For those that saw the reference to our recent article in Barron’s and the unfortunate, derogatory counter-punch by another author, we appreciate the support and congratulations! The Barron’s article highlighting our work was a victory lap on our call on Kinder Morgan, or we think most should have interpreted it as such. The recognition was well-received by existing members and interested new members alike!

How to interpret our call on Kinder Morgan >>

As many of you know, however, the call on Kinder Morgan has been off the table for some time now. We had recently moved to “neutral” on Kinder Morgan (see here), after shares collapsed from $40 to $29, which is our current fair value estimate of the firm at this point in time (based on management’s 2015 sensitivities).

Shares of the corporate have even bounced back from the mid-$20s, to our fair value estimate. Though we continue to monitor deterioration in its fundamentals, Kinder Morgan is no longer as overpriced as it once was–our updated ratings reflect this. Readers should interpret our fair value estimates similar to a magnet attracting the stock price, which can bounce up and down around them.

As is often the case in this business, however, the slander, attacks, mis-interpretations, and derogatory counter-punches don’t stop; in fact, they only get worse the more right you are. We accept that, and we know the market can still “make” us wrong in the near term, as it often does to so many investors quite frequently. Our goal as a firm, however, is to help investors get an unbiased view on equities. The importance of this has only become clearer in the past few days.

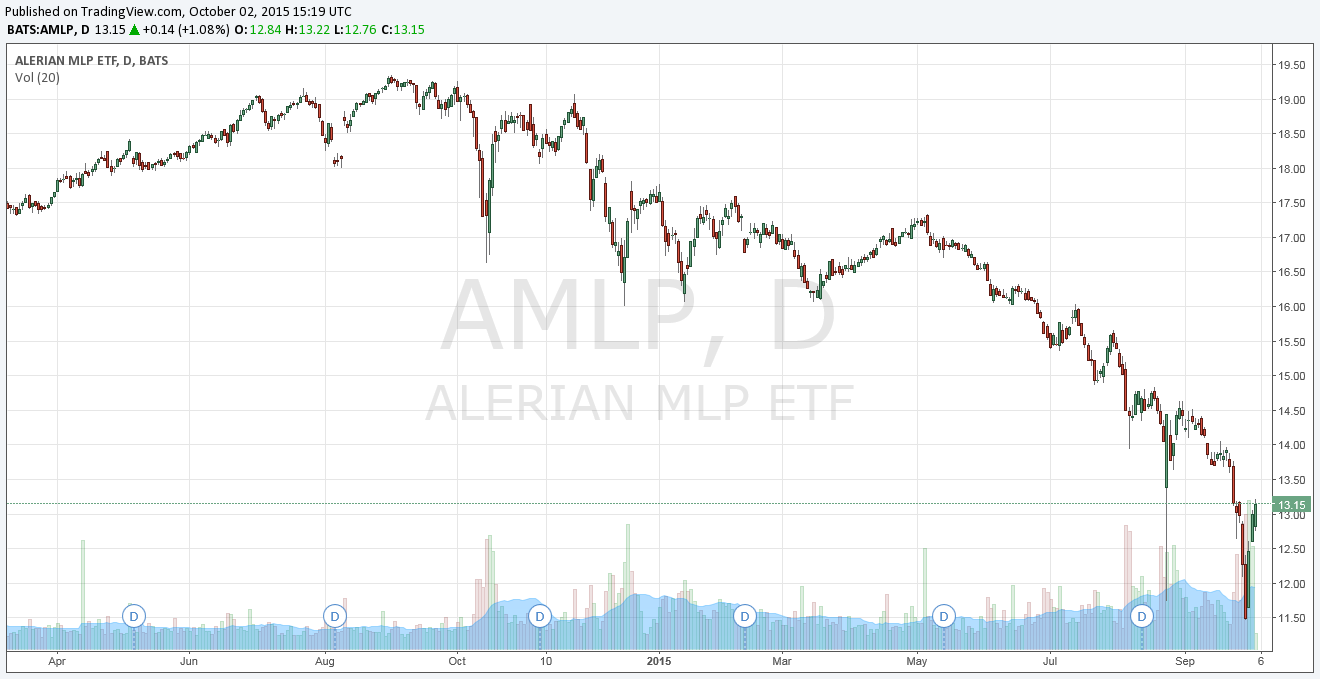

That said, we’re writing this short piece because we think some clarification is needed with respect to our take on the MLPs, at least for new readers. First, just because Barron’s this week picked up our growing concern on a group, which has effectively collapsed since 2014, doesn’t necessarily make it a brand new thesis, even though it may seem like one to new members. In fact, we made it very clear that the points in the piece we sent to members this week in an email, the ones that were also highlighted in the Barron’s article, were not new “news.”

We’ve held such a thesis on MLPs through the course of their share price collapse from 2014 highs (see chart above), and we want readers to know that the sharp snapback in shares of the Alerian MLP ETF (AMLP) shouldn’t tarnish our near-pristine track record in the energy space. A technical bounce in shares of the group can only be expected in light of their collapse, and we can’t even rule out the view that the MLP shares may break through the downtrend, if only before it heads lower again. Such a move will make us look wrong to some.

Over the long haul, not unlike the past, however, capital appreciation potential in MLPs will continue to face strong headwinds in the form of the very distributions paid to investors themselves. Unlike the past, however, MLPs will be faced with a rising interest-rate environment, which will only pressure valuations as higher fixed-income yields offer alternative risk-free options across asset classes. We won’t see new price highs in MLPs for a very long time as a result of these two structural impediments.

Frankly, we’re a bit embarrassed that someone stuck their leg out to trip us on our victory lap. We’re going to stick to the fundamentals, to in-depth financial analysis. In the meantime, we may have to deal with investors telling us how wrong we were, even though we’ve been so right. We can’t change that – a victim of circumstance, if you will. Such is this business.

Yours sincerely,

Brian Nelson, CFA

President, Equity Research and ETF Analysis