How fragile is this bubbly market?

The long-anticipated Organization of the Petroleum Exporting Countries (OPEC) conference in Doha, Qatar, that would mark the beginning of the end for all of crude oil’s (USO) malaise came and went, and nothing happened. We’ve now had a series of rumors about the potential for production freezes that have driven crude oil prices from the mid-$20s to nearly $40 per barrel, but nothing fundamental has changed. The bump in crude oil prices since the bottom has been almost entirely speculative. Crude oil prices would jump on rumors, and then when the rumor would prove untrue, they wouldn’t give back the gains.

It appears hopes, dreams and speculation with a dash of short covering have been fueling the rally in crude oil prices – nothing more, nothing less – and what many market participants may not understand is that even the prospect of a production freeze by OPEC member nations means they still would be producing at all-time highs. Peculiar to say the least, especially as the bounce in the price of the black liquid has somewhat counterintuitively paved the ground for the Dow Jones Industrial Average (DIA) to surpass 18,000 again as default risk in the weakest sectors eases bolstering the prospects of the biggest banks (XLF). Political posturing by OPEC is working for the time being, but even this will eventually run its course without some meaningful action.

Coca-Cola Is Today’s Quintessential Bubble Stock

Image Source: Coca-Cola

Nobody is going to say that Coca-Cola’s (KO) business model isn’t a great one, and we’ll leave that conversion for more rudimentary beginners. What drives stocks is the market’s interpretation or valuation of the realizable value to the owner, the shareholder, as represented by the net cash on the balance sheet, future free cash flow, and other non-operating assets. Our fair value estimate for Coca-Cola is $39, and we’re not surprised by shares selling off after a lackluster first-quarter report.

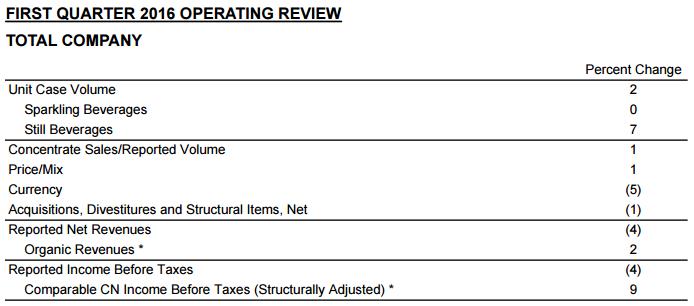

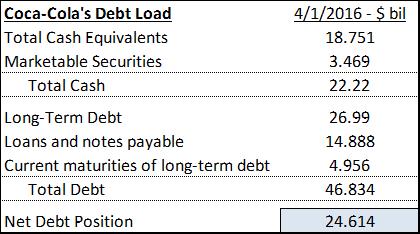

During the three months ended April 1, 2016, reported net operating revenues fell 4% while reported income before income taxes dropped 4% from the previous quarter; net income dropped 5%, while diluted net income per share dropped a penny, to $0.34. If we annualize the reported diluted net income per share mark ($0.34 x 4), we arrive at $1.36 per share on an equity that is trading at ~$45, translating into a PE ratio of 33 times forward earnings on a company that has net debt of $24.6 billion and whose reported performance is weakening.

Can you believe it? My goodness – Coca Cola’s reporting is so out of whack that the company is pushing the following to investors: Comparable Currency Neutral Income Before Taxes (Structurally Adjusted). I’ve never heard of anything of the sort. Such far-fetched non-GAAP reporting and a bubbly valuation won’t mean shares can’t continue to run higher as investors seek out dividend payers, but Coca-Cola’s stock is as bubbly as its drinks.

Intel Gives Pink Slip to 12,000 Employees

We’re never happy to hear that people will be losing their jobs, but such is the case in business, unfortunately. Where one door closes, however, another opens, and the market is viewing the cost-cutting at Intel (INTC) as a sharp positive. The company also announced that its current CFO Stacy Smith will be transitioning to a new sales-type role at the company, and frankly, we very much like the idea of a “finance guy” being more hands-on in a business that needs to keep costs tightly in check. Or it could be more subtle – maybe Mr. Smith doesn’t like handing out pink slips?

Unlike Coca-Cola’s reported revenue that dropped in its first quarter of 2016, Intel’s GAAP revenue leapt an impressive 7% over the comparable period in 2015 thanks to strength in Data Center (+9%) and Internet of Things Groups’ (+22%) revenue. By how the media presents weakness in the PC market, however, an onlooker might have thought Intel was going the way of the dodo bird, but that couldn’t be further from the truth. Intel is taking share in the mobile market, and the job cuts reflect its transformation to one focused on the cloud. The company is doing a much better job handling the changing technology market than IBM (IBM), which continues to face a host of challenges, not the least of which is revenue stability.

We thought 2016 would be a strong year for Intel, and while it has gotten off to a rough start, the company is now but a stone’s throw away from hitting new highs again. The acquisition of Altera has pushed Intel’s balance sheet into a net debt position as of the last report, but its valuation is much more palatable for one of the strongest dividend payers on the market. The company is also one of the strongest free-cash-flow generators, and with a dividend yield of 3.3%, it’s simply hard to pass up. Intel last increased its dividend 8.3% in late January – not bad.