By Brian Nelson, CFA

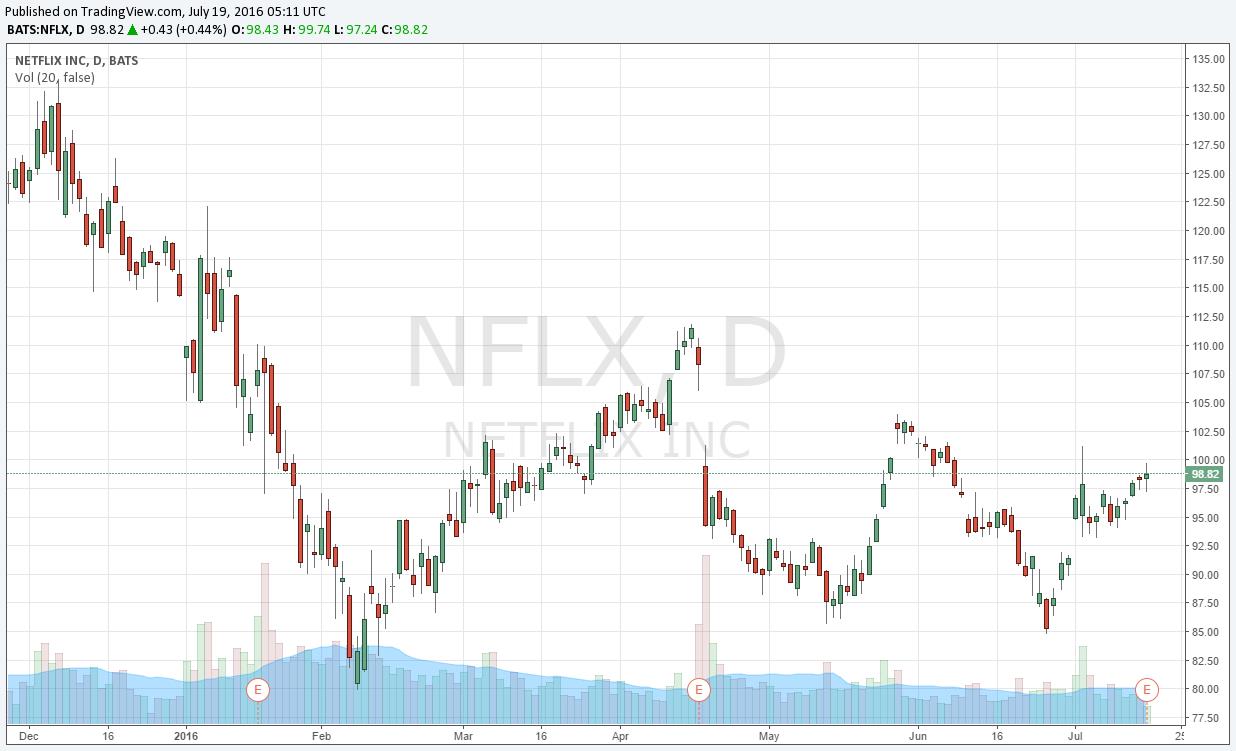

We’re not going to say much about Netflix’s (NFLX) quarterly “miss” other than adding 1.7 million members, as it did during its second quarter 2016, wasn’t horrible. The media outlets and sell-side analysts will tell you that this came in below Netflix’s 2.5 million net new member forecast and below the 3.3 million net-add mark in the prior-year. This is no surprise to the Valuentum readership. We had been expecting significant weakness at Netflix. The stock is ~15% lower in after-hours trading.

What to do now? Well, the air is slowing coming out of the Netflix bubble. The market is slowly realizing that growth in the US is grinding to a halt. On a trailing 12-month basis, excluding all overhead, contribution profit in its US operations came in at $1.55 billion, meaning shares of Netflix are trading at ~27x US contribution profit, a measure that ignores the hundreds of millions in contribution losses in its international operations (and massive overhead expenses). Free cash flow performance is even worse. Netflix has burned through $250+ million in free cash flow in each of the past four quarters, good for a cool billion in cash right out the door. Look for Netflix to raise debt, debt and more debt to meet content obligations. Management should be raising as much equity as it can at current levels – its shares are way overpriced.

Netflix is blaming the “un-grandfathering” of a price increase and “associated media coverage” for the weak growth in the quarter, but management has to come to grips with reality. The company’s library can’t possibly please everyone at all times, and the increased churn, in our view, is a function of those canceling after signing up to watch Making a Murderer. Netflix has now become a hit-or-miss media content company, as it spends more and more on programming costs. The company’s biggest threat is Amazon (AMZN) Prime, but management is open to highlighting the growth of other rivals, including CBS All Access, Seeso, Hulu, and YouTube Red. The space is becoming more and more crowded, and the biggest winners will be the ones that generate the best home-grown content. Netflix doesn’t have the upper hand in this department, in our view.

In part as a result of such heightened competition, we think Netflix will come up short against its third-quarter net add targets of 0.3 million and 2 million in its US and international operations, respectively. China will also disappoint for Netflix, with management noting that the regulatory environment for its service has become “more challenging.” Netflix was quick to note that Disney’s (DIS) streaming service and Apple’s (AAPL) movie offering had been shut down in the country. Given various regulatory dynamics, consumer behavior, and rather lax intellectual property rights in China, Netflix may not have as much runway in China as it thinks. Long-term growth expectations need to be ratcheted down considerably.

There’s not much to like about Netflix at a $40 billion price tag.