I had to do a double take.

Citigroup’s commodities research department issued a warning that crude oil prices (USO) could plunge to $20 per barrel “for a while.” They believe this time is different. Pointing to an oversupplied market and full storage tanks, the research outfit believes shale-oil in the US has changed the game and may sound the death knell for the cartel. We haven’t seen $20 crude oil prices since the 1990s, and even then, only for a short period of time.

This is a big call.

Our view, however, is that OPEC remains as powerful as ever. The fact that crude oil prices have reacted so negatively to the cartel’s commitment to producing regardless of the price of oil speaks volumes to its continued dominance. Exploration and production firms from the largest including Chevron (CVX) and ConocoPhillips (COP) to niche fracking players Continental Resources (CLR) and EOG Resources (EOG) have been scaling back spending plans, but is that enough to support prices? If OPEC is fighting for share, why won’t it just increase production to fill the US void? After all, OPEC has a massive amount of reserves that it can put to use.

Though we had warned about the likelihood of crude oil prices falling to $45 per barrel, we’re not so sure $20 per barrel is a meaningful-probability event, at least in the near term and in light of the aggressive project spending cuts across non-OPEC participants. We continue to prefer the toll-road-like operations of Kinder Morgan (KMI) and Energy Transfer Partners (ETP) over any small exploration and production entity tied to the spot price of the black liquid, as they all are eventually. Though the firm’s net debt position continues to expand, our favorite oil and gas idea among the majors continues to be Chevron, not because its business model is immune to the current environment (it’s not), but because it still is in a better position than its major peers. Chevron’s management is fully committed to the dividend, having suspended buybacks for a year, at least. We liked that move, but we’re not putting any incremental capital into the energy sector at the moment.

In other news, Dividend Aristocrat REIT HCP (HCP), a holding in the Dividend Growth portfolio, released decent fourth-quarter results. Adjusted funds from operations advanced 4% on a year-over-year basis as the REIT achieved cash NOI SPP growth of 3.5%. The REIT issued a 2015 outlook that bounds adjusted funds from operations at $3.15-$3.21 per share, representing a growth rate of 5% over the most-recently reported year. An increased quarterly cash dividend of 3.7% in January, to $0.565 per share, marks the REIT’s 30th consecutive year of dividend increases, an enviable track record for any company, but especially for any REIT that is tied to the vicissitudes of the cyclical real estate markets. HCP is the only REIT in the S&P 500 Dividend Aristocrats index, and management is sure to remind us frequently.

Coca-Cola (KO) reported a much better fourth-quarter this time around relative to its weak third-quarter sequential showing. Comparable currency-neutral net revenues advanced 4%, and fourth-quarter reported earnings per share came in at $0.44, slightly better than expectations. Management noted that it gained share in the nonalcoholic ready-to-drink beverage category and in sparkling and still beverages as well as juice. Brand Coca-Cola was up 1% in the quarter.

Coca-Cola (KO) reported a much better fourth-quarter this time around relative to its weak third-quarter sequential showing. Comparable currency-neutral net revenues advanced 4%, and fourth-quarter reported earnings per share came in at $0.44, slightly better than expectations. Management noted that it gained share in the nonalcoholic ready-to-drink beverage category and in sparkling and still beverages as well as juice. Brand Coca-Cola was up 1% in the quarter.

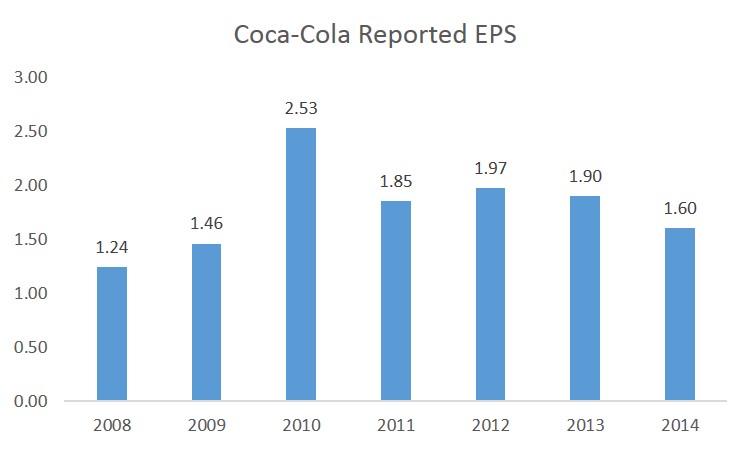

To us, the main question about Coca-Cola is not whether it is a fantastic company or whether its dividend is sustainable and poised for growth (we answer yes to both of those questions). Instead, the most important question is whether the firm’s valuation is stretched too far. We’re modeling in about $2 per share in earnings during 2015, higher than its annualized fourth-quarter mark, and such a forecast implies that Coca-Cola is trading at more than 20 times earnings. If a normalized 15-times forward earnings multiple were applied to Coke’s earnings, Coca-Cola could have downside to as little as $30 per share. Shares are trading north of $40 at present.

Are income investors willing to take that risk? Coca-Cola’s shares last hit the $30 mark in late 2010, so not too long ago. Incidentally, the company earned $1.85 per share the following year in 2011. Coca-Cola reported earnings per share of just $1.60 in 2014, significantly lower – yet shares are up more than 30% since then. Investors may be drinking too much of the corporate Kool-Aid. Or maybe too much Coca-Cola?

In any case, something’s not right. Coca-Cola is mispriced to the upside, and dividend growth investors should take note.