“Buy and hold investing has done more to turn perfectly decent people into the worst sort.”

As others are poo-pooing Kinder Morgan’s (KMI) third-quarter report, we wanted to share a few observations. Our $29 per share fair value estimate for the corporate is unchanged, as we note the low end of our fair value range is $23 per share. We’re reiterating our “neutral” view on the company.

First, we were beyond pleased to see Executive Chairman Richard Kinder come to terms with emphasizing the fact that Kinder Morgan is not totally immune to commodity price impacts. He said as much in the press release. Though top analysts on Wall Street are well-aware of this (or they should be), there are thousands, if not more, investors–some even portfolio managers (managing billions?)–that may not be aware of this. We simply applaud the executive team’s step toward “straight talk,” and we hope that this will extend in the future to disclosing widely-accepted measures of non-GAAP free cash flow, as defined as cash flow from operations less all capital expenditures.

Rewards in the form of higher share price may not happen anytime soon, however.

For those that need a background on our efforts to help the investor avoid the collapse in Kinder Morgan’s shares (from $40), please view our work here, here, here, here, here, here. You might say, “big deal, right? These days, everyone and their mother can publish on an idea. Well, this one was different–something like 80%-90% of sell-side analysts had a “buy rating” on the stock. Many had price targets close to twice today’s levels. The cult of “buy and bash everyone else” investors on other websites may be far greater with Kinder Morgan than any other equity. Kinder Morgan has been traditionally viewed as “immune” to commodity price changes, and we had to move mountains to redefine how investors should be looking at the midstream entity. It was as bold a call as it gets, like no other I’ve ever seen in my career. Some are still in denial.

But why was it a great call?

First, because all of the facets of our thesis that were outlined in the June 11 “5 Reasons” piece remain valid: The Valuation Paradigm Has Changed (it has), Kinder Morgan’s Dividend Growth Endeavors Will Disappoint (they have), The Company’s Net Debt Load is $40+ Billion (it’s still growing), The Company Is Trading at 40+ Forward Earnings (it’s even worse), and the Natural Reactions from Shareholders Will Be Skepticism and Disbelief (yes). That the last part was true probably rubbed most every skeptic the wrong way, but what are we supposed to do? They may still be in disbelief. Should we have followed the herd and set a $50+ price target like most everyone else? Should we not have outlined what we really thought was going to happen? These things go against everything we stand for as an independent research firm. We’re not selling newspapers or looking to generate trading commissions or help the firm raise more capital. We’re genuinely trying to help people, many of which “already know everything,” unfortunately.

I remember the name-calling toward us when we first went public on our views, the lady that said “bozo”, the gentleman that said “moron,” and some even worse—it’s simply horrible out there. Buy and hold investing has done more to turn perfectly decent people into the worst sort. Let’s end the “buy and hold” client brainwashing, please. Personally, I think it’s a shame that people on the Internet can’t take back the hurtful things they say after the fact when they finally “see the light,” or at least acknowledge that they might be wrong. It’s exhausting. It happed to us with the mortgage REITs here, it happened with our August 30, 2012 piece regarding SeaDrill (SDRL), “We Don’t Think SeaDrill’s Dividend Is Sustainable,” and now it’s happened with Kinder Morgan. My goodness, when will readers start saying, “we know what we’re talking about.” Never mind the significant risk-adjusted outperformance in the Valuentum newsletter portfolios.

We won’t parade around saying that comment sections on websites are completely useless, but their usefulness is close to nil. The proliferation of online abuse has simply gotten out of control, and it is getting worse. For one, the abuse that is happening on Twitter (TWTR) may completely destroy the company’s business model, if not checked. When will we as a society realize that it is not Twitter that is the problem, it is society. If you’re one of those abusers, better known as an ‘Internet troll,’ stop it! Stop it now!

