To us, there really never was an investment case for Sprint (S). Let us explain.

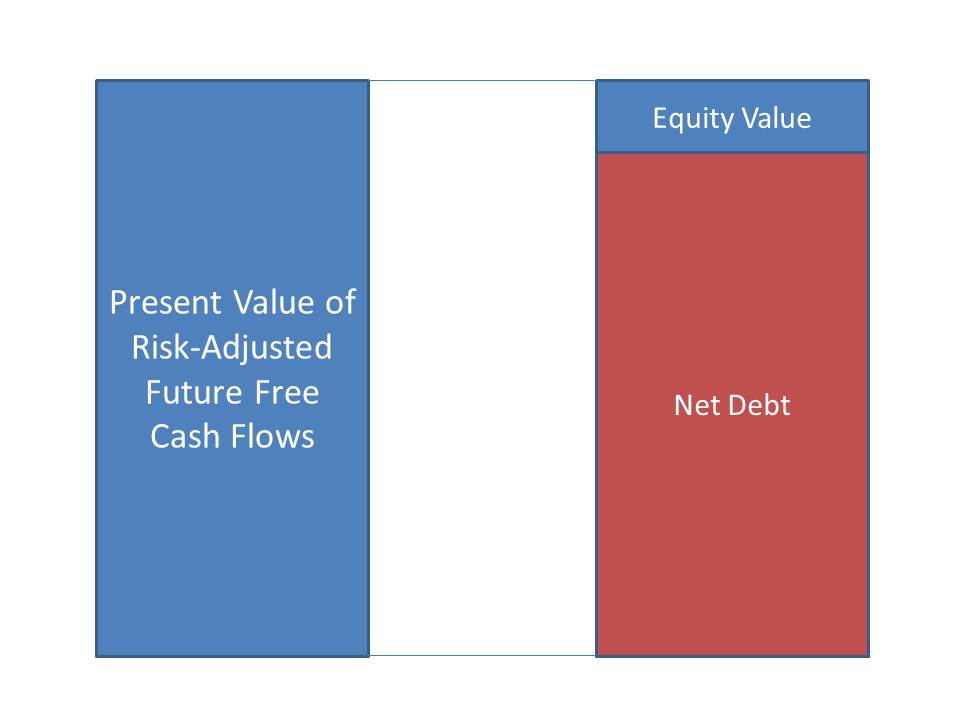

In investing, the “capital stack” represents the firm’s capital structure, beginning with net debt at the bottom and moving up to equity at the top. In order for any firm to have any equity value, the present value of its risk-adjusted future free cash flows must sum to a value greater than its net debt. The hypothetical firm shown below in the image has equity value because the present value of its risk-adjusted future free cash flows is greater than the sum of its net debt.

At Valuentum, we spend most of our time paying attention to the firm’s regulatory filings. In Sprint’s most recent annual report form 10-K, the firm’s long-term debt totaled $32 billion versus $7.46 billion in cash and cash equivalents. That means that its net debt position totals roughly $24.5 billion, a hefty amount to overcome with future free cash flows. In 2013, for example, net cash used in operating activities was a negative $61 million while capital expenditures totaled $3.847 billion, resulting in significantly negative free cash flow generation during the annual period. Sprint’s third-quarter report showed $1.19 billion in operating cash flow generation but more than $2 billion in cash outflows related to capex. That’s just not a healthy cash flow situation.

To us, how can we come close to highlighting Sprint as an idea under these conditions? Not only would we have to factor in a turnaround in free cash flow in an ultra-competitive environment, but the return to free cash flow would have to be so great that it must overcome Sprint’s mountain of net debt to have any equity value whatsoever. Sprint’s market capitalization, which represents the market’s interpretation of the equity value on top of its stack of net debt, is $19.4 billion at ~$5 per share. Sprint traded at over $10 per share at one point, and to us, this was simply an irrational price, absent takeout speculation.

Not only does Sprint have an unattractive Economic Castle rating, but we assigned it one of the largest fair value ranges in our coverage universe ($4 – $12). When you look at the slice of equity on top of its massive debt load, and the uncertainty of its future free cash flow profile, it becomes obvious that a large fair value range is not only the right move, but also quite an informative one. In the 16-page reports, there is simply a wealth of information and observations that can be ascertained from their study. Everything in those reports tells you something about the company. In Sprint’s case, the larger the fair value range, the more uncertain the value of the firm’s equity.

Sprint may find a suitor for its assets (and this may offer a speculative premium to shares), but the competitive environment with AT&T (T) and Verizon (VZ) has never been more aggressive. Sprint is a lotto ticket with non-zero bankruptcy risk. The company is only for investors that can handle wild swings in equity prices, but even then, Sprint may not deliver on a reasonable return. You won’t see us adding the company to the Best Ideas portfolio at any price. Gambling is not what we do here.