Image Source: Janet Ramsden

UK property funds have frozen redemptions. What happens when they finally allow investors to flee the country?

The US equity markets continue to set new highs, but many risks remain, not the least of which is the fallout to come from Brexit. In some respects, we’re surprised nobody is really talking about it much anymore, but UK property funds have suspended redemptions, even beyond the previous three we reported on, “The Next Banking Crisis? No… Well, Not Yet (July 2016).” This is a big deal because it is just the beginning of the capital-flight process.

We think it is wise that such funds are limiting redemptions to avoid an all-out collapse in property prices across the UK due to forced selling, but such action only delays the inevitable, the true problem. Assets want to leave the UK, and that means deflation across most property classes there (particularly in London), which could have serious implications on the UK and European banks.

Right now, billions of dollars invested in UK property simply can’t flee the country (it’s frozen), but we posit aggressive capital flight will occur once investors can get their money out, perhaps in the coming months. That’s when a tailspin truly might occur within the UK property market. To thwart this threat, will property funds have to continue to keep investors’ money tied up for the foreseeable future?

Here’s a quick snapshot of the seven high-profile UK property funds that have frozen redemptions in recent weeks. We continue to monitor developments in the UK market.

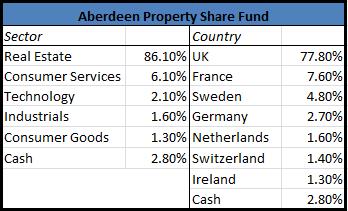

Aberdeen Asset Management

The Aberdeen Property Share Fund does not invest directly into commercial real estate assets. Instead it invests mostly in UK real estate companies but also has exposure to other sectors and countries, mostly in Europe. The most recent breakdown of exposure can be seen in the chart above. The fund was launched in 1990.

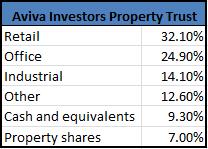

Aviva Investors

The Aviva Investors Property Trust typically invests up to 90% of total assets into UK commercial property and can invest at most 30% in property related shares. The most recently reported breakdown of sector exposure is on display in the above chart. The fund’s inception took place in 1991.

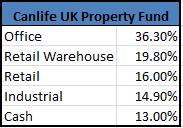

Canada Life

The Canlife UK Property Fund invests directly in the property market by buying and selling commercial property in the UK, the most recently reported breakdown of which can be seen above. It has been in existence since 1975.

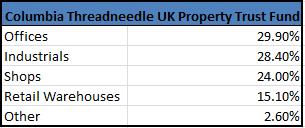

Columbia Threadneedle

The Columbia Threadneedle UK Property Trust Fund will typically invest at least two-thirds of its assets in commercial real estate in the UK, and may also invest in shares, bonds, gilts, and other funds. The most recently reported breakdown of sector exposure can be seen in the chart above. The fund was initiated in 2007.

Henderson Global Investments

The Henderson Global Investor UK Property PAIF invests primarily in commercial property and property related assets. Such other assets may include money market instruments, derivatives, and forward foreign exchange contracts. The most recently reported sector exposure breakdown is on display in the above chart. The fund was launched in 1999.

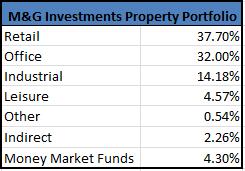

M&G Investments

The M&G Investments Property Portfolio invests in a diversified portfolio of commercial property, primarily in the UK, but also may invest in other property related assets, which can include collective investment schemes, transferable securities, derivatives, debt instruments, government debt, and money market instruments. The most recently reported breakdown of the fund’s sector exposure can be seen above. The fund has been in existence since 2013.

Standard Life Investments

The Standard Life UK Commercial Property Trust holds a diversified portfolio of commercial property in the UK, the most recently reported sector exposure breakdown of which can be seen in the chart above. The trust was initiated in 2006.

Related Tickers: EWU, LYG, BCS, RBS