Sometimes valuation is its own catalyst. That’s what we think has happened to Google (GOOG, GOOGL). This isn’t our first note on Google; the search giant was added to the Best Ideas Newsletter portfolio October 2012 at ~$340. Shares are approaching $700 at present. As with all of the holdings in the newsletter portfolios, they represent our best ideas at any given time.

Image Source: Google

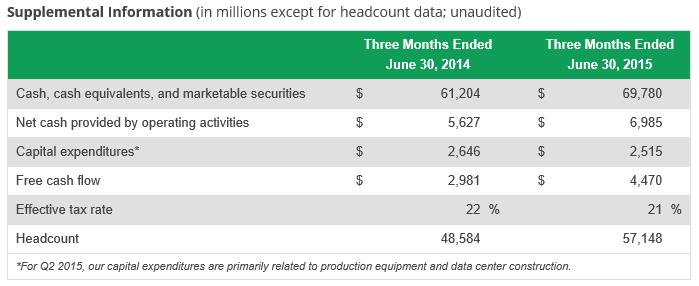

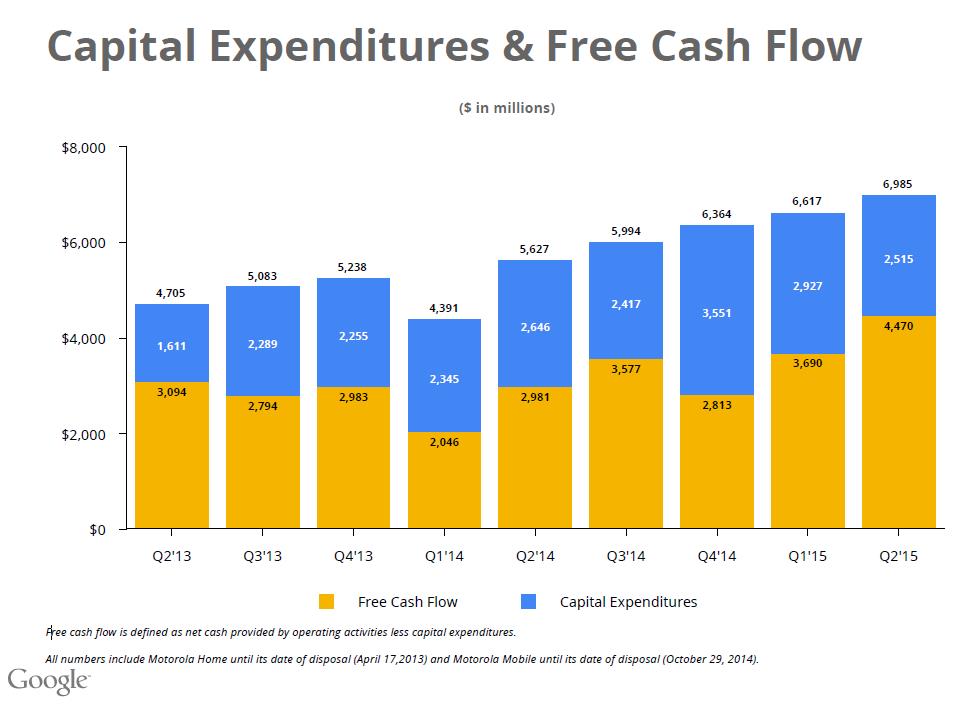

Google’s financial profile continues to be one of the best in our coverage universe. A cash balance of nearly $70 billion showcases the firm’s tremendous financial flexibility; its short and long-term debt was just over $5 billion at the end of the second quarter. Cash flow generating from operating activities expanded nicely on a year-over-year basis during the period, while free cash flow jumped nearly $1.5 billion from the June 2014 quarter, as the image above shows.

Google’s second quarter revealed constant-currency revenue growth of 18% as it retained its dominance in search and overcame challenges with mobile, especially competitive pressures from Facebook (FB) and Twitter (TWTR). YouTube (TrueView ads) and programmatic advertising among brand advertisers were also key strengths in the period. Non-GAAP operating income leapt 16% in the second quarter, and its non-GAAP operating margin expanded two percentage points.

Image Source: Google

But that’s not what has investors excited.

Investors are applauding the firm’s new discipline toward spending. On the conference call, management emphasized the “sequential deceleration in expense growth…reflect(s) in part the benefit of expense discipline discussed in prior calls. We (Google) remain focused on judiciously capitalizing on the strategic opportunities that we have, which are many.” Clearly, improved expense management coupled with strong expected revenue expansion will be a boon for the pace of earnings expansion.

We were also pleased with CFO Ruth Porat’s continued reiteration of Google’s focus on return on capital and her emphasis on balance sheet efficiency throughout much of the call. Though not asked directly if Google plans to pursue share buybacks or a dividend in the future, the writing is on the wall, in our view, as Porat did not dismiss it outright. We had highlighted how Google’s equity was a coiled spring should optimism in this area surge in this note here, and surely, the performance of the company’s stock after the report has affirmed such a view.

There are three classes of Google shares. The firm’s Class B common stock (not traded) has 10 votes per share (and is primarily owned by senior management: Larry Page, Sergey Brin, and Eric Schmidt); its Class A common stock has one vote per share (ticker symbol GOOGL), and its Class C capital stock has no voting rights (ticker symbol GOOG). Valuentum had included Google (GOOG) in the Best Ideas Newsletter portfolio prior to the firm’s stock split in April 2014. Following the split, owners of the GOOG shares received an equal number of new Class C shares (GOOG), while the existing Class A shares, previously GOOG, now trade under the symbol GOOGL.

Given the growing discrepancy between the GOOG and GOOGL share prices as of late, Valuentum’s Best Ideas Newsletter will now make the distinction between Class A and Class C shares within the portfolio in its next update. A cash adjustment is also necessary in accordance with a settlement involving Google’s authorization to distribute Class C capital stock. Both of these adjustments will positively impact performance.

We continue to prefer the GOOGL shares, which have voting rights (a core aspect of being a shareholder), and we expect an upward bias to our fair value estimate of Google in light of new information in the quarterly report and conference call. A fair value estimate in the ballpark of $800 should be expected.