Key Takeaways

–> The three months from May-July mark the best three month stretch in terms of vehicles sold in the US since August-October 2000.

–> Truck and SUV demand remains high. Ford is gaining momentum as the F-Series nears full supply, and GM trucks continue strong sales growth. Honda set a July record for truck and SUV sales.

–> The safety of connected vehicles and advanced auto technology has come into question recently. Fiat Chrysler has been hit by the largest safety fine in the industry’s history after failing to recall millions of vehicles.

The US auto market continues on its pace for the best year in the past decade. A seasonally adjusted annual rate (SAAR) of 17.55 million in the month of July beat consensus estimates of 17.2 million. The three-month period from May-July marks the best three month stretch in terms of vehicles sold for the US auto industry since August-October 2000.

These record numbers are being realized despite the continued poor growth in car sales. Strong demand for SUVs and pickups has driven the market through the first seven months of the year, and each of the five major automakers reported sales advancing in the month of July. In the order of highest growth rate to smallest, Honda (HMC), GM (GM), Fiat Chrysler (FCAU), Ford (F), and Toyota (TM) all grew sales ahead of expectations in the month. Let’s take a deeper look at each of the automaker’s July performance.

Ford Gaining Momentum from F-Series

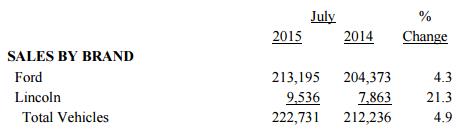

Ford sold a total of 222,731 vehicles in the month of July, a 5% increase from the July 2014. This marks the best July sales numbers since 2006, as demand for its newest models– including the F-150, Explorer, Edge, Mustang, and Transit–remains high. The company’s timely innovations have enabled it to capture the shift in consumer demand towards SUVs and trucks.

Image source: Ford July sales presentation

Ford brand car sales fell nearly 4% in July, while SUV and truck sales grew by 11.4% and 5.7%, respectively. The Edge and Explorer led SUVs in unit sales growth rate, at 27% and 17%, respectively, but the Escape remained the company’s most popular SUV based on number of units sold. The continued improvement in F-Series inventory helped advance F-Series retail sales by 13%, and transaction prices remain at an all-time high. The only Ford brand cars to report an increase in sales from July 104 were the Fusion and the Mustang, and the Mustang is the brand’s only car line to have positive growth through the first seven months of the year. The company’s Lincoln division sales advanced over 21% in the month, the luxury brand’s best July in a decade, driven by nearly 40% sales growth from its SUV line.

Though Ford cars have not sold well recently, we think the firm is well-positioned to continue taking advantage of the pent-up demand in the auto industry. The timeliness of its new releases have given consumers exactly what they want, and we think that as inventory for the innovative F-Series continues to improve, sales growth rates will continue to advance. The firm is expecting to have full inventory for the line by the end of September. A potential cause for concern has risen overseas. The once positive outlook for the China auto industry has soured amid the market failure, and China auto sales fell 6.6% in the month of July to the lowest monthly level in 17 months. Our fair value estimate for Ford remains $16.

Chevrolet Trucks Help Power GM

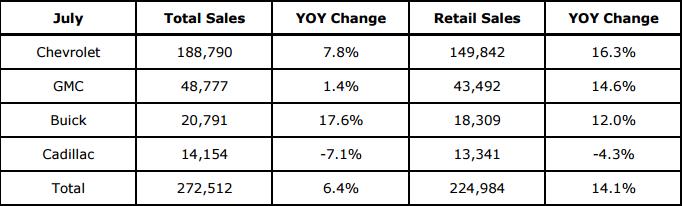

GM sales grew over 6% in the month of July to a total of 272,512 vehicles sold, good for its best month of July since 2007. The company’s Chevrolet brand, its largest division, advanced sales nearly 8% in the month, and the only of its four brands to report a loss in the month was the Cadillac division, which accounted for only ~5% of sales. Buick sales increased 17.6%, and GMC sales grew 1.4%.

Image source: GM July sales presentation

Chevrolet sales were driven by its best-selling line, the Silverado pick-up, which sold nearly 34% more units compared to July 2014, and the Traverse, which also grew sales more than 30%. The all-new mid-size Colorado pick-up continues to experience strong momentum. Buick crossovers were in high demand in the month, as the Encore and Enclave both experienced outstanding double-digit growth rates. GMC’s poor large SUV performance was buoyed by solid growth in Sierra pick-up sales, and a near 32% increase in sales from its crossover Acadia. The company continues its initiative to reduce the number of lower-margin deliveries to rental companies, while increasing its government and commercial increases.

Though GM grew total and retail sales impressively in the month of July, total sales continues to outpace retail sales by a large margin. This evokes memories of past channel stuffing allegations, of which GM was eventually dismissed. We aren’t accusing the automaker of any wrongdoing, but we’re keeping an eye on the situation. Though the firm has been performing well in China in 2015, the recent economic slowdown in the country will likely weigh on sales. GM thinks it has subdued safety concerns with the hack-ability of its OnStar system, but the issue will likely linger in the back of consumers’ minds. At the management level, we like the focus on margins and return on invested capital at GM, and we think the top-selling US automaker’s shares are currently worth $43 apiece.

Toyota Retains Retail Sales Leader Crown

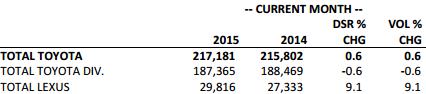

Toyota reported sales of 217,181 in July, a growth rate of 0.6% compared to the year-ago period. The Toyota brand was the leading retail selling brand in the month, and its Camry was the best-selling car in the US with over 38,000 units sold. Nevertheless, Toyota brand sales declined by less than 1% in July, while the smaller Lexus luxury brand grew over 9%.

