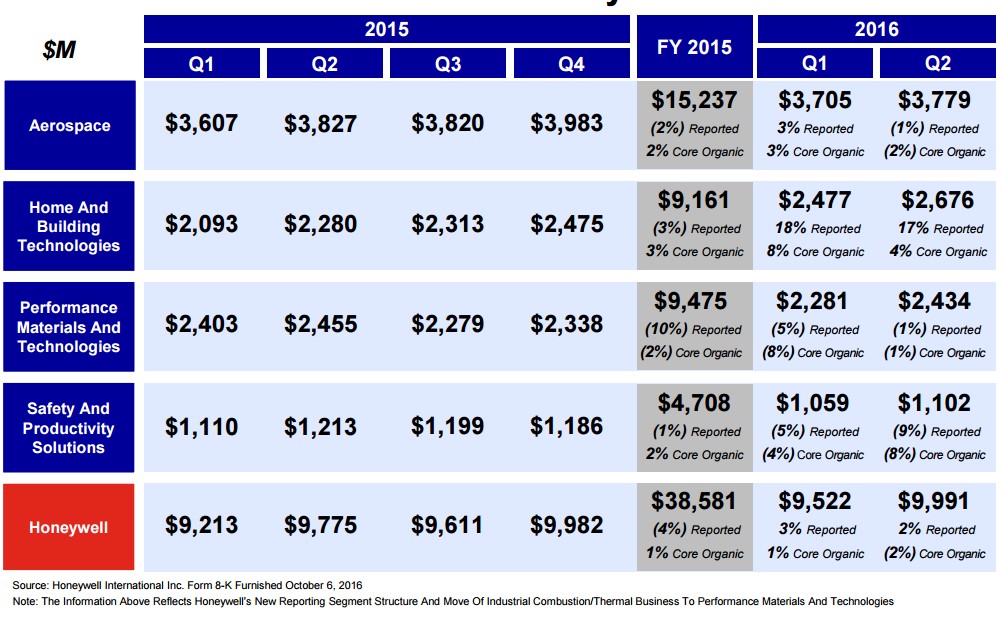

Honeywell has its hands in a lot of end markets, and as the commercial aviation cycle matures, growth continues to slow. Its defense and space end market has also proved challenging, as oil and gas markets continue to be dislocated as a result of the collapse in energy resource pricing through much of the past 18 months. We like the visibility of commercial aerospace in light of the massive backlogs at the commercial airframe makers, but we’re less enthused at the prospects of a resurgence in the defense/space and oil/gas markets. New products in homes/buildings should help offset some of the weakness, and prospects in turbo remain strong thanks to increasing penetration rates. Still, core organic growth remains under pressure.

Image Source: Honeywell

All in, there’s a lot to like about Honeywell, particularly its tremendous free cash flow generation, which helps support its solid dividend payout, which translates into a ~2.2% yield at current price levels. Shares continue to trade near the middle of our fair value estimate range, however, so we’re not rushing to add Honeywell to either newsletter portfolio at this time. Our favorite industrial giant remains General Electric (GE), though its shares, too, have been under material pressure, but from August of the year. GE seems like a much better bet than Honeywell at the moment, and the former boasts a higher yield of 3%. GE’s decision to take on more debt, while pressuring its credit ratings, will offer a cash coffer to further pad its dividend profile. Though we tend to be debt-averse equity investors, GE’s A1 unsecured debt rating is solid. GE is a holding in both newsletter portfolios.

Access GE’s stock landing page >>

Aug 23, 2016

Our Fair Values for the Conglomerates

We’ve updated our fair value estimates on a number of conglomerates. Reports include DHR, GE, HON, MMM, SIEGY, TYC, UTX.