Medtronic (MDT), a core holding in the Dividend Growth Newsletter portfolio, reported strong results in its fiscal second quarter, performance released December 3. All of its segments delivered revenue growth in the quarter on a comparable, constant-currency basis, which includes comparable results from Covidien’s businesses. Total revenue grew 6% on a comparable, constant-currency basis, to $7.1 billion, which is a 62% increase from Medtronic’s reported results in the prior-year period.

Medtronic posted strong growth in the US and non-US developed countries across the world of 4% and 6%, respectively, as well as 11% growth in emerging markets. The Greater China, the Middle East & Africa, Latin America, India, and Southeast Asia regions all grew revenue at a double-digit pace on a year-over-year basis. The company generates 13% of total revenue in emerging markets, a figure that has improved since the acquisition of Covidien and is expected to continue to advance to approximately 20% in the coming years.

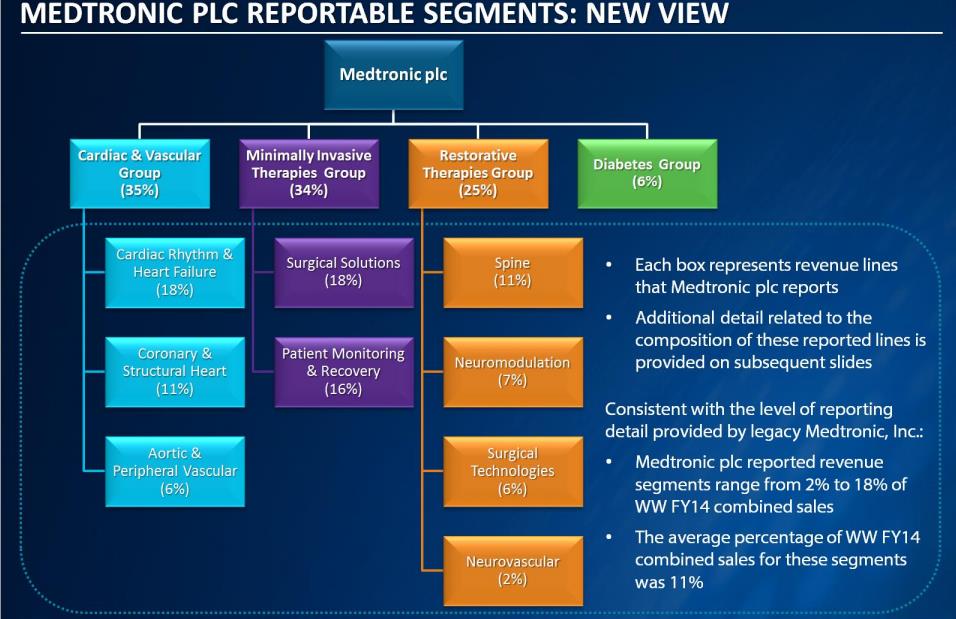

While the implications of the acquisition of Covidien demand the headlines, as they should, the rest of Medtronic’s business continues to grow at a solid rate. In the firm’s fiscal second quarter, its ‘Cardiac and Vascular Group’ advanced revenue 8% from the year-ago period on a comparable basis. The ‘Restorative Therapies Group’ grew revenue by 5% in the quarter on a comparable basis, driven by strong performance in the Neurovascular division, which was a benefactor of the legacy Covidien operations. The company’s smallest reporting segment, the ‘Diabetes Group,’ turned in respectable growth of 11% on a comparable, year-over-year basis.

The chart below shows a breakdown of the new Medtronic’s reportable segments.

Image Source: Medtronic

The ‘Minimally Invasive Therapies Group,’ which consists entirely of legacy Covidien operations, reported revenue growth of 3% in the fiscal second quarter. This growth rate is slightly lower than the group’s historical run rate. However, the relative weakness can be partially attributed to the fact that Covidien’s fiscal year end took place during Medtronic’s fiscal second quarter in 2014, making accurate comparisons more difficult.

The impact of the difficult comparisons was felt on the company’s bottom line, as Medtronic estimated that if the fiscal year end of Covidien had not been in the middle of its fiscal second quarter, then the combined entity’s operating margin improvement in the quarter would have been a whopping 300 basis points compared to the reported 60 basis points. In any case, the firm reported non-GAAP earnings per share of $1.03, an increase of 11% on a comparable basis and 1% on an as reported basis from the year-ago period. We’ll be watching the pace of operating leverage moving forward, as it, in our view, will be a solid indicator as to whether management is delivering on the synergies it has promised.

Medtronic expects to realize a total of $850 million in synergies from the Covidien deal by the end of fiscal 2018; in fiscal 2016, it is expecting cost savings to be in a range of $300-$350 million, which management states it is on track to achieve. It will realize these savings through optimizing global back-office operations, manufacturing and supply-chain infrastructure, and through the elimination of redundant public company costs.

Even more encouragingly, at each turn management seems to uncover additional savings opportunities that may very well serve as a catalyst for ongoing reevaluation of the firm’s overall operating models and cost structures. Though the deal is not expected to be accretive to GAAP earnings until fiscal 2018, it is expected to be accretive to cash earnings in fiscal 2016. Furthermore, the company was able to unlock $6 billion in “trapped” cash through internal restructuring. This cash will likely be used to accelerate debt repayments.

Medtronic’s free cash flow growth in the first half of fiscal 2016 suggests that management was correct in stating that the acquisition would be accretive to cash earnings on the year. Free cash flow leapt more than 60% compared to the year-ago period to $1.65 billion, and the firm now expects to generate approximately $40 billion in free cash flow over the next five years, meaning that the current run rate is but a fraction of what it hopes to achieve in the coming years.

So what does all this cash mean for our position in the company in the Dividend Growth Newsletter portfolio?

More than likely it means a growing dividend. Management expects to grow its quarterly payout at a rate faster than earnings growth to a target of a 40% payout ratio with respect to non-GAAP earnings per share over the next few years–the payout ratio in the second quarter of fiscal 2016 was just under 37%. Further, 50% of all free cash flow is planned to be returned to shareholders; over the next five years, the company anticipates returning $20 billion in cash to shareholders via dividends and share buybacks. Medtronic’s relatively small dividend yield may very well become much more noteworthy over the next five years (from dividend growth, of course).

The increased debt level as a result of the acquisition is material, but if the company delivers on its promise of $40 billion in free cash flow over the next five years, there’s not much to worry about. At the end of the fiscal second quarter the firm had nearly $35.8 billion in total debt compared to $17.2 billion in cash and investments. Its liquidity position remains fantastic, even after the Covidien tie-up.

All things considered, we’re going to continue to let this winner run (a core part of the Valuentum process), despite the fact that shares are nearing the upper bound of our fair value range. We continue to point to strong free cash flow generation as the key to a truly strong business, and our fair value range may still be a bit conservative if synergies end up being better than expected. We continue to be pleased with the progress the firm is making with its integration of Covidien, and we love to see the company continue to iron out any further inefficiencies it sees in its business. We’re comfortable sitting back and watching Medtronic’s dividends grow.