Image source: Toyota July sales presentation

Despite being the best-selling car in the US, Toyota Camry sales declined nearly 4% compared to July 2014, and the entire Toyota car division sales fell nearly 6%. The best-performer in the division was the Corolla, which experienced a 1.9% decline in unit sales. The lackluster performance of Toyota’s car division was nearly offset by solid performance from its pick-up and SUV divisions. The mid-size Toyota Tacoma pick-up continued its dominance of its niche market with sales growth of nearly 29%, and the Toyota SUV division grew sales by 2.6%, a significantly lower growth rate than June 2015. Lexus brand car sales fell by over 5% in the month, but the decline was more than offset by the brand’s SUV and truck sales increasing by nearly 28%. As a whole, the company’s truck and SUV sales advanced 8.6% in the month of July.

Though its sales growth was not on par with its peers in the month of July, Toyota continues to sell high volumes of cars. Consumer demand has had an impact on the growth of its most popular lines, and it may not return to former levels until the price of gasoline rises for a sustained period of time. We think shares are currently worth $154 each.

Honda Breaks July Truck Sales Record

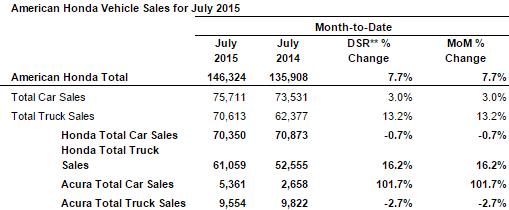

Honda reported robust vehicle sales growth of 7.7% in the month of July, as it sold 146,324 Honda and Acura vehicles. The Honda division grew sales by 6.5%, and the firm sold 19.5% more Acura brand vehicles compared to July 2014. The company advanced its truck and SUV sales 13.2% in the month and broke its July sales record for the segment.

Image source: PR Newswire

Honda brand trucks and SUVs led the growth of the segment with 16.2% more sales than the year-ago period, thanks to the high-volume selling CR-V and all new HR-V SUVs. Acura’s truck segment reported a decline of nearly 3% in the month, but the brand’s car sales continue to significantly outperform the rest of the car market, as the segment doubled sales from last July. Honda brand cars were not as successful, though sharp drops in its less popular models were nearly offset by a 3.7% increase in Civic sales and a 1.6% decline in Accord sales; both the Civic and Accord sold over 31,000 units in the month.

Management was encouraged by the improved sequential performance of its car division. With new models of its always popular Accord and Civic on the horizon, the firm is confident that the segment will return to positive growth trends. The attention grabbing growth of the Honda SUV and Acura car lineups is certainly exciting, but not likely sustainable, making the resurgence of Honda cars eventually necessary. The firm should continue to receive additional support from its motorcycle business, which has been experiencing solid momentum in recent quarters. Our fair value estimate for the firm is $35.

Fiat Chrysler Reports 64th Consecutive Month of Sales Growth

Fiat Chrysler reported sales of 178,027 in the month of July, a 6% growth rate on a year-over-year basis, and the 64th consecutive month in which the company has experienced year-over-year sales growth. This marks the group of brands’ best July since 2005. The company’s Jeep and Chrysler brands continued their positive momentum in the month with sales growth of 23% and 10%, respectively, while the Ram brand was relatively flat with 1% sales growth. The Dodge and Fiat brands both experienced sales falling by double-digits, with declines of 13% and 15%, respectively.

The Jeep brand’s solid line-up of SUVs continued to take advantage of consumer demand, with each of its models posting positive growth rates in July. The Chrysler brand’s growth in the month was driven by the continued outstanding performance of the 200 mid-size sedan, which nearly doubled the number of vehicles sold from July 2014. Dodge brand results were impacted by the discontinuation of production of the Avenger in 2014, and its other car models were not able to account for the decrease in sales. The Fiat brand continues to struggle in the US, but the company was encouraged by a solid number of sales from the new 500X crossover.

Fiat Chrysler was recently hit with the largest safety fine in the US auto industry’s history, a $105 million fine for failing to complete 23 safety recalls that affected more than 11 million vehicles. This is in addition to a recall of over 1.4 million vehicles over concerns over the hacking of one of its Jeep models. The public perception of the safety of the Jeep brand may cut into its sales growth in the future, but a negative impact has yet to be seen. We think the brand’s sales growth will eventually normalize along with consumer demand trends, and the phenomenal growth of the Chrysler 200 is not likely sustainable. Fiat Chrysler will eventually need its Dodge and Ram brands, its second and third largest in terms of sales, to rebound.

Tesla Productions Come Under Question

We continue to be of the opinion that Tesla provides a glimpse of the future of automobile technology. However, Tesla Motors recently lowered its vehicle delivery guidance for the full year. The company now expects to deliver between 50,000 and 55,000 vehicles in 2015, compared to previous guidance of 55,000 due to potential issues in its supply chain associated with the ramp in production late in the year. This is a key example of the speculative nature of Tesla. We think the firm and its innovative products in both the automotive and energy storage markets have tremendous upside, but its operations have yet to be tested on a large scale. The lack of dependability across production is what has caused the lowered guidance, not lowered demand for its products, and a cyber-security scare has added uncertainty to the safety of advancing auto technology. The speculation continues, and the resignation of CFO Deepak Ahuja isn’t helping matters.