Key Takeaways

-

The auto industry continues its strong comeback in 2015. Volume and profits are growing, and the industry is poised for a banner year.

-

SUV and light truck demand are the primary drivers behind the sales growth, as the drop in gasoline prices slows purchases of smaller, more fuel-efficient cars.

-

America’s best-selling line, the Ford F-Series, remains in limited supply, even as demand for the truck line remains high, but other producers, including GM, are looking to take advantage of the mismatch.

-

Toyota remains the top-selling retail brand in the US, despite weak industry-wide car sales.

June US auto sales, according to Autodata Corp, increased 3.9% over the year-ago period to a total of 1.48 million units, the most June sales since 2006, helping the industry to its strongest first half since before the Great Recession and bringing the seasonally adjusted annual rate (SAAR) to ~17.16 million. Pricing and profits also increased in the month, while the average vehicle price came in at ~$33,340, a 2.5% increase from June 2014.

Strong demand for light trucks and SUVs drove sales thanks to lower gasoline prices. This dynamic, along with years of pent-up demand from delayed purchases during the Financial Crisis, should push annual auto sales past the 17 million mark in 2015. The National Automobile Dealers Association, for example, recently increased its forecast to 17.17 million for the year, and we think the industry will hit or beat that mark. During the first half of 2015, light truck and SUV sales have increased ~10% while car sales have dropped 1.7% from the same period in 2014. Mid-size trucks have claimed their highest ever share of the light truck market with 15.1% of overall truck sales at the half-way point of the year, and sales have grown nearly 52% from last year.

Despite the solid reported numbers, the 1.48 million unit sales in June came in slightly below consensus expectations that were only slightly higher (1.49 million). Though GM (GM) was the sole major automaker to report a decline in unit sales, only Toyota (TM) beat consensus expectations in the month. Ford (F), Honda (HMC), and Fiat Chrysler (FCAU) all reported growth below that of expectations, but still strong performance nonetheless. There was one additional selling day in June 2015 than June 2014. Let’s break down the monthly performance of individual automakers. Links to monthly reports can be found in the company headings.

Ford’s New Models Flying Off Assembly Lines

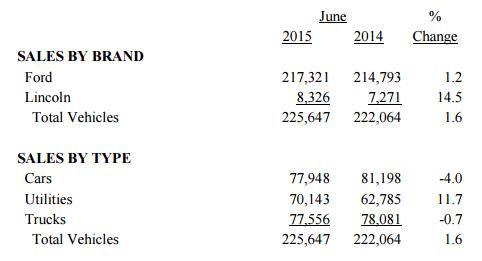

Ford experienced a slight 1.6% improvement in unit sales to a total of 225,647 in the month of June, and a similar 1.9% increase during the first half of 2015. Highlights for the month include SUV sales growing 11.7%, with unit sales of the all-new Edge rising 29.8% and unit sales of the newly-redesigned Explorer increasing 30.2%, and the F-Series, achieving record average transaction pricing. Though a small portion of sales, the firm’s Lincoln brand continues to show strong momentum, increasing units sold by 14.5% in the month.

Ford’s performance was similar to the mixed overall market trends in the month of June, with impressive SUV growth and declines in unit car sales–though the latest Mustang model continued momentum with unit expansion of 53.6%. The limited availability of Ford’s top-seller, the F-Series, continues to weigh on the company’s ‘Trucks’ division, where unit sales fell 0.7%, and its overall sales. Unit sales for the F-Series dropped 8.9% in the month as the firm continues to build inventory for the innovative aluminum-bodied F-150. Ford is operating at full production for the model, but only had half of its normal inventory on dealer lots in June. The company is expecting to have full supply by the end of September 2015.

Demand remains “sky-high” for the new F-150. The model turned twice as fast on dealer lots than the industry average half-ton pickup, and its average transaction price was $3,600 higher than that in June 2014. In addition, the Ford brand as a whole increased average transaction prices by $2,700, good for three times the average industry increase. We like where Ford is headed, and despite the aggressive competition from GM’s truck lines, once Ford is able to reach full capacity on the F-Series, we expect unit sales to accelerate significantly. Our fair value estimate for the company is $16 per share, slightly lower than the previous fair value estimate on account of reduced global growth expectations.

