Those that apply the Valuentum framework are less likely to be involved in value or income traps because, among other variables, they demand material revenue and earnings growth for firms to earn a 10 on the Valuentum Buying Index. Value and income traps often occur as a result of secular declines in a firm’s products or services, resulting in deteriorating revenue and earnings trends (and a falling stock price). Value and income traps can also result from abrupt cyclical shocks that cause vast shifts in a company’s future free cash flows, or that which happened to firms such as Seadrill (SDRL) and Linn Energy (LINE).

Users of the Valuentum approach are less likely to be exposed to these “falling knives” since the process requires firms to not only be undervalued but also be exhibiting bullish technical and momentum indicators before considering ideas for addition to the actively-managed portfolios. The reason for demanding both good value and good momentum characteristics is simple. The stock market is a forward-looking mechanism, and price usually leads fundamentals. Without a turnaround in price, the risk that the fundamentals of an undervalued stock have not turned for the positive is higher.

Where value strategies may encourage the buying of a stock all the way down regardless of whether fundamentals ever turn, the Valuentum strategy simply steers clear of these situations. We wait for technical improvement in the equity, which often precedes fundamental changes at the company. After all, basic stock market tenets indicate that other investors must eventually agree with our ideas if they are ever to converge to fair value. Without buying in our ideas, the stock will never go up. Success in the stock market often depends more heavily on what others think.

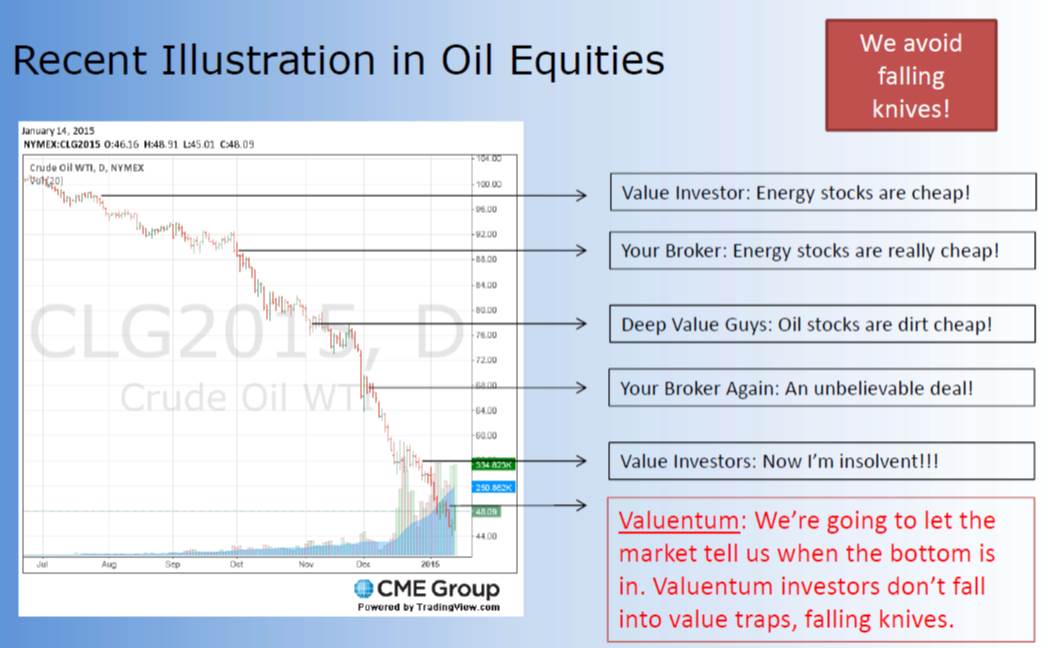

The most recent illustration of the Valuentum philosophy in action was with respect to oil equities. How many times over the past few months did you get pitched oil and gas equities? To us, it’s all very silly. Why not just wait for the market to tell you when it’s time to jump aboard. Only at a technical bottom would we grow interested in oil and gas shares, and only in the strongest stocks and healthiest business models that have the lowest price-to-fair value ratios. Having the best investing framework is much better than identifying the best stocks.

Some “value” investors, for example, that jumped on the oil and gas bandwagon early now require a 20%-30% move higher just to break even, given the steep price decline in recent months. Even if we agree that the same businesses are attractive, the Valuentum process helps maximize profits by adding discipline to both the buy and sell process. We’ll have a much lower entry point than traditional value investors. That’s why process is infinitely more important than the stocks you choose. The Valuentum process is second to none.