Personally, we have thick skins (sometimes)—you have to in this business—and we know that in the words of Taylor Swift, “people only throw rocks at things that shine,” or maybe the better line is “shake it off,” (yeah, we just quoted Taylor Swift, not once but twice), but the comments on other websites can also confuse and harm readers. It is simply frightening what readers can be led on to believe. It’s downright scary the conclusions that some arrive at. Are they purposely trying to deceive?

Kinder Morgan’s third-quarter report spoke a lot about the character of management, and we think they are working toward the right answer. I think the team sees some of the issues related to their overleveraged business model that generates a deficit in free cash flow, as measured by cash flow from operations less all capital spending, after dividends paid. I think they recognize how external financing initiatives are supporting the dividend, and they are looking to change that.

After all, it should not come as a surprise to readers that management’s planned pausing of equity share issuance has been accompanied with an expected slowing of dividend growth. Kinder Morgan now expects 8% dividend growth in 2016 (6%-10%) from expectations of 10% previously. We’ve been talking about how external capital-market issuance has been fueling the dividend for some time—this very idea was included in our “5 More Reasons” piece (yes, 5 More). We had pounded the table.

We like that management is doing all that it can to meet the needs of its income-investor base, but those same investors are driving it to the brink of disaster. I don’t think those investors give a darn about earnings or free cash flow or the health of the balance sheet – all they care about is that dividend, and not even if it is organic or financially-engineered. We think management knows it’s going to be near-impossible to meet its 10% compound annual dividend growth target for the next 5 years without external capital assistance, and frankly we don’t know what they should say to their investor base. In many cases, the executive team has made the right move: stay near-term focused, and hope (pray?) that commodity prices will rebound in time?

We wish we could go back in time and say, “you might be overpromising and end up under-delivering” with your 5-year dividend growth outlook, but the team at the time had to jump ship in a hurry from the sticky MLP situation, which itself was even worse. The company ended up paying far too much for its own MLP assets at the time, something we had outlined in our “5 Reasons” piece as well. It’s probably worth noting that we’re reiterating our view that the MLP (AMLP) business model may not survive over the long haul. Energy Transfer (ETE) very well may have overpaid for Williams (WMB), too.

Go ahead: tell us how we’ll be wrong again, how weak our analysis is…how we don’t “get it.” The future starting today, one of a near-0% federal funds rate is far different than the future of yesterday, one that started with a 20% federal funds rate in 1980, for example. Today’s future will be much different than the past, and MLPs are ultra-interest-rate sensitive, perhaps more so than any other product. The long term is the enemy of the MLP, not its friend. The time of near-zero interest rate policy (ZIRP) will be looked back upon as the peak of MLP exuberance, in our view. Why don’t long-term investors see the very real hazards of the long term that they hold so dear?

Kinder Morgan’s third quarter net income before certain items dropped to $348 million from $537 million in the prior-year period. The firm generated less than $400 million in net income during the quarter, and its market capitalization is nearly $65 billion. Management continues to present its performance as an MLP, even though it is a corporate, pointing to internally-derived measures of “cash flow,” but we maintain our view that non-GAAP free cash flow, as measured by cash flow from operations less all capital spending, is the best measure to present to investors regarding internal free cash flow generation. We continue to believe “distributable cash flow” is misleading in that it ignores growth capital spending that is vital to net income, which itself is a component of “distributable cash flow.” “Distributable cash flow” is an imbalanced metric, and we think management teams across the midstream space should add the widely-accepted form of non-GAAP free cash flow to disclosures.

We’re awaiting the release of Kinder Morgan’s 10-Q to better evaluate cash flow trends, but based on a proxy for cash flow from operations, net income + D&A, cash flow from operations approximated $1.05 billion in the period, and if we assume that management spent one-fourth of its annual capital expenditure-budget in the third quarter, that would indicate about $875 million in total capex, translating into about $175 million in free cash flow generated in the quarter. This measure compares to ~$1.1 billion in dividends paid, revealing nearly a $1 billion free cash flow shortfall in the period. In the quarter, the company raised $1.275 billion in new equity, “under its at-the-market equity distribution program,” conveniently covering the shortfall. Through the first nine months of the year, Kinder Morgan has raised $3.884 billion in equity, almost enough to cover expected dividend obligations of $4.4 billion for the year.

