Image Source: m01229

On April 28, Coach (COH) reported a doozy of a calendar first quarter. Sales fell 15% while adjusted net income dropped to $0.36 per share from $0.68 per share in the year-ago period. For many, as with us, it’s difficult to accept such declining performance. However, we think the market is simply overlooking a recovery that we think will eventually take hold.

Brand transformation is a difficult maneuver but something that Coach looks to be executing upon, albeit slowly. The company’s international business posted decent growth on a constant-currency basis thanks to fantastic expansion in Europe and China, the latter increasing 10% on a constant-currency basis. The executive suite drove sequential improvement in its North American bricks and mortar business (though total North American sales suffered greatly), successfully rolled out the Stuart Veverss product, and received a positive reception during New York Fashion Week.

But why aren’t all of these positive developments showing up in the company’s results?

The reality is that the recovery for Coach will be long and arduous. Profit margins continue to be under pressure, and we would expect the aspirational brand to continue to have to invest heavily in SG&A in order to propel the transformation. In its calendar first quarter, for example, its non-GAAP operating income margin came in at ~16% from ~24% in the prior-year quarter, while SG&A as a percentage of revenue leapt to ~56% from ~47% in last year’s period. Coach’s results reflect a textbook case of earnings deleveraging.

But leverage cuts both ways, good and bad. And the good times may be right around the corner.

Coach is included in the Dividend Growth portfolio because it yields ~3.2%, and up until its recent acquisition of the Stuart Weitzman brand, which absorbed most of its excess cash, we were loving its dividend growth potential. In the context of the Dividend Growth portfolio, where companies such as Microsoft (MSFT) and Hasbro (HAS) are fueling tremendous gains, we can afford to be patient with this fashion-dependent entity. However, will we be putting new capital to work in the firm? Not likely.

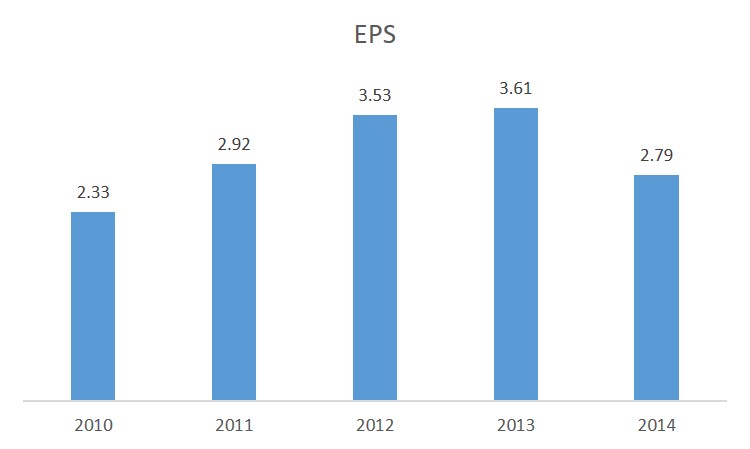

Still, we value Coach’s shares at $50 each and think upside potential is far greater than downside risk at present levels. Our thesis rests on an eventual recovery in its North American women’s handbag business and the belief that earnings will normalize at levels much higher than today’s run-rate (look at its annual earnings performance in recent years below). At the end of March 2015, Coach had $2.02 billion in cash and short-term investments and ~$890 million in long-term debt.

Coach’s Trailing Earnings per Share Performance

Source: Coach