Guess which stock was the best performer in the Dow during 2014 and a holding in the Best Ideas portfolio? Yep, that’s right: Intel (INTC). The company finished 2014 up more than 40%!

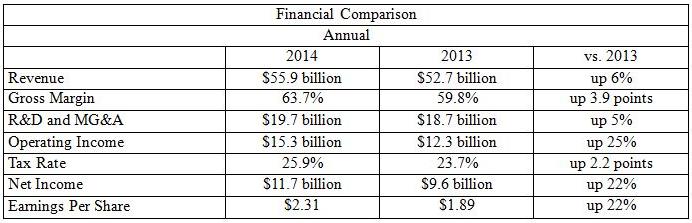

The chip giant reported solid fourth-quarter results January 15, beating expectations on both the top and bottom line. The key word in the press release: record. Intel put up record full-year revenue and fourth-quarter revenue and record chip shipments that go into PCs, servers, tablets, phones and Internet of Things. The company is seemingly doing everything right, as it pleases dividend growth investors. On an annual basis, all key financial metrics advanced nicely.

Image Source: Intel

Management commentary was also encouraging: “We met or exceeded several important goals: reinvigorated the PC business, grew the Data Center business, established a footprint in tablets, and drove growth and innovation in new areas. There is more to do in 2015. We’ll improve our profitability in mobile, and keep Intel focused on the next wave of computing.” The outlook for 2015 was also rather solid: revenue growth in the mid-single-digit range, gross margins of 62% +/- a couple percentage points, and full year capital spending of $10 billion +/- $500 million.

Shares sold off on the report, but we think the selling is more profit taking on a stock that has been one of the best big-cap performers on the market during the past 12 months. We can point to first-quarter gross margin guidance of 60% +/- a couple percentage points as slightly disappointing, but we think management is simply being conservative. We’re sticking with Intel in both newsletter portfolios and think its dividend presents investors with one of the best long-term growth opportunities.