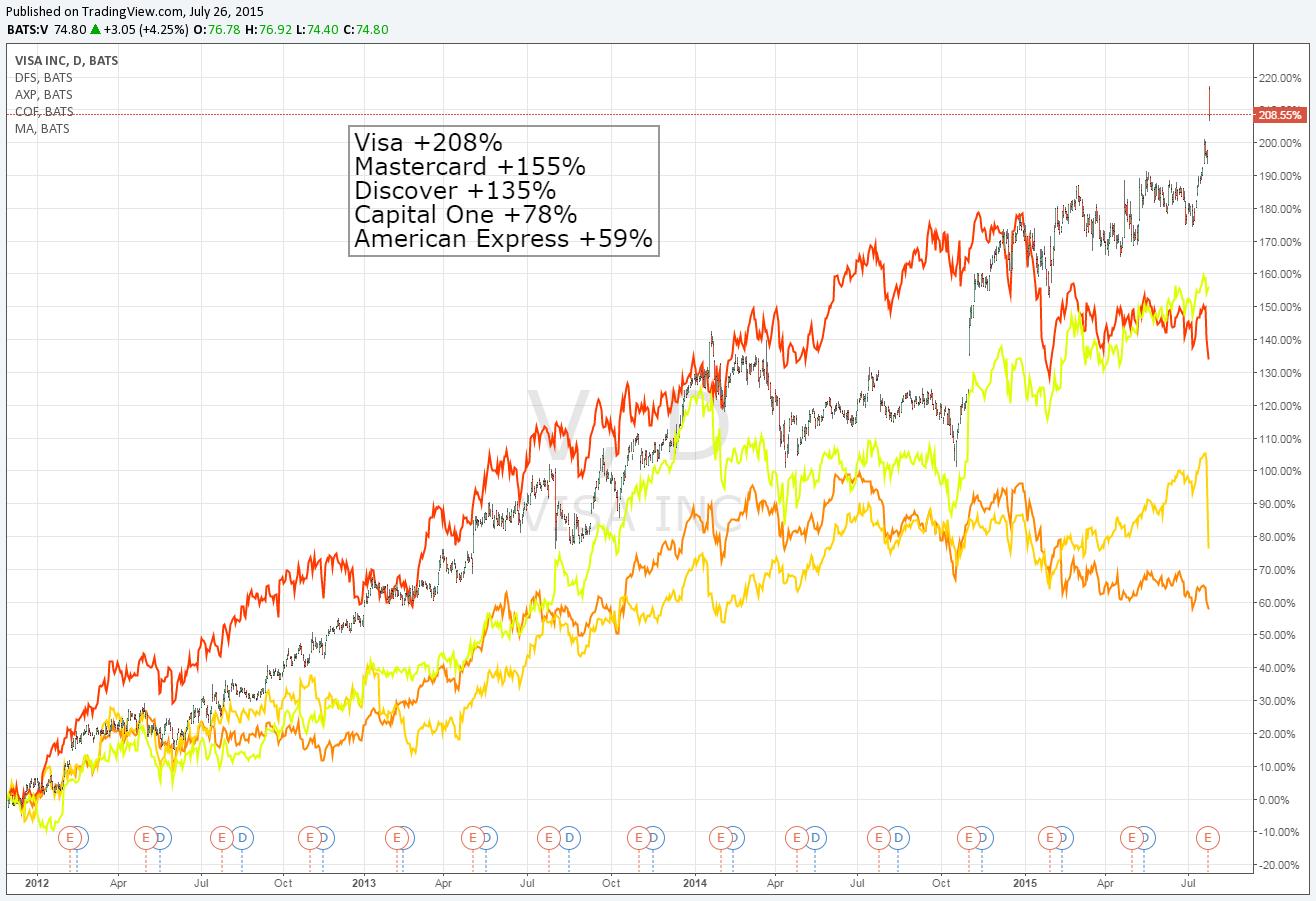

It’s hard to go wrong with exposure to the credit-card processing arena. Investors have made a lot of money in Visa (V), MasterCard (MA), Discover Financial (DFS), American Express (AXP) and Capital One (COF) during the past several years, but they’ve made the most with Best Ideas Newsletter portfolio holding Visa. Since Visa was added in November 30, 2011, the company has more than tripled, a return that is more than 50 percentage points better than MasterCard’s, more than 70 percentage points better than Discover’s, more than 120 percentage points better than Capital One’s, and about 150 percentage points better than American Express’. All have done well, but Visa has done the best.

Long-time readers of Valuentum know that we’ve held Visa for a long time, and we’ve even taken profits on the company to de-risk an overweighting in the newsletter portfolio. The company represents one of the best examples of the outperformance of a 9 rating on the Valuentum Buying Index, and why we may trim a position when a company’s rating is in the big middle (3 through 8). We know many also hold another one of our favorites MasterCard, and we have enjoyed watching Discover do well, too, but we seek to provide the best of the best to our members. We not only hope you have noticed, but we certainly appreciate your attention.

On July 23, Visa showed why investors have been excited about the company. In its fiscal third-quarter (calendar second quarter) results, net operating revenue jumped 14% on a constant-dollar basis, and the firm levered that growth into adjusted net income expansion of 33% from the prior-year period. The pace of top-line expansion and the tremendous earnings leverage in the company’s business model can be found in few other companies. Strength in service, data processing and international transaction revenues were the primary drivers behind the fantastic operating performance.

The company has now converged to our $75 per-share fair value estimate, and while this has been a significant move, we’re going to let this winner continue to run, a characteristic of the low-turnover Valuentum process. Very few companies outside of the payments arena are able to post an annual operating margin in the mid-60% range and generate annual free cash flow north of 40% of revenue like Visa can. We think the company will easily exceed its free-cash-flow target of greater-than-$6-billion for 2015, and mid-teens adjusted earnings-per-share growth in the year looks to be a very conservative target by management in light of the adjusted net income performance of the most recently-reported fiscal third quarter (+33%).

Visa has one of the best business models in our coverage universe. It generates revenue every time someone swipes one of its cards, and the number of cards in use is significantly larger than those issued by MasterCard. Unlike Discover and American Express, Visa does not take on credit risk, and while that may limit some opportunities, it also significantly reduces the uncertainly related to adverse consumer-credit conditions near the trough of the economic cycle. China’s $73 trillion-a-year payments market, which recently was opened up to global bank card operators, offers upside that may not yet be completely factored into Visa’s valuation.

The company remains a top holding in the Best Ideas Newsletter portfolio.