Would we ever considering owning Alcoa (AA) near a cyclical peak in economic demand, roughly 5-7 years into one of the strongest stock-market recoveries in history, or said differently, in the current environment? The short answer is: No. Market veterans know that the time to consider buying Alcoa is at a cyclical trough, not at peaks, and only then if there is no tangible risk of default. Alcoa may not be as much of an economic bellwether as it once was when the US was a much larger manufacturer of goods, but the aluminum giant is still relevant in assessing underlying demand trends in various end markets across the globe. The lightweight metal producer finds its way into just about everything that is made, and typically when Alcoa does well, it is often the case that the economy is leading such strength.

As in the case of most economic recoveries, the aluminum markets have been resilient, and we continued to witness this dynamic during Alcoa’s fourth quarter, results released January 12. On a fundamental basis, Alcoa is executing quite nicely from our perspective, and we were very impressed with the firm’s cash-flow management, which has been a focus for some time at the company. The firm posted record cash from operations in the period and the best free cash flow mark since 2010, two items we liked a lot. Alcoa’s ongoing transition to more innovative, multi-material value-add businesses is aiding margins, which we point to as the primary driver for any improvement to be sustainable. Better cash management via the conversion cycle is usually a one-time shot in the arm once metrics are fully enhanced.

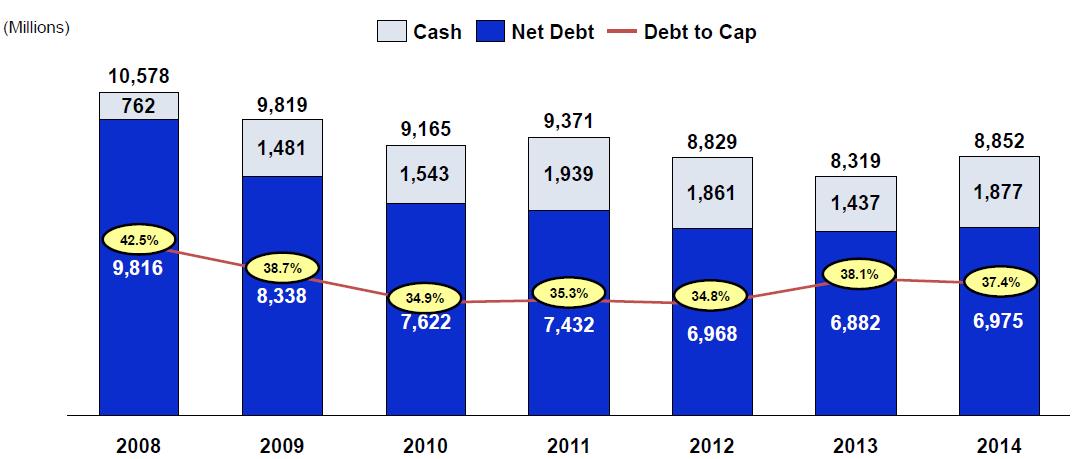

In the quarter, revenue jumped 14%, while adjusted net income reached $0.33 per share versus $0.04 in the year-ago period and better than consensus expectations. CEO Klaus Kleinfeld noted that it was the firm’s strongest operating results since 2008 and emphasized that it has entered 2015 on solid footing. Though performance has certainly improved through this upswing, Alcoa is approaching peak earnings this cycle, and its balance sheet leaves much to be desired. At the end of 2014, the firm had $1.88 billion in cash and cash equivalents and about $8.8 billion in total debt, clearly not a healthy position. In fact, the company is a borderline, if not, a junk credit (see here and here), and while net debt has improved since 2008, it’s now higher than 2012 levels again. Alcoa may be losing its focus.

Image Source: Alcoa

We’d prefer Alcoa focus almost exclusively on repaying debt with excess free cash flow, which came in at $455 million in 2014 (up 18% over 2013 levels), instead of pursuing large acquisitions even if they are in the “right” pockets of strength (jet-engine component firm Firth Rixson and titanium aerospace component maker TITAL). Granted, the acquisitions are having a positive impact on operating performance, but Alcoa is likely paying up to complete such deals this far into the upcycle as the competition for them is likely great considering a whole host of firms that continue to look to increase their exposure to the commercial aerospace markets from Precision Castparts (PCP) to United Tech (UTX) and beyond.

Image Source: Alcoa

The two top performing end markets in the industrial economy continue to be aerospace and automotive. Boeing (BA) and Airbus (EADSY) continue to rake in orders, and planes are flying off the assembly lines. In 2014, both large commercial airframe makers received over 1,400 net orders, and Boeing delivered a record 723 commercial jetliners during the year. Airbus delivered 629. The regional jet market is also healthy, and we’d expect Bombardier (BDRAF) and Embraer (ERJ) to capitalize on the best order book from the segment in five years. Plummeting crude oil prices should bolster demand for more planes, and even gas-guzzling automobiles may come back into favor. These were GM’s (GM) and Ford’s (F) bread-and-butter in the late-1990s, and we could see improvement in this category as a result of prices at the pump falling below $2 for most of the country. Our top fundamental idea in aerospace is Precision Castparts, and our top fundamental idea within automotive is Ford, which recently upped its dividend and now offers investors a near-4% dividend yield. Both were recent holdings in the Best Ideas portfolio.

Alcoa also noted that the building and construction end market is shaping up for a strong 2015. Citing non-residential contract awards, the Architectural Billings Index, and the Case-Shiller Home Price Index, North American building and construction activity is expected to jump 4%-5% in 2015. Alcoa expects China’s construction markets to expand 7%-9% during the year as fundamentals continue to stabilize. Unlike the commercial aerospace market, where the airframe makers have years’ worth of unfulfilled deliveries, the building and construction markets are rather fickle, however. One has to look no further than late last decade to understand the fragility of the banking and housing markets. We’re not compelled to own any particular homebuilder so late into the housing recovery. KB Home (KBH) recently warned on margins.

Having run from under $8 per share in mid-late 2013 to nearly $16 per share, Alcoa is tired. We doubt there’s enough juice left in the firm’s tank to drive annualized earnings much higher than the $1.32 per share current organic run-rate ($0.33 per share x 4). Any further earnings expansion will be driven more by acquisitive behavior, and we’re not sure Alcoa is getting the best deal on these transactions. We’re staying on the sidelines with respect to Alcoa’s shares for the foreseeable future. Any potential upside in shares is more than offset by downside risk that we know is real once the economy slows.