The news flow in the markets has started to slow as third-quarter earnings season nears a close. According to FactSet, through November 14, “of the 462 companies (out of the S&P 500) that have reported earnings to date for Q3 2014, 77% have reported earnings above the mean estimate and 59% have reported sales above the mean estimate…The blended earnings growth rate for Q3 2014 is 7.9%.” It appears that even with some big disappointments from such large firms as McDonald’s (MCD), Coca-Cola (KO), IBM (IBM) and Amazon (AMZN) that third-quarter earnings season could be considered better than mixed.

That said, “for Q4 2014, 62 companies have issued negative EPS guidance and 19 companies have issued positive EPS guidance.” We think this imbalance speaks to the ongoing uncertain economic climate, monetary policy decisions that continue to be debated, volatile crude oil prices, and geopolitical tensions. Valuations of S&P 500 constituents aren’t terribly exciting either, with “the current 12-month forward P/E ratio (at) 15.9,” well above the 5-year and 10-year averages. We continue to generate new ideas via the Valuentum Buying Index, and the newsletter portfolios continue to perform well. If you haven’t considered any ideas in either the Best Ideas portfolio or Dividend Growth portfolio, you’re missing out on some of our best ideas.

Speaking of one of our best ideas, newsletter portfolio holding Intel (INTC), at its 2014 investor meeting, raised its dividend by $0.06 per share to an annual payout of $0.96/share, implying an annual yield of 2.7% at present prices. The company remains on track for high-single-digit, low-double digit dividend growth over our discrete 5-year forecast horizon. As you’re using the dividend reports, assessing a normalized rate of growth of the dividend is far more important than assessing whether a firm exceeded or missed the dividend growth estimate. Remember, dividend expectations are estimates, and only the board knows what it plans to do with the dividend over the near term.

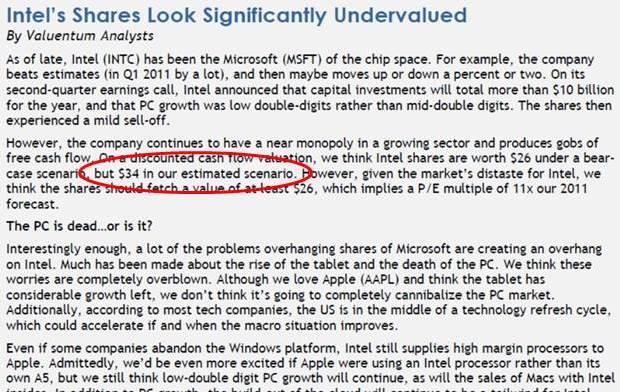

With that said, we wanted to do a #throwbackthursday with Intel. It’s somewhat sad that the squeaky wheel always gets the grease in the financial publishing industry, regardless of credentials or track record, but we don’t mind…well, maybe we do, a little. Of course we don’t have the reach of CNBC or a Twitter superstar with 500,000 followers, but we are flat-out doing the best work out of anyone in the business. You should really take a look at some of the early editions of the newsletters. It’s incredible how well the newsletter portfolios have fared (and with less risk). From the second-ever edition of the Best Ideas Newsletter, released August 15, 2011, when Intel was ~$20 per share (Intel closed over $35 per share today):

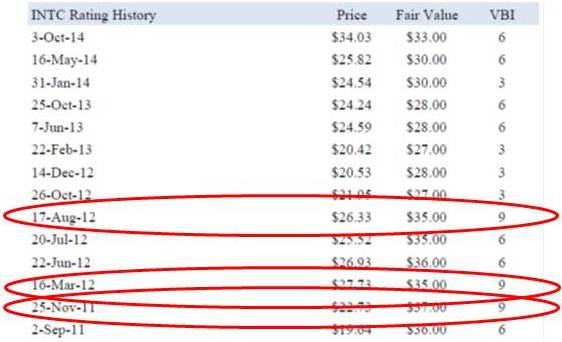

We don’t give individual personal advice, but if you’ve been a member for a while and you don’t own Intel, despite 1) it being a holding in both newsletter portfolios, 2) it registering a 9 on the Valuentum Buying Index on a number of occasions (see below), and 3) its awesome Dividend Cushion score and solid dividend yield…well then…you don’t own Intel. We’re just teasing as we know that a very large number of our members do hold the company, and those that don’t are doing quite well, too. Intel registered one of the highest ratings on the Valuentum Buying Index, a 9, on November 2011 and March and August of 2012.

Intel also provided its outlook for 2015. The chip giant is expecting revenue growth in the mid-single-digits, gross margin percentage at 62% (+/- two points), and R&D plus MG&A spending “to be down with spending of approximately $20 billion, plus or minus $400 million.” Capital spending is targeted at $10.5 billion, plus or minus $400 million. The outlook was fantastic, in our view. Revenue growth was better than expected, R&D/MG&A spending is slowing, and the firm is cutting its capex relative to last year, which should bolster free cash flow. We think Intel is being conservative with its gross margin guidance as it sorts through the value chain in advance of negotiations for the oncoming year.

Intel will remain a newsletter holding. The firm’s dividend report will be refreshed as a part of the standard update cycle. We hope you’ll stick with us.