By Brian Nelson, CFA

Have we finally reached the limits when it comes to enhancing the functionality of the smartphone?

Many are speculating this to be true, if Apple’s (AAPL) decision to now “take three years between full-model changes of its iPhone devices, a year longer than the current cycle,” is true, as reported by the Nikkei Asian Review May 31. The report comes a mere month after Apple’s first-quarter internal unit sales metrics left much to be desired, “Apple: Nowhere To Run, Nowhere To Hide (April 2016),” where unit sales of the iPhone dropped 16% and where iPad performance was even worse. A logical read-through from the news of a more prolonged update cycle may be that the iPhone is now “old tech,” but perhaps it may also be the case that two-year full-model revamps are no longer required to capture each and every consumer upgrade. There are a large number of Apple die-hards, for example, that aren’t even on the latest version, me included. I’m still sporting the iPhone 5, and I’ll be getting the latest and greatest Apple phone, whichever it may be, when it’s time.

Others are logically assuming that Apple is starting to become a victim of its own success, if such a claim hasn’t already been stated for much of the past year. Nobody will argue that the pace of Apple’s innovation has been phenomenal with respect to the iPhone, and to a large degree, it then isn’t too far of a stretch to assume that massive future changes to the platform just don’t fit market need. How bad could this news really be? The prospect of a slowing iPhone upgrade cycle has been rumored for some time and perhaps had been weighing on the stock more than anything else, at least in our view. Just last week though, Taiwan’s Economic Daily News reported that Apple is looking to produce as many as 72-78 million iPhone 7 units in 2017, “a record figure for a new iPhone and above analyst estimates of ~65 million.” Given the apparent conflicting information, one thing is clear: even if the pace of iPhone overhauls slow, the gadget remains in considerable demand.

We had written in January our view that Apple “will be ‘forced’ into acquisitions” as organic growth comes under pressure, but we didn’t think that anyone in the Apple executive suite would be considering Netflix (NFLX), which continues to trade at an extremely bloated valuation. Netflix’s competitive advantage stems from its domestic brand recognition and the barriers to entry to building a vast collection of fascinating video content, but to the new subscriber interested in movies, the company’s library isn’t all that impressive, “5 Reasons Why We Think Netflix’s Shares Will Collapse (February 2016).” We wrote how Netflix is beginning to implode on the basis of management’s expectations of a slowdown in the pace of new adds in both the US and internationally, the latter we view unacceptable in light of the long-term targets implied by its share price.

Netflix’s intrinsic value is based on its steady-state performance of the company and its free cash flow over the long haul, and we believe the market continues to vastly overestimate the long-term economics of its international business, both potential full-penetration numbers as well as the hefty costs (shareholder capital) needed to reach peak subscribers. Why Netflix wants to use the debt markets to fund growth instead of raising as much equity capital “up here” is beyond us. But no matter your opinion on Netflix, rumors are flying that it and Time Warner (TWX) are takeover targets as the iPhone maker is said to be seeking a solution to its “content problem.” It doesn’t take but one “believable” rumor to send shares of Netflix higher on speculation.

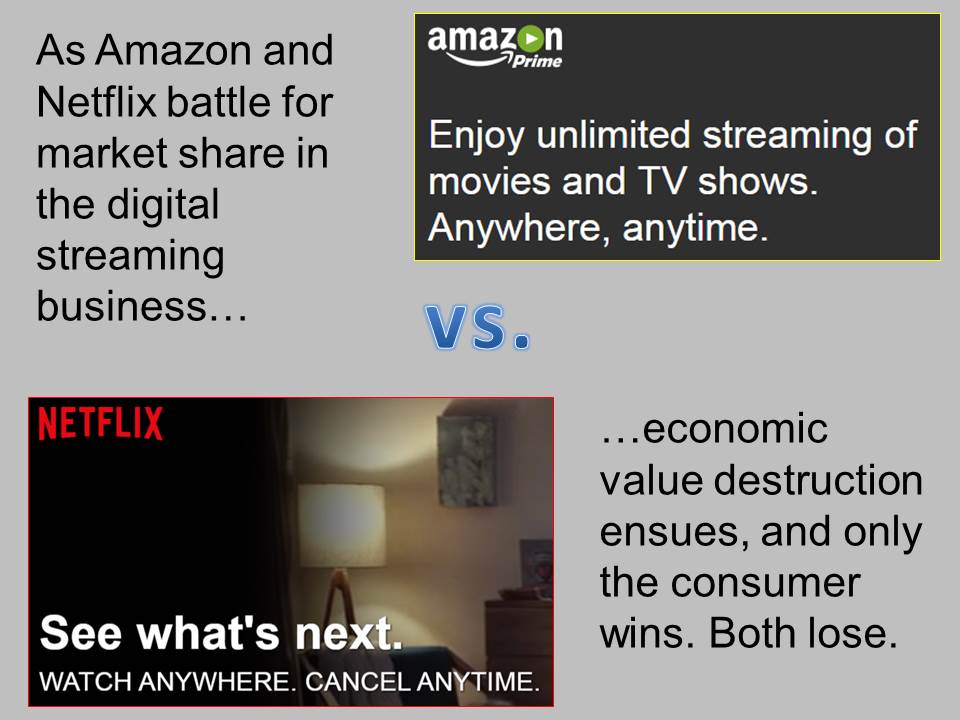

We doubt Apple is interested in purchasing a digital streaming website that is becoming more and more tied to its very own hit-or-miss content, and we find it very difficult to believe that CEO Tim Cook could justify Netflix’s ~$45 billion price tag in light of its deteriorating growth metrics, negative free cash flow, and an impending massive investment cycle to grow its international business, profits outside the US still elusive. But even if Apple is interested, the company shouldn’t be in any hurry. It has time to wait for Netflix’s shares to come back down to reality, and there are at least three catalysts that can cause this to happen: 1) general market malaise that punishes high-beta names disproportionately, 2) the market’s realization of Netflix’s unattainable, frothy international growth targets and the magnitude of investment needed as it strives to achieve them, or 3) the implications of the pricing war just launched by Amazon’s (AMZN) Prime service, where video is now a standalone option at $8.99/month – a dollar less than Netflix’s recently-raised price on its most popular plan.

Logical investors may be asking the question: If consumers can get everything from Amazon by subscription for $99 year, including original video content, deliveries and more, why do they need Netflix? Unless Netflix wants to start delivering diapers and paper towels to consumers’ doorsteps, it’s going to have a hard time competing with Amazon’s significantly more comprehensive suite of offerings that hit almost every aspect of our daily lives. We believe the Netflix fallout is inevitable, in our view, and any buyout that Netflix shareholders are hoping for may turn into a “buy-under” in coming years as reality sets in. Apple would be wise to stay away from the Amazon-Netflix fight, as neither will win, with the only beneficiary the consumer through ever-lower prices as both destroy economic value in a quest for growth. We’re not buying the Apple-Netflix tie-up.