GM’s Lackluster June Sales Not Reflective of Strong First Half

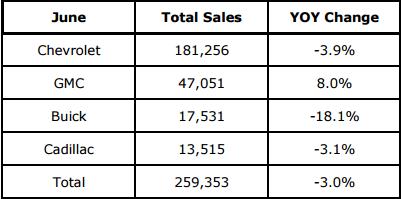

GM was the only major automaker to report a decline in unit sales in the month of June, down 3%, to 259,353, versus consensus expectations of 3% growth. Though retail sales advanced 6.8%, the biggest highlight for the company in the month was the head-to-head performance of its Chevrolet division with the Ford brand. Chevrolet retail sales were up 9%, surpassing that of the Ford brand in the month. The division’s leading truck, the Silverado, outsold the F-Series on a retail basis, though the latter continues to be impacted by supply issues.

GM’s share gains in the truck market have been a result of the ongoing success of the full-size Silverado and GMC Sierra pickups, which were redesigned in the 2014 model year, as well as the strong momentum of the Chevy Colorado, where “days to turn” are just 15 days (among the best in its group). The Colorado continues to gain share relative to the Toyota Tacoma, while the GMC Canyon also hopes to gain share in the increasingly crowded mid-size market. The Silverado and Sierra unit sales grew 18.4% and 20.8%, respectively, as GM continues to take advantage of the limited supply of the F-Series.

The GMC division has grown its retail sales for 17 consecutive months and increased retail sales 12% in June. GMC was the only division to improve unit sales from the year-ago period as the firm seeks to capitalize on strong retail demand for the line. Poor unit sales have continued for the Buick and Cadillac divisions, even though retail sales advanced for Cadillac in the month. Unit sales of the Buick Encore and the Cadillac SRX, however, are growing 33.4% and 23.5%, respectively. The GMC Acadia, a crossover SUV, also reported solid growth of 17.4% in unit sales. In line with market trends, the company experienced lackluster performance from all of its car models, excluding the Chevy Camaro, where unit sales advanced 11.5%.

Despite mixed June results, GM has performed well during the first half of 2015, having increased total unit sales 3.4% in the period. The firm is well positioned to continue to take advantage of market trends, as it has truck, van, and SUV share of 38.9%, up 2.1 percentage points from the year-ago period. We expect performance at GM to remain resilient in the face of incremental supply from the F-Series, but we’re monitoring customer behavior and overall retail trends from the lots closely. Our fair value estimate is $43.

Toyota Retains Retail Sales Leader Crown

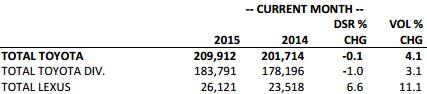

The only major automaker to beat consensus expectations in the month, Toyota reported unit sales of 209,912, an increase of 4.1% from June 2014. Toyota was once again the top selling retail brand in the US, led by strong sales of Tacoma, RAV4, and Highlander. Unit sales of the firm’s Toyota and Lexus divisions grew 3.1% and 11.1%, respectively, and the performance of both divisions were in line overall market trends. Toyota division car sales fell 6.9%, while its truck and SUV division increased 11.8%. Lexus division car sales were relatively flat at 0.2%, while its truck division was up 19.6%.

Toyota’s top-selling SUVs, the RAV4 and Highlander, drove segment growth, along with 36.8% growth from the 4Runner. Driving growth in its truck segment was the Tacoma, the top-selling mid-size pickup, increasing sales an impressive 31.1%. Toyota has been the leader in the difficult-to-perfect mid-size truck market, though times may be changing with the growing popularity of GM’s new offerings and the expected release of more models from the likes of Honda and Nissan in coming years. Toyota is confident its 2016 model will continue the momentum, however.

The Lexus division experienced a solid month in its luxury SUV segment, where unit sales grew 24.6%, driven by the all-new NX compact crossover and 17.3% growth from the GX. Lexus has long been synonymous with luxury vehicles, and we think its brand continues to resonate with consumers. Consumer Reports, for example, continues to rate Lexus at the top of its best brands list, calling Lexus a company “known for making quiet, plush, and very reliable cars.”

