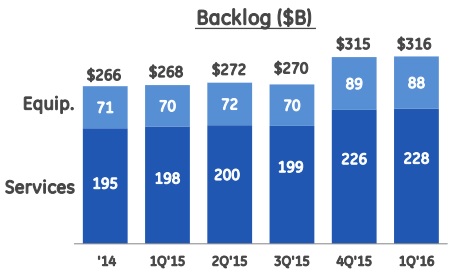

Shown: GE’s backlog of unfulfilled orders remains robust, a sign of durability and strength. Image Source: GE’s earnings presentation.

We continue to be encouraged by the progress newsletter portfolio holding General Electric (GE) is showing in its GE Capital exit plan. The firm is now ahead of schedule on that plan, having signed $166 billion in asset sales and closed $146 billion of those sales. Its transformation is now ~80% complete, and it continues to pick up momentum in 2016. The company also submitted its application for de-designation as a systematically important financial institution (SIFI) on March 31. However, as GE continues its transformation, which includes the integration of recent acquisition Alstom, its reported results have become quite convoluted as the number of moving parts in its businesses remains high. We think it is best to remain focused on the reported industrial and verticals results, which include results from the core industrial operating segment and the GE Capital businesses the firm expects to retain (verticals).

In the first quarter of 2016, GE reported industrials and verticals revenue growth of 6% from the year-ago period to $27.6 billion despite industrial segment organic revenue falling 1%. The acquisition of Alstom and a diverse industrial portfolio helped offset the ongoing weakness in the firm’s Oil & Gas and Transportation operations, and higher shipments in Power in the second half of the year are expected to buoy full-year results. Industrial and verticals earnings per share increased 5% on a year-over-year basis to $0.21, but industrial segment operating profit did not fare as well in the quarter, falling 7% from the comparable period in 2015 due to decreased cost productivity and inflation among other margin pressuring factors.

GE also reported cash from operating activities of $7.9 billion, or 6 times that of the same period in 2015, but we are quick to warn investors that this high level of cash flow generation may not be sustainable. $7.5 billion of that cash was capital returned from GE Capital, which is being phased out. Industrial cash from operating activities dropped 60% on a year-over year basis to $356 million, and ~$18 billion of the expected $30-$32 billion of cash from operations the company expects to generate this year will come in the form of dividends from GE Capital. The firm’s cash flow profile may be worth watching amidst the ongoing transformation. We’re not worried about the cash-cow nature of GE’s industrial businesses, however.

Perhaps most importantly in the quarter was the strong backlog growth GE experienced. Orders were up slightly from the first quarter of 2015 thanks to robust growth in power and renewable energy offsetting declines in the oil & gas businesses, and the company continues to see strong demand for its GE Digital offerings as orders leapt 29% in the quarter. The firm believes its investments in GE Digital have positioned it as the leader in the Industrial Internet, a coveted position to lay claim to. Total backlog jumped 18% from the year-ago period, and backlog excluding the acquisition of Alstom businesses still advanced a strong 7%.

GE reiterated its previous guidance levels for organic revenue growth, earnings per share, and capital returned to shareholders. The firm expects organic growth of 2%-4% from 2015, earnings per share to be in a range of $1.45-$1.55, and to return $26 billion to shareholders via dividends and share repurchases. GE has largely converged to our $32 per share fair value estimate, and we trust that many members took advantage of this price-to-fair value arbitrage opportunity when we released the alert October 2013. The company continues to hover around all-time highs.

Though there were some parallels to be drawn, industrial bellwether Honeywell’s (HON) first quarter 2016 report did not contain as many moving parts as that of GE. Honeywell reported revenue growth of 3% on a reported basis from the year-ago period, and core organic revenue advanced slightly to beat the high end of the firm’s guidance for the quarter. The sales growth was driven by strong increases in its Automation and Control Solutions segment as well as solid organic growth in its Aerospace segment. The Performance Materials and Technology sales segment provided a material drag on sales in the quarter due to low raw material pricing pass through and lower processing, catalyst, and equipment sales in the oil division of the segment.

Solid execution across all segments resulting in strong bottom line growth for Honeywell as the firm reported earnings per diluted share growth of 9% on a year-over-year basis to $1.53. Cash from operating activities fell 39% in the quarter, however, due in part to pension adjustments and inventory build, and free cash flow fell 75% to a mere $63 million as a result of the significantly lower cash from operating activities and an increase in capital spending. Despite the weak cash-flow generation, Honeywell did not adjust its full-year outlook for free cash flow of $4.6-$4.8 billion. The firm increased the lower bound of its earnings per share guidance after the quarter, and it is now expecting full-year earnings per share (excluding a mark-to-market pension adjustment) to be in a range of $6.55-$6.70 compared to the previous range of $6.45-$6.70. Core organic revenue growth guidance was maintained at 1%-2% for 2016.

Though the industrial sector remains pressured in general due to commodity weakness and economic growth concerns around the globe, GE and Honeywell both have reasonably optimistic expectations for organic top-line growth in 2016. The industrial bellwethers have diverse enough portfolios to avoid the pitfalls of being tied to any one end market, as can be seen by GE’s portfolio picking up the slack from its Oil & Gas segment or two of Honeywell’s three segments providing enough growth to buoy the declines in its energy-serving division in the first quarter. However, we’d like to see much more stable cash flow generation from both companies.

While we remain optimistic on the outcome of GE’s portfolio transformation, and are, in fact, big supporters of the transition away from GE Capital, the amount of moving parts in the firm’s quarterly results are not exactly comforting – it will just take some time before everything is ironed out. However, the growth in backlog and strong orders in certain industrial categories provides sufficient reassurance that the industrial giant’s industrial operations are as strong as can be given the operating environment. GE remains a holding in both newsletter portfolios, and we continue to be laser-focused on evaluating the progress of its business transformation.