The supply and demand imbalance of crude oil has been one of the most talked about market factors in 2015 as prices continue their downward trajectory. Unfortunately, the predictability of crude oil prices continues to fall as well.

One of the the most important factors in the global supply of crude oil looking to 2016 is the developing situation in Iran. The country had indicated that it would increase its production of oil immediately following the lifting of economic sanctions from the US and EU by 500,000 barrels a day, and then potentially double that increase in the following months. While this still may be the most likely scenario, there could still be challenges to do the deal’s implementation.

Some Iranian parliament members, for example, have demanded that their leaders do not carry out the commitments related to the country’s nuclear capabilities until after all financial and economic sanctions are lifted. This may jeopardize the accord as it would be a breach of the Joint Comprehensive Plan of Action (JCPOA), which is set up to “ensure that Iran’s nuclear program will be exclusively peaceful.” Additional uncertainty surrounding the deal comes from the nation’s leader Ayatollah Khamenei, who has given his blessing to the deal, but has also made repeated strong anti-western statements and warning that the deal is a “western plot.”

Regardless of whether or not the sanctions against Iran are lifted and the country pumps surplus into the market, OPEC is already producing more oil than its demand requires. According to the cartel, demand for OPEC crude in 2015 is estimated to be ~29.6 million barrels per day, compared to September production figures of an average of ~31.6 million barrels per day (in 2016, demand for OPEC crude is forecast at 30.8 million barrels per day). The cartel has been adamant about increasing market share and seems intent on taking as much business from independent US producers as possible. All eyes and ears will be on OPEC’s meeting December 4.

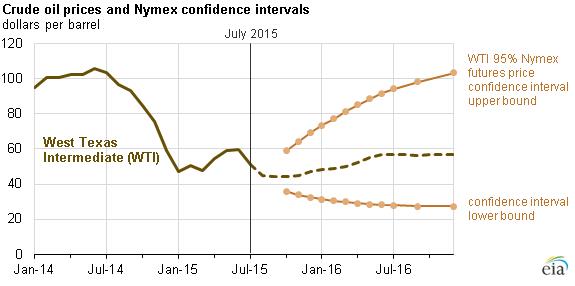

Levels of US commercial crude inventories are not helping either. As of October 23, US commercial crude oil stock was at 480 million barrels, the highest level for this time of year in at least 80 years. This factored into the EIA’s decision to lower its estimates for 2016 West Texas Intermediate (WTI) crude oil prices to $54 per barrel, a reduction of $8 from previous forecasts. The EIA expects North Brent Sea crude oil to continue to trade at ~$5 more per barrel than West Texas Intermediate through 2016, however. The graph below shows the EIA’s forecast for WTI crude in the coming year.