Image Source: September 2014 Best Ideas Newsletter, page 9

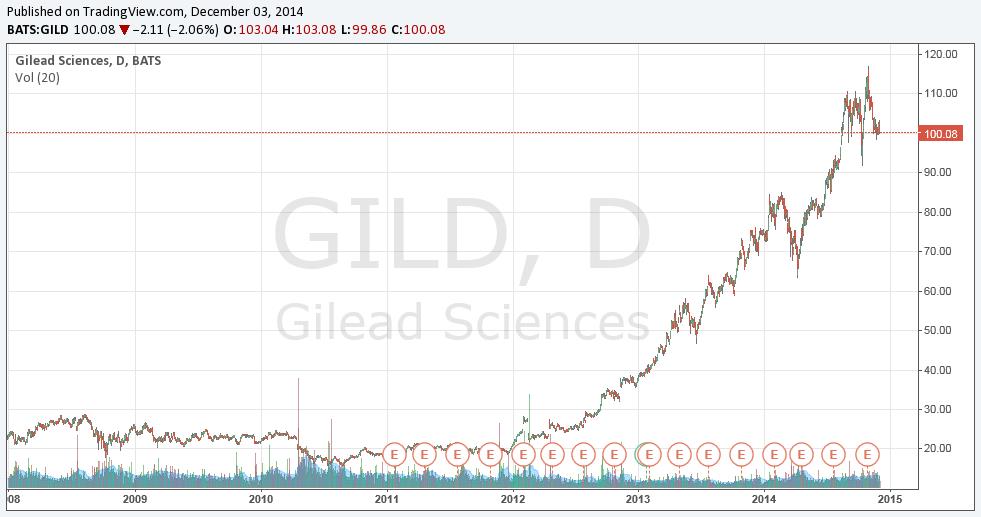

If there is one thing that I would encourage all of you to do when looking at your holdings in your portfolio it would be to look at their long-term charts. There is nothing that provides greater perspective than looking at historical performance and assessing when price moves may just be reasonable profit-taking (and/or risk-mitigation) versus something more serious. You don’t have to be a highly-trained technician to know that a 5% pullback on a stock that has more than quintupled is a meaningless move. Case in point: Gilead Sciences (GILD).

I want you to check your stocks every day, if you feel the need, but you shouldn’t make assessments on a weekly, or even on a quarterly basis. If nothing has changed with respect to the thesis, well, nothing has changed. If you’re getting spooked by every news piece, rumor, or blog item, you’re going to fail as a long-term investor. In any stock price decline, remember, there were investors that bought shares before you, and they may want to take some profits on their positions. Perhaps they want to take their kids on vacation for the holidays or buy a new SUV now that gas prices have fallen, or get their significant other something nice. The only way to become a better investor is to gain perspective. Work on this every single day, please.

For those new members, Gilead was added to the Best Ideas portfolio at ~$105 per share (just a couple months ago!), and the stock is trading at $100 per share at the moment. Some members even bought in the mid-$90s as we had outlined in this piece at the top of this article. Come on, give us a break. Looking at the above chart, I will tell you that I wouldn’t start becoming concerned about Gilead’s long-term promise until shares fell below $70 each. Why?

Because it is within the realm of possibilities that technicians could break down the stock on any competitive news from AbbVie (ABBV) that may surface in the next few months. When weak hands fold because of price moves, the stock sells off. Certainly, the fall I described is a wide range of outcomes for some investors, but for stocks that have quintupled as Gilead’s stock has, it is only reasonable to assume that some pullback should be expected. Investors should expect the possibility of Gilead’s stock to decline before it eventually converges to intrinsic value. Remember, we target our ideas to work out over a 12-24 month period.

But seriously, how can we be so confident in holding Gilead at the moment? Well, shares are trading at ~10 times 2015 expected earnings. If AbbVie comes in and disrupts the HCV market by slashing prices in half, Gilead would only be trading at 20 times 2015 earnings – and that’s if AbbVie completely disrupts the market, a very low probability. At the moment, Gilead is a stock that holds a lot of risk, but in most cases like this, the payout could potentially be quite large. Our fair value for Gilead remains north of $150 per share, though its Valuentum Buying Index rating is now a 6 following the modest sell-off. The firm remains in the Best Ideas portfolio, and it is still one of the best ideas. Once stocks register a high rating on the Valuentum Buying Index and are added to the portfolio, they are not removed until they register a 1 or 2 (a we’d consider selling rating), which would mean that we now think they are overvalued and will continue to demonstrate negative pricing momentum.

By the way, how about the other two recent transaction alerts? If you know about Gilead, how did you miss Alibaba?

November 14, Cisco (CSCO): $26.15 per share à $27.79 per share – up 6%+.

October 22, Alibaba (BABA): $93.20 per share à $110.21 per share – up 18%+.

Can you imagine if I had to write about every stock that moved 5%? I’d simply run out of ink, and my nickel an hour wage won’t allow it. It’s possible you’re confusing us with someone else.

Cheers!