All-in, Toyota continues to sell high volumes of cars, and first-half numbers were better than June results throughout all segments, and we don’t think recent PR nightmares in the executive suite will impact fundamental performance. Our fair value estimate of shares is $154.

Honda’s SUVs and Acura Brand Drives Solid June

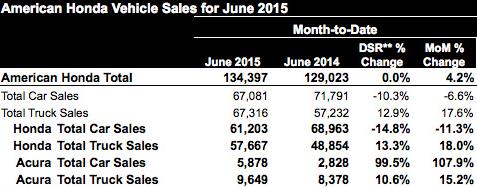

Despite missing consensus expectations calling for 7.1% growth, Honda reported an increase in unit sales of 4.2% from the year-ago period, resulting in total sales of 134,397. The firm continues to capitalize on consumer demand trends. Both its Honda and Acura divisions’ truck and SUV segments posted record June unit sales, and company-wide total truck and SUV sales increased 18%.

Acura cars continue to buck market trends, with sales more than doubling during the month. Such strength, however, was not significant enough to salvage the company’s total car sales performance, which declined 6.6% (with the much larger Honda car division losing 11.3% of sales from last June). The Honda brand as a whole grew just 0.9% in the month, while the Acura brand grew 38.6%.

Consistent with Honda’s recent efforts to strengthen its SUV lineup, Honda’s CR-V and HR-V crossovers saw significant growth. Though the introduction of the redesigned 2016 Pilot in June strengthened the company’s SUV lineup, the new model did not grow at the same pace as the smaller crossovers. Management remains confident that its light truck lineup will continue to perform as it focuses on renewing and expanding the car lineup. Efforts in this area are vital, as company-wide car sales still make up just under half of total unit sales. Both the Accord and Civic have suffered thus far in 2015, but we think the company will be successful in re-igniting these two popular brands. Our fair value estimate is $35.

Fiat Chrysler Remains a Mixed Bag in June

Fiat Chrysler reported June unit sales of 185,035, an 8% increase from June 2014, and its 63rd consecutive month of year-over-year sales gains. The firm owns the Fiat, Chrysler, Jeep, Dodge, and Ram brands. Chrysler, Jeep, and Ram grew by 28%, 25%, and 2% respectively, while Fiat and Dodge declined 30% and 14%. Jeep is its largest brand by volume and benefited from consumer demand for SUVs, Jeep’s specialty. Ram pickup sales were relatively flat, as it struggled to take advantage of the limited availability of the F-Series.

Defying overall industry-wide weak demand in car unit sales was growth in the Chrysler division, driven by strong unit performance of the 200 sedan. The mid-size sedan has had an impressive run of 10 consecutive months in which it has posted a sales record. Furthering growth was the 300, one of the most popular large sedans on the market; its unit sales grew by 11% in June. Dodge division car sales did not fare as well, with the Challenger being the only material model increasing sales. The Dodge Journey minivan also grew sales, but not enough to combat the significant backslide of fellow-family vehicle Caravan. The Fiat brand’s compact cars also took it on the chin in the month; neither of its two pre-existing models grew sales.

Fiat Chrysler plans to spin-off its Ferrari unit later this year via an IPO. The split of the luxury brand Ferrari should enable Fiat Chrysler to further focus on its core brands, helping both its US operations and performance in Europe, where it has ~7% market share. In the US, Fiat Chrysler will need to regain the health of its Dodge brand to keep growing, as the terrific momentum of Chrysler sedans is not likely sustainable. Jeep may lose some momentum as demand for SUVs normalizes in the future. Chrysler’s situation is much more dynamic than its peers’ at the moment.

Though many may rule out Tesla (TSLA) as a key US automaker, we think it belongs. Tesla Motors reported deliveries of 11,507 Model S vehicles in the second quarter of 2015. This is a company record and a 50%+ increase from the year-ago period, but only 15% growth sequentially. We continue be of the opinion that Tesla is the future of advanced electric automobile technology, though the path won’t be without challenges. From our perspective, the firm has capabilities and a thirst for innovation that no other automaker does at this point in time. Tesla is expected to begin deliveries of the newly-developed Model X, its second premium sedan engineered from the ground up as an electric vehicle, in the third quarter of this year. Our fair value estimate for the company is $257.