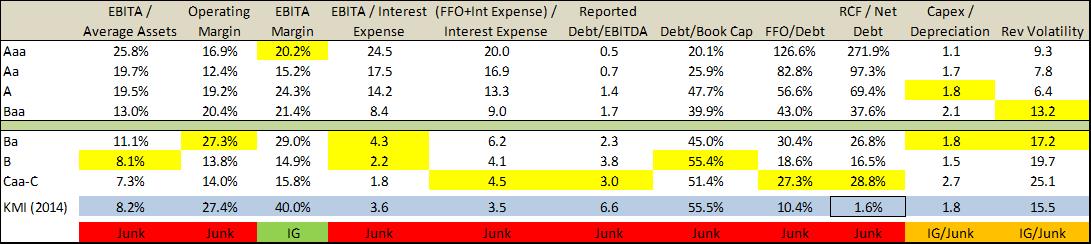

We’re awaiting the 10-Q for more polished numbers, and we encourage investors to compare total debt in the press release to the SEC filing when it comes, but at the moment, net debt, or debt net of cash, stood at $42.5 billion at the end of the third quarter, 5.8 times that of adjusted EBITDA. We’re paying very close attention to net-debt-reported-EBITDA, which may be approaching 7-8 times, something the credit agencies can’t possibly still be ignoring. That management plans to pause equity issuance means that it may have to rely even heavier on more sophisticated financing, or quite the contrary, it may have to rely heavier on debt issuance. We would expect Moody’s and S&P to eventually place Kinder Morgan under a review for a credit downgrade to junk status. It’s possible that this conversation might have already happened, prompting the reduction in the expected pace of dividend growth. Kinder Morgan is “junk rated” across almost every key metric.

Source: Moody’s Financial Metrics™ Key Ratios by Rating and Industry for Global Non-Financial Corporations, December 2007, Kinder Morgan regulatory filings

Our guess is the “alternative means to fund its growth capital” that management is talking about is its revolving credit facility, a savvy consideration as borrowing bases are being cut back. Linn Energy (LINE) just noted a cut to its borrowing base, and while lenders haven’t taken a full axe to them, something that might not happen until early 2016, we think Kinder Morgan has taken notice. In some ways, it may serve the company well to “max” out its revolver so banks cannot take it away. But this isn’t good either.

The credit rating agencies have to be taking note of this possibility. If we assume a generous 10% discount rate on a stand-still $4.4 billion annual dividend obligation, that’s a present value of $44 billion in cash, debt-like obligations to add to the $42.5 billion tangible total net debt the company has. Kinder Morgan generated less than $400 million in reported net income in the period against an implied debt load of ~$87 billion! This is not an investment grade company. We fear bond holders may be hurt the most out of all of this as reality sets in that either they’re not getting their money back or the equity investors aren’t getting a dividend. Both sets of stakeholders can’t have it their way.

Kinder Morgan also outlined the distinct possibility that it will run at negative “distributable cash flow” coverage relative to the dividend in coming periods. This is not free cash flow, as measured by cash flow from operations less all capex. What management is talking about is its own internal measure of “cash flow” that completely ignores cash outlays related to growth capital spending. We wrote extensively about the application of financial-engineering to prop up an artificial dividend in the energy sector in the following piece, “Understanding Your MLPs Financially-Engineered Equity Value.” Kinder Morgan is a corporate that wants to still be an MLP. The company will be a significant federal tax payer in 2020. Surely the Street is reducing estimates by the statutory rate at that time, right?

To our question of the title, “no.” We have very little interest in Kinder Morgan’s shares, and we point to free-cash-flow rich and net-cash-rich companies such as Apple (AAPL) and Microsoft (MSFT) for long-term dividend health. Overleveraged companies that do not expect to cover their dividend with internally-derived measures of cash flow just don’t make the cut.