By Brian Nelson, CFA

We think investors are finally getting a feel for the vulnerability of commodity-oriented equities, almost across the board.

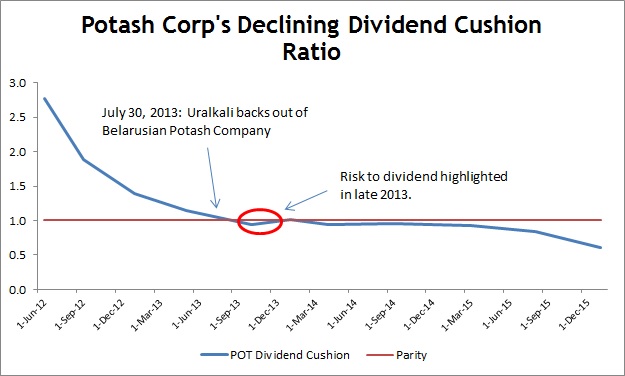

Potash (POT), the largest member of Canpotex, rang the alarm bell a number of weeks ago, slashing its dividend, “The Bounce in Energy and Potash’s ‘Surprising’ Dividend Cut (Jan 2016).” Times have been tough across the industry, but the big shocker was its “little brother,” pure-play Intrepid Potash (IPI), which put up terrible fourth-quarter results February 29 and warned that “pricing pressure…has the potential to cause a breach in (its) loan covenants.” Incredible. Intrepid Potash has now fallen to under $1 per share from ~$40 in early 2011. As we wrote in July 2013, “Uralkali Backs Out of Belarusian Potash Company; Industry to Change,” and more recently in August 2015, “Potash Miners Digging Themselves a Hole,” all of this was avoidable for investors.

Industry structure can and does change over time, for better or worse. Intrepid Potash’s language in its fourth-quarter release that the “recent series of potash price reductions has created a more dynamic market than we’ve experienced in some time” doesn’t bode well for the near term potash market, in our view, and even worse, Intrepid Potash’s auditors have “added going concern language to their audit opinion,” meaning bankruptcy for the company may be nigh. The struggling company still has ~$64 million in cash and investments at the end of 2015, though it burned through more than $23 million during the year and holds $150 million in long-term debt. The company now has a market capitalization of ~$74 million at the time of this writing.

Investors in commodity-tied stocks love the “quick buck” during the upswing, but fickle commodity prices can cut like a knife during demand downturns or disruptive structural developments across once-rational industries. We can point to OPEC producing aggressively to combat the shale revolution in the States as one instance, and the onset of aggressive pricing across potash cartel constituents is another example illustrating how vulnerable commodity-producing companies can be. Agrium (AGU) and Mosaic (MOS), the other two large members of Canpotex, won’t have it easy going forward either. It hasn’t been two weeks since BHP (BHP) CEO Andrew Mackenzie said his company is still moving forward with building the largest potash mine, even if it may be slow to develop it. A severe two-notch downgrade from Moody’s and having to abandon its progressive dividend policy are doing nothing to dissuade the mining giant’s plans to become a powerhouse potash producer in the long run.

We continue to avoid exposure to the potash market and the basic materials industry (XLB) in general, and we reiterate the long-term picture for the potash industry has become a lot less attractive given structural changes that are hurting pricing power, arguably one of the most attractive attributes of the once-rational market. Even if an argument can be made that potash pricing will improve in the near term, BHP is just waiting to flood the market with new production itself. It is time for investors to adjust to the new reality, unfortunately.