It’s a bird… It’s a plane… Nope, it’s Best Ideas Newsletter Portfolio holding Gilead Sciences (GILD) flying high in the months of May and June.

For those that are new to the Gilead “story,” shares registered a 10 on the Valuentum Buying Index in September of last year, and while the near term has been a bit rocky, the company is now off to the races. The pharma giant was trading just over $100 at the end of April, and now, 10 days into the month of June, its share price is over $117 and climbing, a cool 17% move.

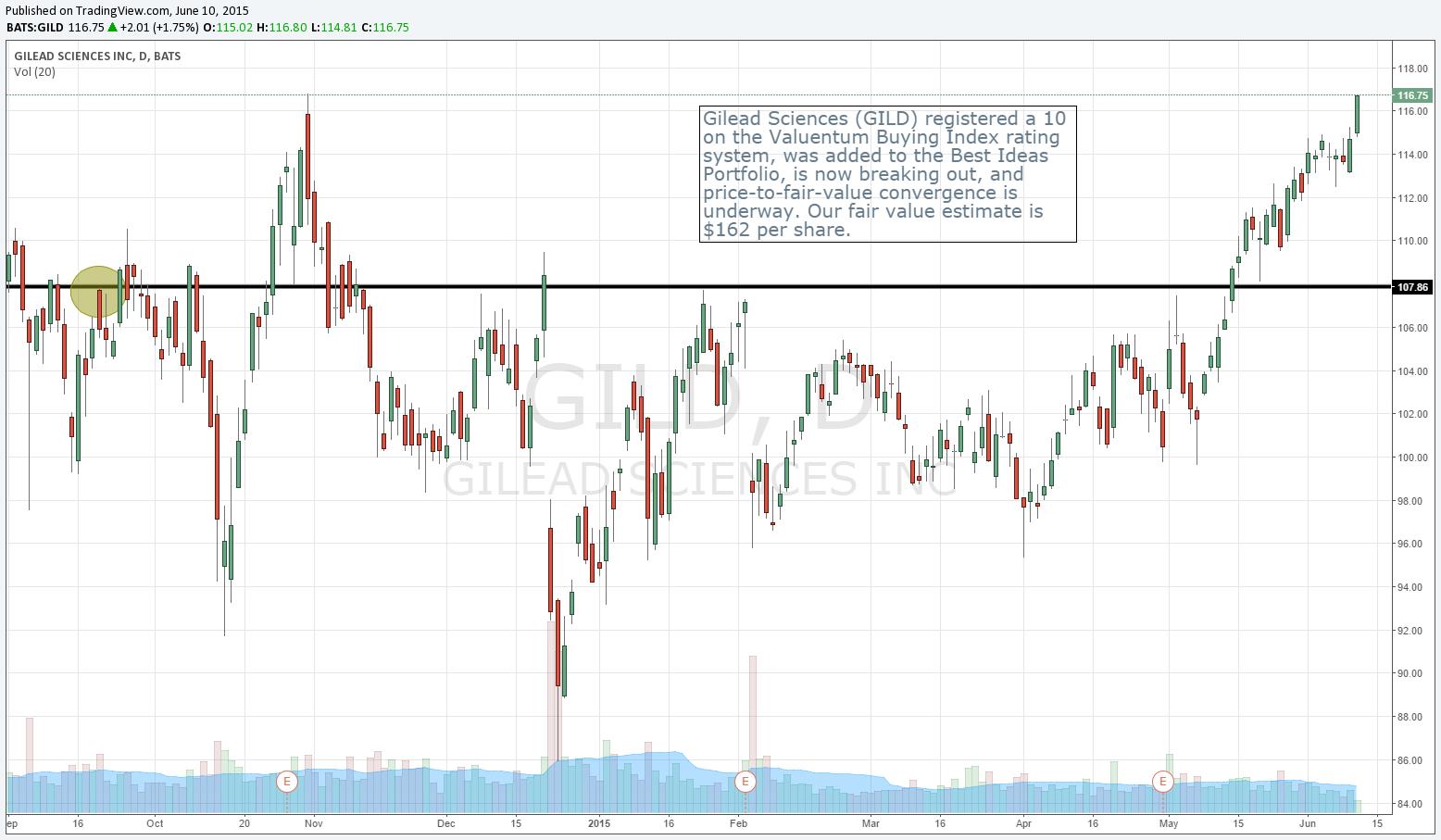

Despite news being sparse on the company during the past few weeks, there are certainly a number of factors driving its share price advance. When examining its price chart–shown above–the company is breaking out technically, and setting a new all-time high in doing so (there’s no overhead supply, as they say!). We continue to believe the firm is undervalued on a fundamental basis, and shares are now firmly in the black since the email transaction alert in September. Be sure to access the firm’s updated 16-page report on the website.

Few seem to be looking to sell Gilead at a price lower than today’s, and we’re certainly not looking back. Price-to-fair value convergence, or when a firm’s price starts to accelerate toward its intrinsic value, is beginning to take hold at Gilead, and significant momentum is building. Our fair value estimate is $162 per share, implying significant upside potential on the basis of its discounted cash-flow derived valuation.

How Gilead, the Valuentum Buying Index, and the Best Ideas Newsletter Portfolio Interact

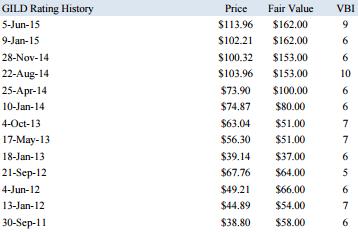

Gilead registered a pristine 10 on the Valuentum Buying Index in late August 2014. The stock was subsequently added to the Best Ideas Newsletter portfolio in mid-September with a fair value estimate of $153 per share. Since then, the company has been rated a 6 on the Valuentum Buying Index, while our fair value estimate has increased to $162 per share. If you’re not sure how the Valuentum Buying Index rating can fall in the event of a fair value increase, please email me at brian@valuentum.com.

For those just getting acquainted with the methodology, the Valuentum Buying Index is a multi-factor rating system (DCF valuation + risk, relative valuation, technical/momentum indicators), while other widely-followed star-rating systems are only single-factor models (e.g. DCF valuation + risk). This is why a Valuentum Buying Index rating on a company can change from a 9 to a 3 or to a 6 and back again in subsequent updates. The Valuentum Buying Index is a dynamic system.

Just like in the case of Gilead, after a company is added to the newsletter portfolio, its Valuentum Buying Index rating may change to a 3 or to a 6 or other. We consider ratings between 3 and 8 the “big middle” of our coverage, equivalent to a “we’d consider holding” rating. In the case of newsletter holdings such as Gilead that had or have these ratings, this is exactly what we’ve been doing or are doing with them – holding the company in the newsletter portfolio.

In such examples, we may add or trim the position in the portfolio if the company has a rating between 3 and 8, but we’d only consider removing the company when it registers a 1 or 2, the equivalent of a “we’d consider selling” rating. Gilead has never registered a 1 or 2 on the index, so we’d still consider it one of our best ideas. Such a dynamic is why companies in the newsletter portfolios can sometimes have ratings below companies that are not included in the portfolios.

Gilead’s most recent VBI rating of 9, updated today, indicates that we may consider adding more shares to the position in the Best Ideas Newsletter portfolio. We’re monitoring the situation closely.