Image source: Teva July 5 investor presentation

We have been adamant on our stance on Best Ideas Newsletter portfolio holding Teva Pharmaceuticals (TEVA) since the initiation of our thesis on the generics industry in June 2013, shortly before we initiated our position in the firm. Since then shares have advanced nearly 50%, and we’ve continued to let this winner run.

A large portion of Teva’s success has been tied to the incredible performance of Copaxone, the leading multiple sclerosis therapy worldwide. In the first quarter of 2015, the drug alone comprised 18.5% of revenue, while contributing an astounding ~55% of net income. These figures are down from the year-ago period–and the majority of its production life–due in part to strong sales in 2014. Teva’s patent on Copaxone recently expired, and considering these impressive statistics, it is understandable why the firm is willing to do whatever it takes to maintain significant market share. Though Teva has been taking steps to prepare for the loss of exclusivity on Copaxone, such as the acquisition of Auspex and a focus on increasing profitability of its generic medicines and other special medicines segments, the acquisition of Mylan (MYL) may be exactly what the doctor ordered for Teva.

But even if the deal does not go through, not all is lost at Teva. The recent patent expiration pertains only to a daily dosage of Copaxone. Teva still holds a patent until 2030 on a higher dosage version of the drug that is taken three times a week and may be its best answer to combating coming generic competitors, though payer pushback could be a significant issue. As of July 5, 69% of Copaxone patients had converted to the tri-weekly version. In addition to the collaboration of Momenta Pharmaceuticals (MNTA) and the Sandoz pharma business of Novartis (NVS) recently releasing its version of Copaxone, Mylan has stated it has a competing product, though its near-term approvability may not be favorable. Teva’s merger with Mylan may provide it with the multiple sclerosis market share stability it desires.

Aside from enhancing both its portfolio and geographical diversification, a Teva-Mylan tie-up is projected to provide an impressive $2 billion in annual cost and tax savings/synergies ($20+ billion in perpetuity value), and the combined entity is expected to receive an investment-grade rating by the rating agencies, allowing for rapid deleveraging and ease of funding of future growth. Management also believes the combined entity could save ~$350 million in capital spending that the separate entities otherwise would have to spend individually. The combined entity’s cash flow profile would be significantly augmented.

But that’s not all. The potential promise of mitigating further pricing pressure across its drug portfolio, particularly with respect to Copaxone, could be material in the event of such a combination, and the consolidation of Teva’s top customers from wholesalers (Walgreen’s-Alliance Boots; Express Scripts-Medco; CVS-Cardinal Health joint venture) means that scale and bargaining power as in the case that would be achieved in such a transaction has become significantly more important. The share of Teva’s top three customers in the US has advanced to more than 80% since 2009, revealing the potential for oligopolistic pricing pressure on the entity. Teva is working hard to offset this dynamic, and a combination with Mylan is one way to do so.

However, it seems as though Mylan is doing everything in its power to avoid the takeover. In a 2014 tax inversion, Mylan moved its corporate address to the Netherlands and adopted a poison pill provision to avoid hostile takeovers. Further complicating Teva’s efforts is resistance from Abbott Laboratories (ABT), which sold its generic drugs business to Mylan in exchange for what is now a 14.5% stake in the company, the largest position of any shareholder. At the moment, Abbott says it will back Mylan’s efforts to avoid the takeover by Teva, perhaps to keep its intellectual property from abruptly landing in Teva’s lap so soon after its own deal with Mylan.

