The Valuentum Buying Index is a system that is designed to generate new ideas. Firms that register a 9 or 10 on the ranking system are ones that our team digs into to decide whether they pass muster for inclusion into the newsletter portfolios. Not all 9’s and 10’s make the cut, but that doesn’t mean they are poor ideas. Once an idea registers a high rating and is added to the newsletter portfolios, it is held until it registers a low rating — thereby, capturing the pricing cycle from undervalued and “going up” to overvalued and “going down.”

The newsletter portfolios are performing great, and so are some of the recent highly-rated companies! Convergys (CVG) was a company that has been atop the VBI ranking for some time, and it has popped nearly 20% since registering the coveted 10 on the index; its rating was only recently revised lower, but to the equivalent of a “we’d hold,” the middle ground of the Valuentum Buying Index distribution (only 1’s and 2’s are ones to worry about).

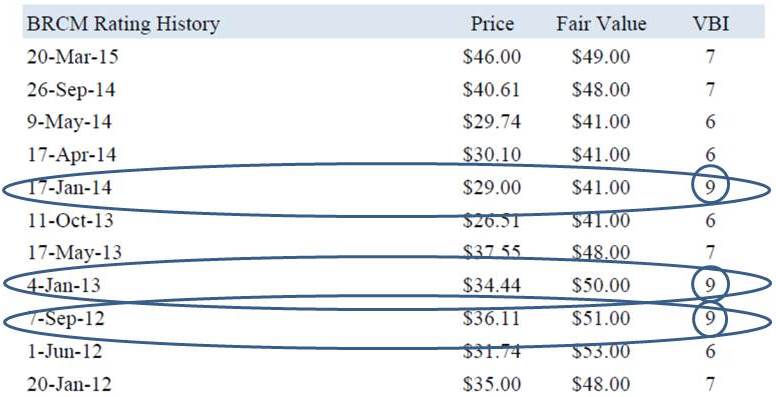

AIG (AIG) has been a highly-rated 9 for a few years, and its performance has been stellar. We’ve been saying that it is our favorite idea in insurance every chance we get. The latest example of the efficacy of the Valuentum Buying Index is Broadcom (BRCM), which has met the criteria to register a 9 on the index on three separate occasions (see image below), but never made it into the newsletter portfolios.

There are a couple reasons for this. One, we already have heavy technology exposure in both newsletter portfolios, and the performance of companies such as Apple (AAPL) and Microsoft (MSFT) has been even better, if not just as good. There are always trade-offs in portfolio construction, and this is why we don’t include all of our favorites. We simply can’t.

News today that Broadcom is in talks to be acquired by Avago (AVGO) has sent Broadcom’s stock soaring! We’ll keep letting you know which companies register these high rankings before they surge. On average, it often takes 12-24 months for an idea to work out, so some patience is often required for the system to perform well. Congrats to those that own Broadcom. We had highlighted the company on a number of occasions at recent American Association of Individual Investor (AAII) . The company is now trading well above our fair value estimate.