By Kris Rosemann

We have not been shy about our concerns with the current overheated state of the market, “A Kleenex? Consumer Staples Trading At Nosebleed Levels (August 2016)”:

At arguably no time in the history of the stock market have investors been willing to pay so much for each unit of earnings to capture a dividend yield of just a few percentage points. Negative interest rates across much of the world have created this scenario. In many ways, the strongest business models have become some of the most risky stocks, to no fault of their own. What do the bulls say though — as long as everybody keeps buying these steady-eddy companies to capture yield, share prices will continue to go up. Why not?

General Mills (GIS) has been a beneficiary of the ongoing dividend growth bubble as its shares are now changing hands at more than 20 times fiscal 2017 earnings per share guidance, even after a material pullback following the release of its fiscal 2017 guidance in early September. Additional pressure has come since the company reported rather pedestrian fiscal first quarter results September 21, as top-line weakness persists in its ‘Foundation’ businesses.

Such performance was not necessarily unexpected, and management reminded investors that it is working to drive efficiency by reducing the number of SKUs it carries and optimizing spending, which will inevitably reduce volume. For fiscal 2017, the firm is expecting organic sales to be flat to down 2% from fiscal 2016, while operating profit and adjusted diluted earnings per share are expected to grow 6%-8% on a constant currency basis from the prior year.

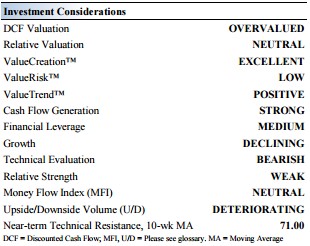

Upon the recent updating of the food products (large/mid-cap) industry, General Mills registered a 1 on the Valuentum Buying Index, the lowest possible rating, as a result of the combination of it being overvalued on both a discounted cash flow basis and a relative valuation basis and its bearish technicals. Could this be the VBI foreshadowing an impending decline in our overheated market, likely to be led by the very stocks that did a large part of the bubble inflating?

Image Source: Valuentum

We’re not going to make such a claim, though it is certainly an interesting development. In fact, it will take some time for price-to-fair value convergence takes place in the stock, the catalyst for which may very well end up being the bursting of the dividend growth bubble. Speculation as to when this will happen could be an exercise in futility, though the Fed’s decisions regarding interest rate increases will play a factor as its recent inactivity has only further fueled the overheated, yield-hungry market. Shares of General Mills currently yield ~3%.

It is important to note that General Mills registering a 1 on the VBI is not an indictment of its business, brands, or staying power, but is instead an assessment of a combination of factors that make it an unattractive investment consideration, in our opinion. It does not indicate that we are anticipating a catastrophic development to unfold in its operation. We are using this instance as a reminder that it is imperative to always keep valuation in mind when making an investment decision. As our loyal readers know, there is much more to consider in a stock than its dividend yield, which accounts for but a portion of shareholder return in a high quality investment consideration.

Food Products (Large/Mid-Cap): ADM, BG, CPB, CAG, GIS, HSY, K, KHC, MDLZ, MJN, NSRGY, UL, UN

Related tickers: XLP, SDY, VIG