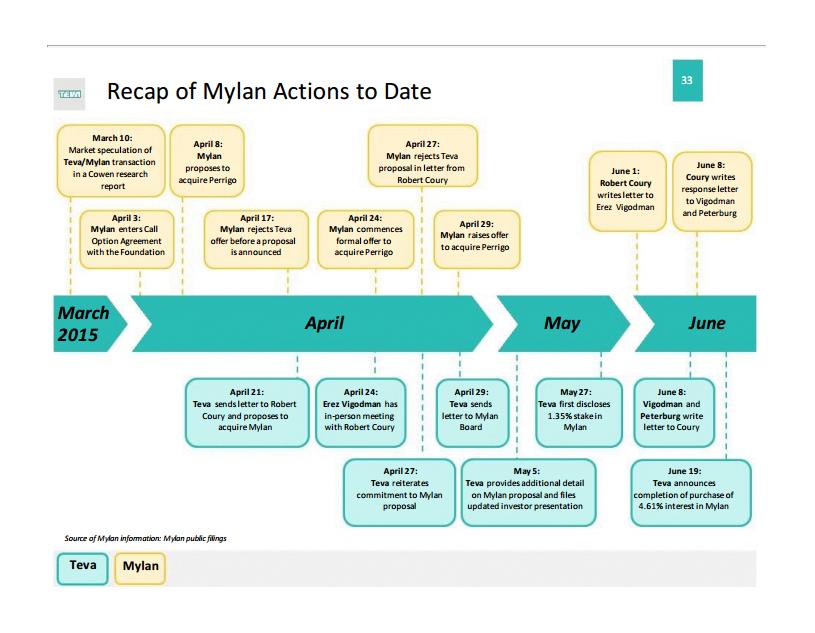

In April 2015, Mylan amplified its takeover defense by making two informal offers to buy Dublin-based generics firm Perrigo (PRGO) for a substantial premium. Teva made it known that if the Mylan-Perrigo deal goes through, it will rescind its offer for Mylan. Perrigo declined both offers, as it felt the offers undervalued the company. Mylan has also looked to the Federal Trade Commission for help with its resistance, contending that, while it is headquartered in the Netherlands, it should be treated as a US issuer by the FTC, which would require Teva’s purchase of Mylan shares to be reviewed by US antitrust officials. Though such defenses may not matter in the end, the situation is fast-developing, and reportedly, Teva is preparing to increase its offer for Mylan from its informal April price of $82 per share to a formal offer in the range of $86-$88 per share in the coming weeks. The higher offer will provide an alternative for Mylan shareholders, who are set to vote this summer on its Perrigo proposal.

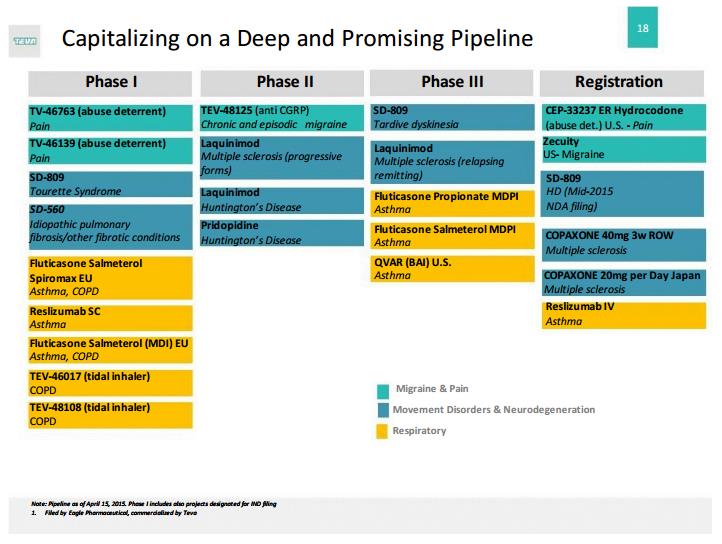

Though we think the merger would be a material positive for Teva, it is not a make-or-break deal for the company’s future health. The most recent update of our analysis of the firm assumes significant loss of share within the multiple sclerosis market, and while that may still happen, other drugs in Teva’s pipeline offer significant potential upside. Management anticipates more than $5 billion in incremental annual “risk-adjusted” revenue from new specialty product launches initiating in 2014. The chart below is a snapshot of the firm’s pipeline as of April 15, following the acquisition of Auspex, a move that solidified Teva’s position as a global leader in the central nervous system treatment market. Regardless of the outcome of the acquisition proceedings with Mylan, a budding late-stage pipeline provides significant growth opportunities, and it’s hard to dislike a company that expects to haul in more than $3.5 billion in free cash flow during 2015, despite all the challenges outlined in this piece.

We continue to include Teva in the Best Ideas Newsletter portfolio.